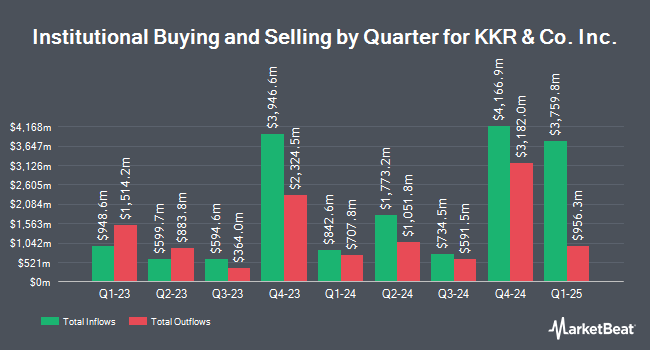

River Road Asset Management LLC decreased its holdings in KKR & Co. Inc. (NYSE:KKR - Free Report) by 32.9% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 229,176 shares of the asset manager's stock after selling 112,380 shares during the quarter. River Road Asset Management LLC's holdings in KKR & Co. Inc. were worth $33,897,000 as of its most recent SEC filing.

Other institutional investors have also recently made changes to their positions in the company. Pettinga Financial Advisors LLC purchased a new position in KKR & Co. Inc. in the 3rd quarter worth $238,000. Van ECK Associates Corp raised its stake in KKR & Co. Inc. by 4.3% in the 3rd quarter. Van ECK Associates Corp now owns 17,166 shares of the asset manager's stock worth $2,378,000 after acquiring an additional 704 shares during the last quarter. Atria Investments Inc raised its stake in shares of KKR & Co. Inc. by 10.3% during the 3rd quarter. Atria Investments Inc now owns 45,329 shares of the asset manager's stock valued at $5,919,000 after buying an additional 4,235 shares during the last quarter. XML Financial LLC raised its stake in shares of KKR & Co. Inc. by 27.1% during the 3rd quarter. XML Financial LLC now owns 3,779 shares of the asset manager's stock valued at $493,000 after buying an additional 806 shares during the last quarter. Finally, Sigma Planning Corp raised its stake in shares of KKR & Co. Inc. by 1.3% during the 3rd quarter. Sigma Planning Corp now owns 6,489 shares of the asset manager's stock valued at $847,000 after buying an additional 81 shares during the last quarter. Institutional investors and hedge funds own 76.26% of the company's stock.

Insider Transactions at KKR & Co. Inc.

In other news, major shareholder Genetic Disorder L.P. Kkr sold 6,000,000 shares of the business's stock in a transaction that occurred on Wednesday, March 5th. The stock was sold at an average price of $32.96, for a total transaction of $197,760,000.00. Following the transaction, the insider now directly owns 19,260,971 shares in the company, valued at $634,841,604.16. The trade was a 23.75 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders own 39.34% of the company's stock.

Analysts Set New Price Targets

A number of research firms have weighed in on KKR. Hsbc Global Res lowered KKR & Co. Inc. from a "strong-buy" rating to a "hold" rating in a research note on Thursday, January 30th. Oppenheimer lifted their price objective on KKR & Co. Inc. from $153.00 to $175.00 and gave the company an "outperform" rating in a research note on Thursday, December 12th. Barclays reduced their price objective on KKR & Co. Inc. from $185.00 to $181.00 and set an "overweight" rating for the company in a research note on Wednesday, February 5th. Morgan Stanley cut their price target on KKR & Co. Inc. from $157.00 to $156.00 and set an "equal weight" rating for the company in a research note on Thursday, February 6th. Finally, Wells Fargo & Company cut their price target on KKR & Co. Inc. from $151.00 to $150.00 and set an "equal weight" rating for the company in a research note on Wednesday, February 5th. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, KKR & Co. Inc. presently has a consensus rating of "Moderate Buy" and a consensus target price of $161.43.

View Our Latest Stock Report on KKR & Co. Inc.

KKR & Co. Inc. Price Performance

KKR stock traded up $4.85 during trading on Friday, hitting $113.54. The stock had a trading volume of 6,824,404 shares, compared to its average volume of 4,342,970. The company has a debt-to-equity ratio of 0.82, a current ratio of 0.07 and a quick ratio of 0.07. KKR & Co. Inc. has a twelve month low of $91.92 and a twelve month high of $170.40. The stock has a market capitalization of $100.85 billion, a P/E ratio of 34.10, a PEG ratio of 1.00 and a beta of 1.72. The company's 50-day moving average price is $142.93 and its two-hundred day moving average price is $141.61.

KKR & Co. Inc. Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Friday, February 14th were issued a dividend of $0.175 per share. This represents a $0.70 annualized dividend and a dividend yield of 0.62%. The ex-dividend date of this dividend was Friday, February 14th. KKR & Co. Inc.'s dividend payout ratio is currently 21.02%.

KKR & Co. Inc. Profile

(

Free Report)

KKR & Co, Inc operates as an investment firm. It offers alternative asset management as well as capital markets and insurance solutions. The firm's business segments include Asset Management and Insurance Business. The Asset Management segment engages in providing private equity, real assets, credit and liquid strategies, capital markets, and principal activities.

Featured Articles

Before you consider KKR & Co. Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KKR & Co. Inc. wasn't on the list.

While KKR & Co. Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.