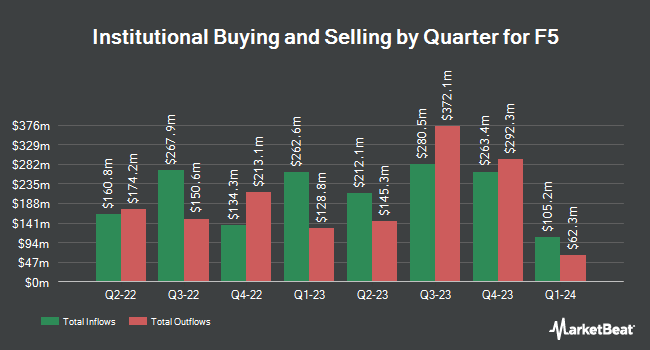

Rhumbline Advisers decreased its position in F5, Inc. (NASDAQ:FFIV - Free Report) by 1.6% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 118,846 shares of the network technology company's stock after selling 1,983 shares during the period. Rhumbline Advisers owned approximately 0.20% of F5 worth $29,886,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in FFIV. Creative Planning raised its stake in F5 by 8.7% in the 3rd quarter. Creative Planning now owns 4,342 shares of the network technology company's stock worth $956,000 after acquiring an additional 348 shares during the last quarter. Bleakley Financial Group LLC purchased a new position in F5 in the 3rd quarter worth $211,000. Sumitomo Mitsui DS Asset Management Company Ltd raised its stake in F5 by 14.0% in the 3rd quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 7,404 shares of the network technology company's stock worth $1,630,000 after acquiring an additional 909 shares during the last quarter. Blue Trust Inc. raised its stake in F5 by 156.0% in the 3rd quarter. Blue Trust Inc. now owns 617 shares of the network technology company's stock worth $136,000 after acquiring an additional 376 shares during the last quarter. Finally, Northwest Investment Counselors LLC purchased a new position in F5 in the 3rd quarter worth $28,000. Hedge funds and other institutional investors own 90.66% of the company's stock.

Wall Street Analysts Forecast Growth

FFIV has been the subject of a number of recent research reports. Evercore ISI lifted their price objective on F5 from $240.00 to $270.00 and gave the company an "in-line" rating in a research note on Friday, January 17th. Royal Bank of Canada lifted their price objective on F5 from $260.00 to $310.00 and gave the company a "sector perform" rating in a research note on Wednesday, January 29th. JPMorgan Chase & Co. lifted their price objective on F5 from $225.00 to $250.00 and gave the company a "neutral" rating in a research note on Tuesday, October 29th. Morgan Stanley lifted their price objective on F5 from $262.00 to $310.00 and gave the company an "equal weight" rating in a research note on Wednesday, January 29th. Finally, StockNews.com upgraded F5 from a "buy" rating to a "strong-buy" rating in a research note on Tuesday, October 29th. One analyst has rated the stock with a sell rating, seven have issued a hold rating, one has given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $295.00.

View Our Latest Stock Report on FFIV

Insider Activity

In related news, CEO Francois Locoh-Donou sold 6,500 shares of F5 stock in a transaction dated Wednesday, February 12th. The stock was sold at an average price of $303.06, for a total value of $1,969,890.00. Following the sale, the chief executive officer now directly owns 151,247 shares in the company, valued at approximately $45,836,915.82. The trade was a 4.12 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, insider Lyra Amber Schramm sold 253 shares of F5 stock in a transaction dated Saturday, February 1st. The stock was sold at an average price of $297.26, for a total value of $75,206.78. Following the completion of the sale, the insider now owns 200 shares in the company, valued at approximately $59,452. The trade was a 55.85 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 11,574 shares of company stock worth $3,455,057 in the last ninety days. Company insiders own 0.52% of the company's stock.

F5 Stock Down 3.0 %

Shares of NASDAQ:FFIV traded down $9.04 during trading on Friday, reaching $295.56. 467,919 shares of the company's stock traded hands, compared to its average volume of 703,624. F5, Inc. has a fifty-two week low of $159.01 and a fifty-two week high of $313.00. The firm has a market cap of $17.04 billion, a PE ratio of 29.38, a P/E/G ratio of 3.85 and a beta of 1.06. The company has a 50-day simple moving average of $275.62 and a 200-day simple moving average of $241.08.

F5 announced that its board has initiated a stock buyback program on Monday, October 28th that permits the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization permits the network technology company to repurchase up to 7.9% of its stock through open market purchases. Stock repurchase programs are often an indication that the company's management believes its stock is undervalued.

About F5

(

Free Report)

F5, Inc provides multi-cloud application security and delivery solutions in the United States, Europe, the Middle East, Africa, and the Asia Pacific region. The company's distributed cloud services enable its customers to deploy, secure, and operate applications in any architecture, from on-premises to the public cloud.

See Also

Before you consider F5, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F5 wasn't on the list.

While F5 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for March 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.