Riverstone Advisors LLC bought a new stake in Howmet Aerospace Inc. (NYSE:HWM - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm bought 4,705 shares of the company's stock, valued at approximately $515,000.

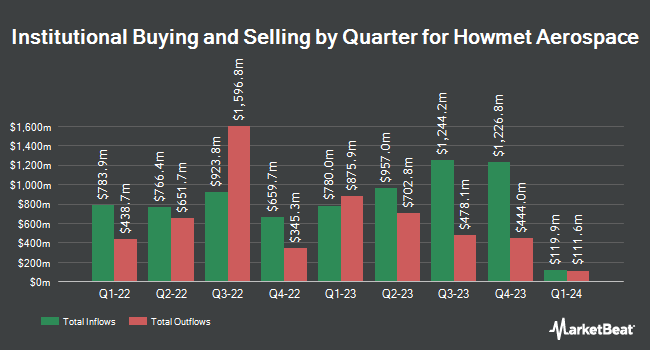

Other institutional investors and hedge funds have also made changes to their positions in the company. RiverPark Advisors LLC purchased a new position in Howmet Aerospace in the 3rd quarter worth about $26,000. R Squared Ltd acquired a new position in Howmet Aerospace in the 4th quarter valued at $26,000. Hollencrest Capital Management bought a new stake in Howmet Aerospace during the 3rd quarter valued at approximately $30,000. Global Trust Asset Management LLC acquired a new position in Howmet Aerospace during the 4th quarter valued at $33,000. Finally, Hanson & Doremus Investment Management acquired a new position in Howmet Aerospace in the 4th quarter valued at approximately $34,000. 90.46% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on HWM shares. Truist Financial raised their price target on Howmet Aerospace from $128.00 to $130.00 and gave the company a "buy" rating in a report on Tuesday, January 14th. Bank of America lifted their target price on Howmet Aerospace from $100.00 to $135.00 and gave the stock a "buy" rating in a research note on Wednesday, November 13th. Barclays increased their price target on shares of Howmet Aerospace from $100.00 to $130.00 and gave the stock an "overweight" rating in a research report on Monday, November 11th. Royal Bank of Canada raised their target price on Howmet Aerospace from $105.00 to $135.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Finally, Wells Fargo & Company increased their price target on Howmet Aerospace from $129.00 to $132.00 and gave the stock an "overweight" rating in a report on Wednesday, December 11th. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and fourteen have given a buy rating to the stock. Based on data from MarketBeat.com, Howmet Aerospace currently has a consensus rating of "Moderate Buy" and an average target price of $115.71.

View Our Latest Research Report on Howmet Aerospace

Howmet Aerospace Trading Up 2.0 %

Howmet Aerospace stock traded up $2.51 during midday trading on Wednesday, hitting $127.99. 869,421 shares of the stock were exchanged, compared to its average volume of 2,619,763. The company has a current ratio of 2.24, a quick ratio of 0.98 and a debt-to-equity ratio of 0.76. The stock's 50-day simple moving average is $117.36 and its 200 day simple moving average is $105.80. Howmet Aerospace Inc. has a fifty-two week low of $57.66 and a fifty-two week high of $129.10. The stock has a market capitalization of $52.00 billion, a price-to-earnings ratio of 48.79, a PEG ratio of 1.43 and a beta of 1.50.

Howmet Aerospace Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, February 25th. Shareholders of record on Friday, February 7th will be given a dividend of $0.10 per share. This is an increase from Howmet Aerospace's previous quarterly dividend of $0.08. This represents a $0.40 annualized dividend and a yield of 0.31%. The ex-dividend date is Friday, February 7th. Howmet Aerospace's dividend payout ratio (DPR) is presently 12.21%.

Howmet Aerospace Company Profile

(

Free Report)

Howmet Aerospace Inc provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally. It operates through four segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels.

Featured Articles

Before you consider Howmet Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Howmet Aerospace wasn't on the list.

While Howmet Aerospace currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.