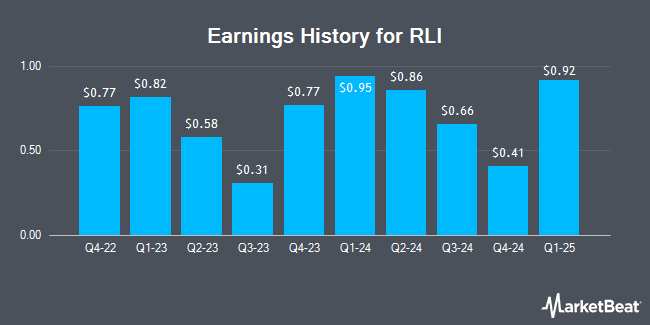

RLI (NYSE:RLI - Get Free Report) is anticipated to announce its earnings results after the market closes on Wednesday, January 22nd. Analysts expect the company to announce earnings of $1.05 per share and revenue of $435,020.80 billion for the quarter.

RLI (NYSE:RLI - Get Free Report) last posted its earnings results on Monday, October 21st. The insurance provider reported $1.31 earnings per share for the quarter, beating analysts' consensus estimates of $0.98 by $0.33. RLI had a return on equity of 19.03% and a net margin of 23.77%. The business had revenue of $470.00 million during the quarter, compared to analyst estimates of $491.54 million. During the same quarter in the previous year, the firm earned $0.61 EPS. The company's quarterly revenue was up 41.7% compared to the same quarter last year. On average, analysts expect RLI to post $6 EPS for the current fiscal year and $6 EPS for the next fiscal year.

RLI Trading Up 0.9 %

Shares of RLI stock traded up $1.34 on Wednesday, reaching $154.38. The stock had a trading volume of 193,835 shares, compared to its average volume of 229,059. The business's 50 day moving average is $168.60 and its two-hundred day moving average is $157.03. RLI has a 1 year low of $134.07 and a 1 year high of $182.29. The company has a market cap of $7.07 billion, a P/E ratio of 16.96 and a beta of 0.47.

RLI's stock is set to split before the market opens on Thursday, January 16th. The 2-1 split was announced on Thursday, November 7th. The newly created shares will be payable to shareholders after the closing bell on Wednesday, January 15th.

RLI Increases Dividend

The business also recently announced a None dividend, which was paid on Friday, December 20th. Shareholders of record on Friday, November 29th were given a dividend of $4.29 per share. The ex-dividend date was Friday, November 29th. This is a positive change from RLI's previous None dividend of $2.25. This represents a yield of 0.7%. RLI's payout ratio is presently 12.75%.

Insider Activity

In related news, Director Michael J. Stone sold 200 shares of the stock in a transaction dated Thursday, December 12th. The stock was sold at an average price of $169.55, for a total transaction of $33,910.00. Following the completion of the sale, the director now directly owns 214,811 shares in the company, valued at $36,421,205.05. This represents a 0.09 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Insiders own 5.09% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have recently weighed in on RLI. Jefferies Financial Group raised their price objective on shares of RLI from $165.00 to $180.00 and gave the company a "buy" rating in a research report on Wednesday, October 9th. Royal Bank of Canada raised their price target on RLI from $162.00 to $165.00 and gave the company a "sector perform" rating in a research report on Wednesday, October 23rd. Compass Point lifted their price target on RLI from $170.00 to $185.00 and gave the stock a "buy" rating in a research note on Friday, October 25th. Oppenheimer began coverage on RLI in a research report on Wednesday, October 16th. They set a "market perform" rating on the stock. Finally, Keefe, Bruyette & Woods dropped their target price on RLI from $201.00 to $200.00 and set an "outperform" rating for the company in a research report on Friday, January 10th. Three equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, RLI presently has an average rating of "Moderate Buy" and an average target price of $182.40.

Get Our Latest Report on RLI

RLI Company Profile

(

Get Free Report)

RLI Corp., an insurance holding company, underwrites property and casualty insurance. Its Casualty segment provides commercial and personal coverage products; and general liability products, such as coverage for third-party liability of commercial insureds, including manufacturers, contractors, apartments, and mercantile.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider RLI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RLI wasn't on the list.

While RLI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.