Robeco Institutional Asset Management B.V. lifted its stake in Radware Ltd. (NASDAQ:RDWR - Free Report) by 162.1% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 55,513 shares of the information technology services provider's stock after acquiring an additional 34,332 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.13% of Radware worth $1,237,000 at the end of the most recent reporting period.

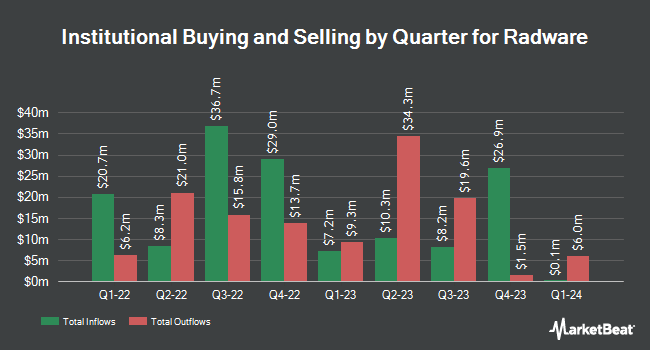

A number of other hedge funds have also added to or reduced their stakes in the stock. Van ECK Associates Corp increased its stake in Radware by 16.4% in the second quarter. Van ECK Associates Corp now owns 9,164 shares of the information technology services provider's stock valued at $167,000 after acquiring an additional 1,291 shares during the last quarter. nVerses Capital LLC bought a new stake in Radware in the 3rd quarter worth approximately $51,000. California State Teachers Retirement System boosted its stake in Radware by 9.7% in the first quarter. California State Teachers Retirement System now owns 40,705 shares of the information technology services provider's stock worth $762,000 after buying an additional 3,599 shares in the last quarter. BNP Paribas Financial Markets grew its position in Radware by 239.5% during the first quarter. BNP Paribas Financial Markets now owns 6,434 shares of the information technology services provider's stock valued at $120,000 after acquiring an additional 4,539 shares during the last quarter. Finally, Point72 Asset Management L.P. purchased a new position in shares of Radware during the second quarter worth approximately $120,000. Hedge funds and other institutional investors own 73.12% of the company's stock.

Radware Stock Up 2.0 %

Shares of NASDAQ:RDWR traded up $0.44 during midday trading on Monday, hitting $22.23. 173,907 shares of the stock traded hands, compared to its average volume of 287,688. The business's 50 day moving average is $22.02 and its two-hundred day moving average is $20.33. The stock has a market capitalization of $933.44 million, a PE ratio of -363.11 and a beta of 0.97. Radware Ltd. has a one year low of $14.80 and a one year high of $24.34.

Wall Street Analyst Weigh In

Several research firms recently commented on RDWR. StockNews.com raised shares of Radware from a "buy" rating to a "strong-buy" rating in a report on Wednesday, August 21st. Barclays lifted their price objective on Radware from $23.00 to $30.00 and gave the stock an "overweight" rating in a report on Thursday, October 31st. Finally, Needham & Company LLC upgraded Radware to a "hold" rating in a research report on Friday, November 1st.

Check Out Our Latest Research Report on RDWR

Radware Company Profile

(

Free Report)

Radware Ltd., together with its subsidiaries, develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data centers worldwide. The company operates in two segments, Radware's Core Business and The Hawks' Business. It offers DefensePro provides automated DDoS protection; Radware Kubernetes, a web application firewall solution; and Cyber Controller, a unified solution for management, configuration, and attack lifecycle.

Read More

Before you consider Radware, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Radware wasn't on the list.

While Radware currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.