RLJ Lodging Trust (NYSE:RLJ - Free Report) had its target price lifted by Oppenheimer from $11.00 to $12.00 in a research note released on Tuesday morning,Benzinga reports. They currently have an outperform rating on the real estate investment trust's stock.

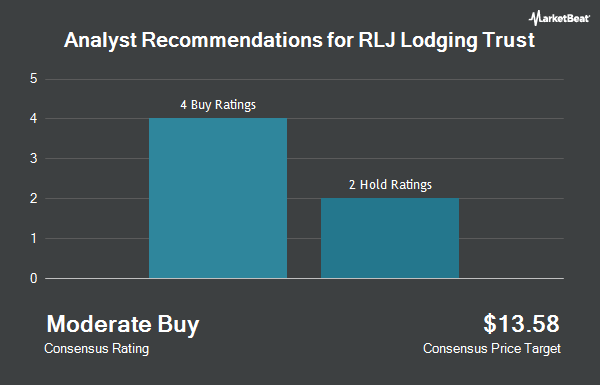

Several other brokerages have also recently weighed in on RLJ. StockNews.com cut shares of RLJ Lodging Trust from a "hold" rating to a "sell" rating in a research note on Wednesday, November 6th. Compass Point cut shares of RLJ Lodging Trust from a "buy" rating to a "neutral" rating and lowered their target price for the company from $18.00 to $10.00 in a research note on Monday, August 5th. Wells Fargo & Company cut RLJ Lodging Trust from an "equal weight" rating to an "underweight" rating and decreased their price target for the company from $11.00 to $9.00 in a report on Friday, September 13th. Truist Financial cut their target price on RLJ Lodging Trust from $14.00 to $11.00 and set a "buy" rating for the company in a research report on Monday, October 28th. Finally, Wolfe Research cut RLJ Lodging Trust from an "outperform" rating to a "peer perform" rating in a report on Thursday, September 26th. Three equities research analysts have rated the stock with a sell rating, two have given a hold rating and three have issued a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $11.29.

Check Out Our Latest Research Report on RLJ

RLJ Lodging Trust Stock Up 1.3 %

RLJ stock traded up $0.13 during trading on Tuesday, hitting $9.94. 2,577,515 shares of the stock traded hands, compared to its average volume of 1,412,368. The stock has a market cap of $1.54 billion, a price-to-earnings ratio of 34.28, a price-to-earnings-growth ratio of 0.92 and a beta of 1.70. The company has a debt-to-equity ratio of 1.12, a current ratio of 2.60 and a quick ratio of 2.60. RLJ Lodging Trust has a 1 year low of $8.74 and a 1 year high of $12.39. The firm's 50 day moving average is $9.24 and its two-hundred day moving average is $9.56.

RLJ Lodging Trust (NYSE:RLJ - Get Free Report) last issued its earnings results on Wednesday, November 6th. The real estate investment trust reported $0.09 EPS for the quarter, missing the consensus estimate of $0.32 by ($0.23). The business had revenue of $345.74 million for the quarter, compared to analysts' expectations of $342.93 million. RLJ Lodging Trust had a net margin of 5.19% and a return on equity of 3.57%. The business's revenue for the quarter was up 3.4% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.40 earnings per share. On average, sell-side analysts anticipate that RLJ Lodging Trust will post 1.34 EPS for the current year.

Institutional Trading of RLJ Lodging Trust

Several institutional investors and hedge funds have recently bought and sold shares of RLJ. Cerity Partners LLC boosted its stake in shares of RLJ Lodging Trust by 12.3% during the 3rd quarter. Cerity Partners LLC now owns 55,310 shares of the real estate investment trust's stock worth $508,000 after acquiring an additional 6,039 shares in the last quarter. Charles Schwab Investment Management Inc. raised its position in shares of RLJ Lodging Trust by 5.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 3,592,272 shares of the real estate investment trust's stock worth $32,977,000 after purchasing an additional 170,484 shares during the last quarter. Intech Investment Management LLC purchased a new position in RLJ Lodging Trust in the 3rd quarter valued at about $406,000. BNP PARIBAS ASSET MANAGEMENT Holding S.A. increased its stake in RLJ Lodging Trust by 25.1% during the 3rd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 1,991,625 shares of the real estate investment trust's stock worth $18,283,000 after buying an additional 400,100 shares in the last quarter. Finally, Metis Global Partners LLC lifted its position in shares of RLJ Lodging Trust by 31.0% in the third quarter. Metis Global Partners LLC now owns 15,798 shares of the real estate investment trust's stock valued at $145,000 after acquiring an additional 3,738 shares in the last quarter. 92.35% of the stock is currently owned by institutional investors and hedge funds.

RLJ Lodging Trust Company Profile

(

Get Free Report)

RLJ Lodging Trust is a self-advised, publicly traded real estate investment trust that owns primarily premium-branded, high-margin, focused-service and compact full-service hotels. The Company's portfolio currently consists of 96 hotels with approximately 21,200 rooms, located in 23 states and the District of Columbia and an ownership interest in one unconsolidated hotel with 171 rooms.

Featured Stories

Before you consider RLJ Lodging Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RLJ Lodging Trust wasn't on the list.

While RLJ Lodging Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.