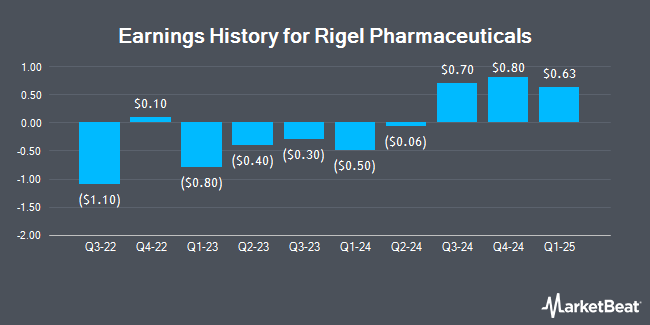

Rigel Pharmaceuticals (NASDAQ:RIGL - Get Free Report) announced its earnings results on Tuesday. The biotechnology company reported $0.80 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.30 by $0.50, Zacks reports. The business had revenue of $57.60 million for the quarter, compared to analysts' expectations of $57.59 million. Rigel Pharmaceuticals had a negative return on equity of 14.80% and a net margin of 2.46%. Rigel Pharmaceuticals updated its FY 2025 guidance to EPS.

Rigel Pharmaceuticals Trading Up 4.2 %

Shares of NASDAQ RIGL traded up $0.82 during trading on Friday, reaching $20.52. 184,891 shares of the company traded hands, compared to its average volume of 244,268. The firm's fifty day simple moving average is $20.14 and its 200 day simple moving average is $18.43. The stock has a market cap of $361.46 million, a P/E ratio of 146.58 and a beta of 1.35. Rigel Pharmaceuticals has a 12-month low of $7.48 and a 12-month high of $29.82.

Insider Buying and Selling at Rigel Pharmaceuticals

In other Rigel Pharmaceuticals news, EVP David A. Santos sold 2,125 shares of Rigel Pharmaceuticals stock in a transaction dated Tuesday, February 4th. The stock was sold at an average price of $20.92, for a total transaction of $44,455.00. Following the completion of the transaction, the executive vice president now owns 53,500 shares in the company, valued at approximately $1,119,220. This trade represents a 3.82 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Also, CEO Raul R. Rodriguez sold 4,952 shares of Rigel Pharmaceuticals stock in a transaction dated Tuesday, February 4th. The shares were sold at an average price of $20.92, for a total value of $103,595.84. Following the transaction, the chief executive officer now owns 243,854 shares of the company's stock, valued at $5,101,425.68. The trade was a 1.99 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 9,113 shares of company stock worth $190,644. Insiders own 9.04% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research firms have recently weighed in on RIGL. Piper Sandler raised their price objective on Rigel Pharmaceuticals from $15.00 to $23.00 and gave the stock a "neutral" rating in a research report on Thursday, November 14th. HC Wainwright reissued a "buy" rating and issued a $57.00 price objective on shares of Rigel Pharmaceuticals in a research report on Wednesday. B. Riley raised their price objective on Rigel Pharmaceuticals from $20.00 to $24.00 and gave the stock a "neutral" rating in a research report on Wednesday. StockNews.com cut Rigel Pharmaceuticals from a "strong-buy" rating to a "buy" rating in a research report on Saturday. Finally, Cantor Fitzgerald lifted their price target on Rigel Pharmaceuticals from $15.00 to $25.00 and gave the stock a "neutral" rating in a research report on Tuesday, December 10th. Three analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus target price of $36.80.

Check Out Our Latest Stock Report on RIGL

About Rigel Pharmaceuticals

(

Get Free Report)

Rigel Pharmaceuticals, Inc, a biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer. The company's commercialized products include Tavalisse, an oral spleen tyrosine kinase inhibitor for the treatment of adult patients with chronic immune thrombocytopenia; Rezlidhia, a non-intensive monotherapy for the treatment of adult patients with relapsed or refractory (R/R) acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test; and GAVRETO, a once daily, small molecule, oral, kinase inhibitor for the treatment of adult patients with metastatic rearranged during transfection (RET) fusion-positive non-small cell lung cancer, as well as for the treatment of adult and pediatric patients 12 years of age and older with advanced or metastatic RET fusion-positive thyroid cancer.

Featured Articles

Before you consider Rigel Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rigel Pharmaceuticals wasn't on the list.

While Rigel Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.