RH (NYSE:RH - Get Free Report)'s stock had its "underperform" rating reissued by equities researchers at BNP Paribas in a research note issued to investors on Wednesday, MarketBeat.com reports. They presently have a $253.00 price target on the stock. BNP Paribas' target price would suggest a potential downside of 22.52% from the company's previous close.

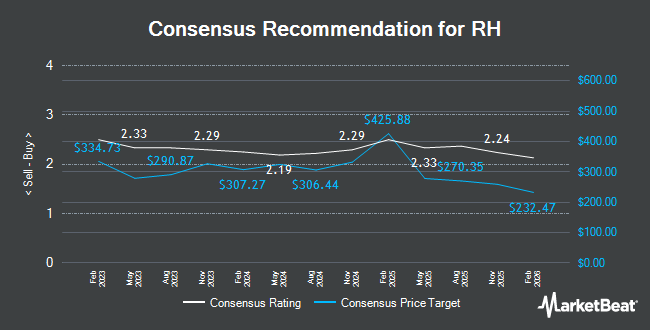

A number of other equities analysts also recently issued reports on RH. Morgan Stanley increased their price target on shares of RH from $300.00 to $310.00 and gave the stock an "equal weight" rating in a research note on Friday, September 13th. Loop Capital increased their target price on RH from $230.00 to $320.00 and gave the stock a "hold" rating in a research report on Monday, September 16th. Telsey Advisory Group reaffirmed a "market perform" rating and issued a $290.00 price target on shares of RH in a research note on Tuesday, September 10th. Stifel Nicolaus raised their price objective on RH from $315.00 to $375.00 and gave the company a "buy" rating in a research report on Monday, September 16th. Finally, JPMorgan Chase & Co. reduced their target price on shares of RH from $345.00 to $338.00 and set an "overweight" rating on the stock in a research report on Monday, September 16th. Three investment analysts have rated the stock with a sell rating, six have given a hold rating and seven have given a buy rating to the company. According to MarketBeat, RH has a consensus rating of "Hold" and a consensus price target of $326.14.

Check Out Our Latest Stock Analysis on RH

RH Stock Down 2.1 %

Shares of RH stock traded down $6.88 during trading on Wednesday, reaching $326.55. 607,858 shares of the stock were exchanged, compared to its average volume of 721,778. RH has a 1 year low of $212.43 and a 1 year high of $367.00. The firm has a market cap of $6.02 billion, a price-to-earnings ratio of 191.19, a price-to-earnings-growth ratio of 1.88 and a beta of 2.43. The stock's fifty day moving average is $320.58 and its 200 day moving average is $282.30.

RH (NYSE:RH - Get Free Report) last issued its quarterly earnings data on Thursday, September 12th. The company reported $1.69 earnings per share for the quarter, topping analysts' consensus estimates of $1.56 by $0.13. The firm had revenue of $829.66 million for the quarter, compared to analyst estimates of $824.52 million. RH had a negative return on equity of 11.29% and a net margin of 1.13%. The business's quarterly revenue was up 3.6% compared to the same quarter last year. During the same period last year, the company earned $3.93 EPS. Equities analysts forecast that RH will post 5.67 earnings per share for the current year.

Insider Activity at RH

In related news, insider Stefan Duban sold 4,285 shares of RH stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $346.37, for a total value of $1,484,195.45. Following the completion of the sale, the insider now directly owns 78 shares in the company, valued at approximately $27,016.86. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, insider Stefan Duban sold 4,285 shares of the stock in a transaction on Thursday, September 19th. The stock was sold at an average price of $346.37, for a total transaction of $1,484,195.45. Following the transaction, the insider now directly owns 78 shares of the company's stock, valued at $27,016.86. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, Director Mark S. Demilio sold 2,000 shares of RH stock in a transaction on Wednesday, September 18th. The stock was sold at an average price of $340.30, for a total value of $680,600.00. Following the completion of the sale, the director now directly owns 10,914 shares of the company's stock, valued at $3,714,034.20. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 8,285 shares of company stock valued at $2,871,935. 28.10% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On RH

Several institutional investors have recently made changes to their positions in RH. Quantbot Technologies LP purchased a new position in RH during the first quarter valued at $354,000. Oppenheimer Asset Management Inc. raised its stake in shares of RH by 20.7% in the first quarter. Oppenheimer Asset Management Inc. now owns 1,418 shares of the company's stock worth $494,000 after buying an additional 243 shares during the period. Sei Investments Co. lifted its position in shares of RH by 25.4% during the 1st quarter. Sei Investments Co. now owns 23,951 shares of the company's stock valued at $8,341,000 after buying an additional 4,847 shares in the last quarter. Russell Investments Group Ltd. grew its stake in shares of RH by 1.9% during the 1st quarter. Russell Investments Group Ltd. now owns 14,503 shares of the company's stock valued at $5,051,000 after acquiring an additional 266 shares during the period. Finally, State Board of Administration of Florida Retirement System grew its stake in shares of RH by 9.7% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 17,884 shares of the company's stock valued at $6,228,000 after acquiring an additional 1,580 shares during the period. Institutional investors own 90.17% of the company's stock.

RH Company Profile

(

Get Free Report)

RH, together with its subsidiaries, operates as a retailer in the home furnishings market. The company offers products in various categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, baby, child, and teen furnishings. It provides its products through rh.com, rhbabyandchild.com, rhteen.com, rhmodern.com, and waterworks.com online channels, as well as operates RH Galleries, RH outlet stores, RH Guesthouse, and Waterworks showrooms in the United States, Canada, the United Kingdom, and Germany.

Featured Stories

Before you consider RH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RH wasn't on the list.

While RH currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.