Robeco Institutional Asset Management B.V. lifted its position in Brandywine Realty Trust (NYSE:BDN - Free Report) by 85.0% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 700,647 shares of the real estate investment trust's stock after acquiring an additional 321,907 shares during the period. Robeco Institutional Asset Management B.V. owned 0.41% of Brandywine Realty Trust worth $3,812,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

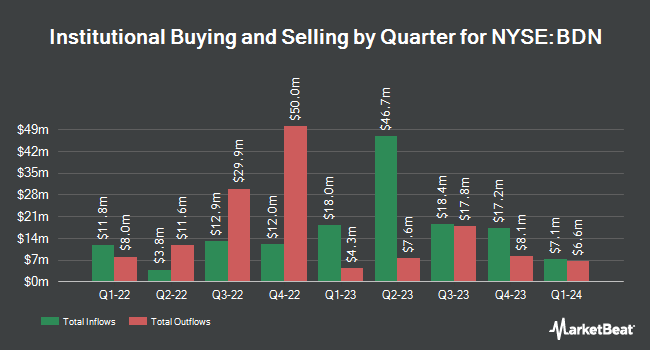

A number of other large investors have also recently bought and sold shares of BDN. Point72 DIFC Ltd purchased a new position in shares of Brandywine Realty Trust during the 2nd quarter valued at approximately $27,000. Sei Investments Co. acquired a new stake in Brandywine Realty Trust during the second quarter worth about $48,000. Bayesian Capital Management LP acquired a new position in Brandywine Realty Trust in the first quarter valued at approximately $56,000. EverSource Wealth Advisors LLC boosted its stake in Brandywine Realty Trust by 381.7% during the second quarter. EverSource Wealth Advisors LLC now owns 12,308 shares of the real estate investment trust's stock worth $55,000 after buying an additional 9,753 shares during the period. Finally, EntryPoint Capital LLC increased its holdings in Brandywine Realty Trust by 811.8% in the 1st quarter. EntryPoint Capital LLC now owns 13,969 shares of the real estate investment trust's stock valued at $67,000 after purchasing an additional 12,437 shares during the last quarter. Hedge funds and other institutional investors own 87.27% of the company's stock.

Analyst Ratings Changes

BDN has been the topic of several recent research reports. StockNews.com upgraded Brandywine Realty Trust from a "sell" rating to a "hold" rating in a report on Thursday, July 25th. Evercore ISI increased their price objective on Brandywine Realty Trust from $5.50 to $6.00 and gave the stock an "in-line" rating in a research report on Monday, September 16th.

Check Out Our Latest Analysis on BDN

Brandywine Realty Trust Price Performance

Shares of NYSE:BDN traded up $0.01 during trading hours on Friday, hitting $5.42. 1,672,521 shares of the company's stock traded hands, compared to its average volume of 2,523,327. The company's fifty day simple moving average is $5.48 and its two-hundred day simple moving average is $4.98. The company has a debt-to-equity ratio of 2.05, a quick ratio of 2.07 and a current ratio of 1.74. The company has a market cap of $935.87 million, a price-to-earnings ratio of -3.01 and a beta of 1.33. Brandywine Realty Trust has a 52 week low of $3.62 and a 52 week high of $6.54.

Brandywine Realty Trust (NYSE:BDN - Get Free Report) last released its quarterly earnings data on Tuesday, October 22nd. The real estate investment trust reported ($0.96) earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($1.20). Brandywine Realty Trust had a negative net margin of 60.08% and a negative return on equity of 24.59%. The company had revenue of $117.96 million for the quarter, compared to analyst estimates of $120.00 million. During the same period in the previous year, the firm posted $0.29 earnings per share. The firm's revenue for the quarter was down 3.0% compared to the same quarter last year. As a group, equities analysts anticipate that Brandywine Realty Trust will post 0.92 EPS for the current fiscal year.

Brandywine Realty Trust Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, October 24th. Shareholders of record on Wednesday, October 9th were paid a $0.15 dividend. The ex-dividend date of this dividend was Wednesday, October 9th. This represents a $0.60 annualized dividend and a yield of 11.07%. Brandywine Realty Trust's dividend payout ratio is -33.33%.

Brandywine Realty Trust Profile

(

Free Report)

Brandywine Realty Trust NYSE: BDN is one of the largest, publicly traded, full-service, integrated real estate companies in the United States with a core focus in the Philadelphia and Austin markets. Organized as a real estate investment trust (REIT), we own, develop, lease and manage an urban, town center and transit-oriented portfolio comprising 160 properties and 22.6 million square feet as of September 30, 2023 which excludes assets held for sale.

See Also

Before you consider Brandywine Realty Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brandywine Realty Trust wasn't on the list.

While Brandywine Realty Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.