River Road Asset Management LLC raised its stake in GXO Logistics, Inc. (NYSE:GXO - Free Report) by 53.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 2,008,168 shares of the company's stock after purchasing an additional 699,636 shares during the quarter. GXO Logistics accounts for about 1.2% of River Road Asset Management LLC's portfolio, making the stock its 28th biggest position. River Road Asset Management LLC owned approximately 1.68% of GXO Logistics worth $87,355,000 as of its most recent filing with the Securities & Exchange Commission.

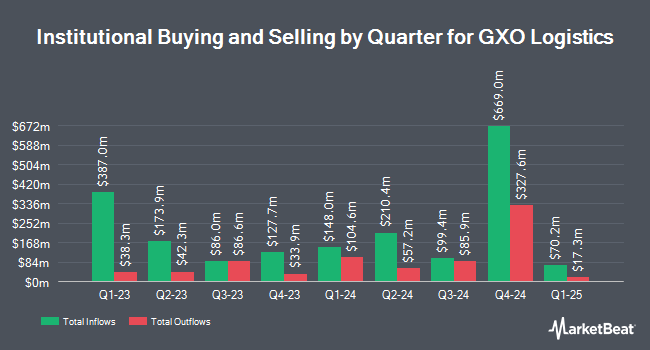

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Vaughan Nelson Investment Management L.P. bought a new position in shares of GXO Logistics in the fourth quarter valued at approximately $47,626,000. Global Alpha Capital Management Ltd. purchased a new stake in GXO Logistics during the 3rd quarter valued at about $32,434,000. Brown Brothers Harriman & Co. increased its position in shares of GXO Logistics by 105.0% in the third quarter. Brown Brothers Harriman & Co. now owns 968,267 shares of the company's stock valued at $50,418,000 after acquiring an additional 495,829 shares during the period. Raymond James Financial Inc. purchased a new stake in GXO Logistics in the 4th quarter worth approximately $20,905,000. Finally, Life Planning Partners Inc grew its holdings in shares of GXO Logistics by 4,250.0% during the 4th quarter. Life Planning Partners Inc now owns 263,393 shares of the company's stock worth $11,458,000 after acquiring an additional 257,338 shares during the period. Hedge funds and other institutional investors own 90.67% of the company's stock.

GXO Logistics Stock Performance

NYSE:GXO traded up $1.12 during trading hours on Friday, reaching $40.26. 2,492,770 shares of the stock were exchanged, compared to its average volume of 1,143,773. The stock has a market capitalization of $4.81 billion, a P/E ratio of 35.94, a P/E/G ratio of 1.34 and a beta of 1.62. GXO Logistics, Inc. has a 52 week low of $34.51 and a 52 week high of $63.33. The firm has a 50 day simple moving average of $42.08 and a 200-day simple moving average of $49.43. The company has a quick ratio of 0.86, a current ratio of 0.83 and a debt-to-equity ratio of 0.83.

GXO Logistics (NYSE:GXO - Get Free Report) last released its earnings results on Wednesday, February 12th. The company reported $1.00 EPS for the quarter, beating the consensus estimate of $0.94 by $0.06. GXO Logistics had a net margin of 1.14% and a return on equity of 11.16%. As a group, sell-side analysts forecast that GXO Logistics, Inc. will post 2.49 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several analysts recently commented on GXO shares. UBS Group cut their price objective on shares of GXO Logistics from $72.00 to $50.00 and set a "buy" rating on the stock in a research report on Friday, February 14th. Oppenheimer decreased their target price on GXO Logistics from $67.00 to $55.00 and set an "outperform" rating on the stock in a research note on Tuesday, February 18th. Deutsche Bank Aktiengesellschaft started coverage on GXO Logistics in a research report on Friday, March 7th. They set a "hold" rating and a $45.00 price objective for the company. Loop Capital lowered GXO Logistics from a "buy" rating to a "hold" rating and dropped their price target for the stock from $71.00 to $49.00 in a research report on Monday, February 3rd. Finally, Truist Financial assumed coverage on GXO Logistics in a research report on Thursday. They issued a "hold" rating and a $40.00 price objective on the stock. Six equities research analysts have rated the stock with a hold rating and nine have assigned a buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $55.60.

Get Our Latest Analysis on GXO Logistics

GXO Logistics Company Profile

(

Free Report)

GXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Read More

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.