Rice Hall James & Associates LLC decreased its position in shares of Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) by 2.3% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 528,345 shares of the specialty pharmaceutical company's stock after selling 12,443 shares during the period. Supernus Pharmaceuticals makes up approximately 1.0% of Rice Hall James & Associates LLC's investment portfolio, making the stock its 28th biggest position. Rice Hall James & Associates LLC owned 0.96% of Supernus Pharmaceuticals worth $19,105,000 at the end of the most recent reporting period.

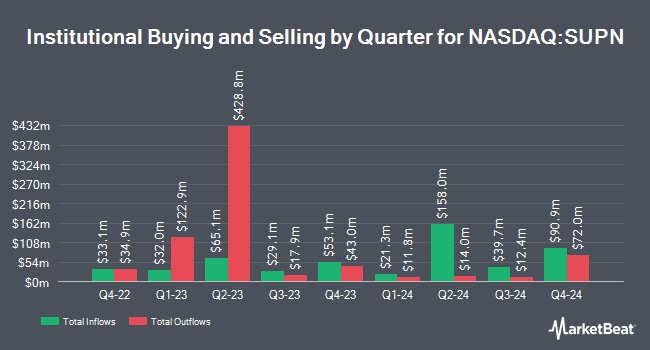

Other institutional investors have also recently made changes to their positions in the company. Pacer Advisors Inc. lifted its holdings in shares of Supernus Pharmaceuticals by 29.9% in the 3rd quarter. Pacer Advisors Inc. now owns 1,752,882 shares of the specialty pharmaceutical company's stock valued at $54,655,000 after acquiring an additional 403,028 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. lifted its holdings in shares of Supernus Pharmaceuticals by 145.7% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 214,864 shares of the specialty pharmaceutical company's stock valued at $6,699,000 after acquiring an additional 127,420 shares during the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in shares of Supernus Pharmaceuticals by 14.7% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 712,395 shares of the specialty pharmaceutical company's stock valued at $22,212,000 after acquiring an additional 91,354 shares during the last quarter. Geode Capital Management LLC lifted its holdings in shares of Supernus Pharmaceuticals by 5.3% in the 3rd quarter. Geode Capital Management LLC now owns 1,482,051 shares of the specialty pharmaceutical company's stock valued at $46,218,000 after acquiring an additional 74,438 shares during the last quarter. Finally, JPMorgan Chase & Co. lifted its holdings in shares of Supernus Pharmaceuticals by 40.6% in the 3rd quarter. JPMorgan Chase & Co. now owns 253,396 shares of the specialty pharmaceutical company's stock valued at $7,901,000 after acquiring an additional 73,118 shares during the last quarter.

Supernus Pharmaceuticals Trading Down 4.5 %

Shares of NASDAQ:SUPN traded down $1.54 during trading on Friday, reaching $33.05. The company's stock had a trading volume of 758,066 shares, compared to its average volume of 435,390. Supernus Pharmaceuticals, Inc. has a 12 month low of $25.53 and a 12 month high of $40.28. The firm's 50 day simple moving average is $37.48 and its two-hundred day simple moving average is $35.30. The stock has a market capitalization of $1.83 billion, a PE ratio of 30.89 and a beta of 0.90.

Wall Street Analysts Forecast Growth

Separately, Cantor Fitzgerald downgraded shares of Supernus Pharmaceuticals from an "overweight" rating to a "neutral" rating and lowered their price target for the company from $57.00 to $36.00 in a report on Wednesday.

Get Our Latest Stock Report on SUPN

Insiders Place Their Bets

In other Supernus Pharmaceuticals news, VP Padmanabh P. Bhatt sold 700 shares of the firm's stock in a transaction dated Tuesday, January 28th. The shares were sold at an average price of $39.62, for a total value of $27,734.00. Following the completion of the sale, the vice president now owns 10,149 shares of the company's stock, valued at $402,103.38. This trade represents a 6.45 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. 9.30% of the stock is owned by insiders.

Supernus Pharmaceuticals Company Profile

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

Featured Stories

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.