Robeco Institutional Asset Management B.V. increased its stake in shares of Jackson Financial Inc. (NYSE:JXN - Free Report) by 22.8% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 89,905 shares of the company's stock after buying an additional 16,663 shares during the quarter. Robeco Institutional Asset Management B.V. owned about 0.12% of Jackson Financial worth $8,202,000 at the end of the most recent quarter.

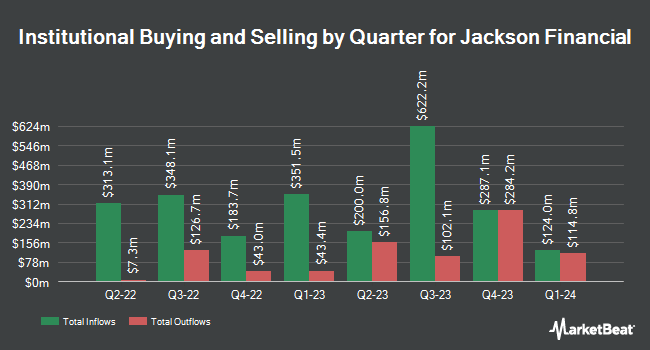

Other large investors have also recently added to or reduced their stakes in the company. Hantz Financial Services Inc. bought a new position in Jackson Financial in the 2nd quarter worth approximately $25,000. EverSource Wealth Advisors LLC grew its stake in shares of Jackson Financial by 400.0% in the first quarter. EverSource Wealth Advisors LLC now owns 395 shares of the company's stock worth $27,000 after purchasing an additional 316 shares in the last quarter. Blue Trust Inc. increased its holdings in shares of Jackson Financial by 232.1% during the third quarter. Blue Trust Inc. now owns 372 shares of the company's stock valued at $34,000 after purchasing an additional 260 shares during the period. GAMMA Investing LLC raised its stake in shares of Jackson Financial by 60.8% during the second quarter. GAMMA Investing LLC now owns 775 shares of the company's stock valued at $58,000 after purchasing an additional 293 shares in the last quarter. Finally, Headlands Technologies LLC lifted its holdings in Jackson Financial by 41.2% in the first quarter. Headlands Technologies LLC now owns 1,055 shares of the company's stock worth $70,000 after purchasing an additional 308 shares during the period. 89.96% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In other news, EVP Carrie Chelko sold 5,500 shares of the company's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $91.31, for a total value of $502,205.00. Following the transaction, the executive vice president now owns 61,829 shares in the company, valued at $5,645,605.99. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Company insiders own 1.30% of the company's stock.

Jackson Financial Trading Down 1.8 %

Shares of NYSE:JXN traded down $2.05 during midday trading on Friday, reaching $108.94. The company had a trading volume of 309,743 shares, compared to its average volume of 734,321. The company has a fifty day simple moving average of $93.64 and a two-hundred day simple moving average of $83.00. The company has a debt-to-equity ratio of 0.42, a quick ratio of 0.30 and a current ratio of 0.30. The firm has a market cap of $8.20 billion, a price-to-earnings ratio of 4.10 and a beta of 1.48. Jackson Financial Inc. has a 1-year low of $41.61 and a 1-year high of $115.09.

Jackson Financial (NYSE:JXN - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported $4.60 earnings per share for the quarter, missing the consensus estimate of $4.66 by ($0.06). The firm had revenue of $2.12 billion for the quarter, compared to analyst estimates of $1.73 billion. During the same quarter in the prior year, the business posted $3.80 earnings per share. Research analysts predict that Jackson Financial Inc. will post 18.78 earnings per share for the current year.

Jackson Financial declared that its Board of Directors has authorized a stock repurchase program on Wednesday, August 7th that permits the company to repurchase $750.00 million in outstanding shares. This repurchase authorization permits the company to repurchase up to 10.8% of its shares through open market purchases. Shares repurchase programs are often an indication that the company's board of directors believes its stock is undervalued.

Jackson Financial Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be issued a $0.70 dividend. The ex-dividend date is Thursday, December 5th. This represents a $2.80 dividend on an annualized basis and a dividend yield of 2.57%. Jackson Financial's payout ratio is currently 10.34%.

Analyst Ratings Changes

A number of research firms have commented on JXN. Keefe, Bruyette & Woods boosted their price target on shares of Jackson Financial from $80.00 to $82.00 and gave the stock a "market perform" rating in a research report on Wednesday, August 14th. Barclays lifted their price target on Jackson Financial from $109.00 to $111.00 and gave the company an "overweight" rating in a research report on Tuesday, October 8th. Jefferies Financial Group upped their price objective on Jackson Financial from $73.00 to $80.00 and gave the company a "hold" rating in a report on Monday, July 29th. Finally, Morgan Stanley boosted their price target on shares of Jackson Financial from $86.00 to $89.00 and gave the stock an "equal weight" rating in a research report on Monday, August 19th. Five research analysts have rated the stock with a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $80.33.

Check Out Our Latest Research Report on JXN

Jackson Financial Profile

(

Free Report)

Jackson Financial Inc, through its subsidiaries, provides suite of annuities to retail investors in the United States. The company operates through three segments: Retail Annuities, Institutional Products, and Closed Life and Annuity Blocks. The Retail Annuities segment offers various retirement income and savings products, including variable, fixed index, fixed, and payout annuities, as well as registered index-linked annuities and lifetime income solutions.

Read More

Before you consider Jackson Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jackson Financial wasn't on the list.

While Jackson Financial currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.