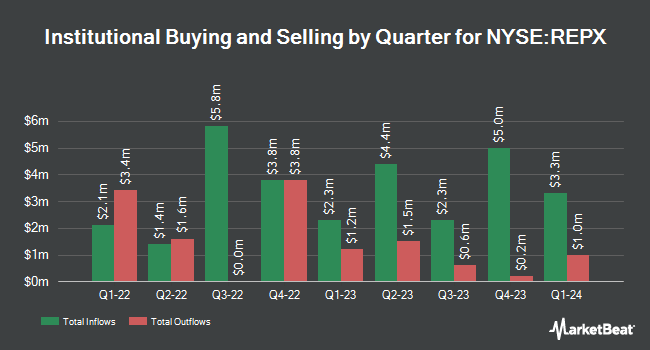

Victory Capital Management Inc. raised its stake in Riley Exploration Permian, Inc. (NYSE:REPX - Free Report) by 61.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 39,091 shares of the company's stock after purchasing an additional 14,810 shares during the period. Victory Capital Management Inc. owned 0.18% of Riley Exploration Permian worth $1,036,000 as of its most recent SEC filing.

Other hedge funds also recently added to or reduced their stakes in the company. CWM LLC boosted its holdings in shares of Riley Exploration Permian by 1,191.7% in the 2nd quarter. CWM LLC now owns 1,240 shares of the company's stock valued at $35,000 after buying an additional 1,144 shares in the last quarter. Ariadne Wealth Management LP purchased a new stake in Riley Exploration Permian in the second quarter valued at $36,000. Zurcher Kantonalbank Zurich Cantonalbank acquired a new position in Riley Exploration Permian in the second quarter valued at $39,000. Copeland Capital Management LLC purchased a new position in shares of Riley Exploration Permian during the third quarter worth about $48,000. Finally, Point72 DIFC Ltd acquired a new stake in shares of Riley Exploration Permian during the second quarter worth about $51,000. 58.91% of the stock is currently owned by hedge funds and other institutional investors.

Riley Exploration Permian Stock Performance

Shares of Riley Exploration Permian stock traded up $0.05 during trading on Thursday, reaching $35.01. The company's stock had a trading volume of 55,509 shares, compared to its average volume of 124,874. The company has a 50-day moving average price of $29.67 and a two-hundred day moving average price of $28.20. Riley Exploration Permian, Inc. has a fifty-two week low of $21.27 and a fifty-two week high of $37.15. The firm has a market cap of $752.01 million, a PE ratio of 6.19 and a beta of 1.34. The company has a current ratio of 0.70, a quick ratio of 0.64 and a debt-to-equity ratio of 0.53.

Riley Exploration Permian Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, November 7th. Stockholders of record on Thursday, October 24th were issued a $0.38 dividend. This represents a $1.52 dividend on an annualized basis and a dividend yield of 4.34%. This is a boost from Riley Exploration Permian's previous quarterly dividend of $0.36. The ex-dividend date of this dividend was Thursday, October 24th. Riley Exploration Permian's dividend payout ratio is presently 26.95%.

Analyst Upgrades and Downgrades

Separately, Truist Financial upped their target price on Riley Exploration Permian from $40.00 to $45.00 and gave the company a "buy" rating in a research report on Thursday, November 14th.

Check Out Our Latest Stock Report on REPX

Insider Transactions at Riley Exploration Permian

In other news, CEO Bobby Riley sold 6,302 shares of the company's stock in a transaction that occurred on Friday, September 27th. The stock was sold at an average price of $26.52, for a total transaction of $167,129.04. Following the completion of the sale, the chief executive officer now owns 335,356 shares in the company, valued at $8,893,641.12. This represents a 1.84 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Insiders own 3.90% of the company's stock.

Riley Exploration Permian Profile

(

Free Report)

Riley Exploration Permian, Inc, an independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil, natural gas, and natural gas liquids in Texas and New Mexico. The company's activities are primarily focused on the Northwest Shelf and Yeso trend of the Permian Basin.

Read More

Before you consider Riley Exploration Permian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Riley Exploration Permian wasn't on the list.

While Riley Exploration Permian currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.