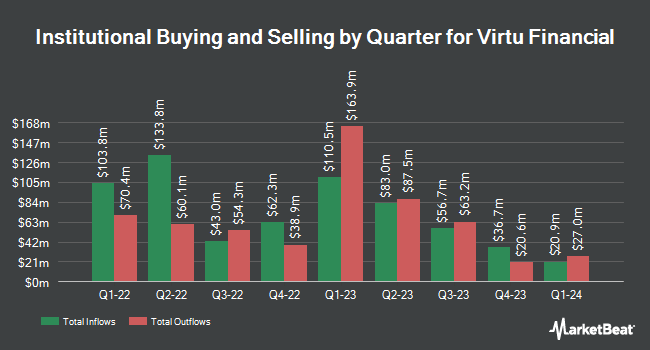

Robeco Institutional Asset Management B.V. lifted its position in shares of Virtu Financial, Inc. (NASDAQ:VIRT - Free Report) by 107.1% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 34,214 shares of the financial services provider's stock after purchasing an additional 17,696 shares during the period. Robeco Institutional Asset Management B.V.'s holdings in Virtu Financial were worth $1,042,000 as of its most recent SEC filing.

A number of other institutional investors also recently modified their holdings of VIRT. Janney Montgomery Scott LLC lifted its holdings in Virtu Financial by 26.2% in the 3rd quarter. Janney Montgomery Scott LLC now owns 48,592 shares of the financial services provider's stock worth $1,480,000 after buying an additional 10,074 shares during the period. Creative Financial Designs Inc. ADV lifted its stake in Virtu Financial by 1,180.1% in the third quarter. Creative Financial Designs Inc. ADV now owns 35,280 shares of the financial services provider's stock worth $1,075,000 after acquiring an additional 32,524 shares during the period. New York State Teachers Retirement System boosted its holdings in Virtu Financial by 25.2% in the third quarter. New York State Teachers Retirement System now owns 34,219 shares of the financial services provider's stock valued at $1,042,000 after acquiring an additional 6,893 shares in the last quarter. Pallas Capital Advisors LLC increased its position in Virtu Financial by 20.4% during the 3rd quarter. Pallas Capital Advisors LLC now owns 9,589 shares of the financial services provider's stock valued at $296,000 after purchasing an additional 1,625 shares during the period. Finally, Pullen Investment Management LLC raised its holdings in Virtu Financial by 8.9% in the 3rd quarter. Pullen Investment Management LLC now owns 72,628 shares of the financial services provider's stock worth $2,212,000 after purchasing an additional 5,936 shares in the last quarter. 45.78% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have recently weighed in on VIRT. Bank of America cut their target price on shares of Virtu Financial from $37.00 to $35.00 and set a "buy" rating on the stock in a research note on Thursday, October 3rd. Morgan Stanley lifted their price objective on Virtu Financial from $23.00 to $25.00 and gave the company an "equal weight" rating in a research report on Thursday, October 17th. The Goldman Sachs Group increased their target price on Virtu Financial from $26.00 to $29.00 and gave the stock a "neutral" rating in a research report on Monday, September 30th. Piper Sandler restated an "overweight" rating and set a $35.00 price target on shares of Virtu Financial in a research report on Thursday, October 24th. Finally, Citigroup upped their price target on Virtu Financial from $32.00 to $37.00 and gave the stock a "buy" rating in a research note on Wednesday, October 9th. Five research analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Virtu Financial currently has an average rating of "Hold" and a consensus target price of $29.50.

Get Our Latest Report on Virtu Financial

Virtu Financial Stock Up 4.9 %

VIRT stock traded up $1.68 on Monday, reaching $35.87. 1,349,251 shares of the company traded hands, compared to its average volume of 1,265,897. The firm has a fifty day simple moving average of $31.76 and a 200-day simple moving average of $27.35. The company has a market cap of $5.55 billion, a P/E ratio of 17.18, a price-to-earnings-growth ratio of 0.54 and a beta of 0.38. Virtu Financial, Inc. has a one year low of $16.02 and a one year high of $36.98. The company has a debt-to-equity ratio of 1.23, a current ratio of 0.47 and a quick ratio of 0.47.

Virtu Financial (NASDAQ:VIRT - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.82 earnings per share for the quarter, beating the consensus estimate of $0.79 by $0.03. The firm had revenue of $388.00 million during the quarter, compared to the consensus estimate of $379.18 million. Virtu Financial had a return on equity of 23.22% and a net margin of 7.29%. The company's revenue was up 30.2% on a year-over-year basis. During the same period last year, the company earned $0.40 earnings per share. Research analysts anticipate that Virtu Financial, Inc. will post 2.7 earnings per share for the current year.

Virtu Financial Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Sunday, December 15th. Stockholders of record on Sunday, December 1st will be paid a $0.24 dividend. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.96 annualized dividend and a dividend yield of 2.68%. Virtu Financial's dividend payout ratio is presently 48.24%.

Virtu Financial Company Profile

(

Free Report)

Virtu Financial, Inc operates as a financial services company in the United States, Asia Pacific, Canada, EMEA, Ireland, and internationally. The company operates through two segments, Market Making and Execution Services. Its product includes offerings in execution, liquidity sourcing, analytics and broker-neutral, capital markets, and multi-dealer platforms in workflow technology.

Featured Stories

Before you consider Virtu Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtu Financial wasn't on the list.

While Virtu Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.