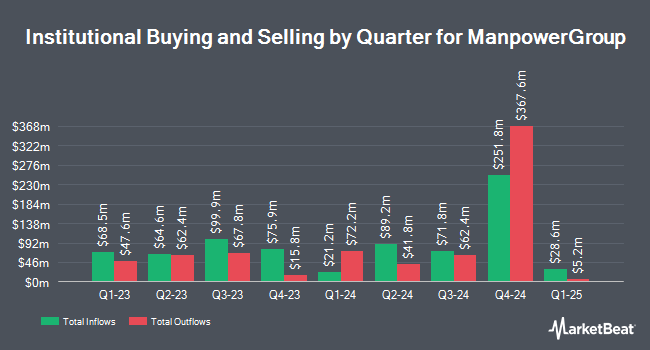

Robeco Institutional Asset Management B.V. lifted its position in shares of ManpowerGroup Inc. (NYSE:MAN - Free Report) by 4.0% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 403,070 shares of the business services provider's stock after buying an additional 15,407 shares during the quarter. Robeco Institutional Asset Management B.V. owned approximately 0.85% of ManpowerGroup worth $29,634,000 at the end of the most recent quarter.

Other institutional investors have also modified their holdings of the company. Tidal Investments LLC raised its holdings in ManpowerGroup by 179.7% in the 1st quarter. Tidal Investments LLC now owns 17,327 shares of the business services provider's stock valued at $1,345,000 after acquiring an additional 11,132 shares during the last quarter. O Shaughnessy Asset Management LLC lifted its position in ManpowerGroup by 510.8% during the first quarter. O Shaughnessy Asset Management LLC now owns 40,206 shares of the business services provider's stock worth $3,122,000 after buying an additional 33,623 shares during the period. CWM LLC boosted its stake in ManpowerGroup by 5,109.1% in the 2nd quarter. CWM LLC now owns 7,449 shares of the business services provider's stock worth $520,000 after buying an additional 7,306 shares during the last quarter. Quadrature Capital Ltd grew its holdings in ManpowerGroup by 140.0% in the 1st quarter. Quadrature Capital Ltd now owns 20,437 shares of the business services provider's stock valued at $1,587,000 after buying an additional 11,921 shares during the period. Finally, Capital Research Global Investors increased its stake in shares of ManpowerGroup by 2.2% during the 1st quarter. Capital Research Global Investors now owns 927,364 shares of the business services provider's stock valued at $72,001,000 after acquiring an additional 19,819 shares during the last quarter. Institutional investors and hedge funds own 98.03% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts recently issued reports on the stock. BMO Capital Markets decreased their target price on shares of ManpowerGroup from $87.00 to $71.00 and set a "market perform" rating on the stock in a research report on Friday, October 18th. Truist Financial lowered their price objective on shares of ManpowerGroup from $78.00 to $74.00 and set a "hold" rating for the company in a research note on Friday, October 18th. UBS Group cut their target price on ManpowerGroup from $78.00 to $71.00 and set a "neutral" rating on the stock in a research report on Friday, October 18th. Finally, JPMorgan Chase & Co. lowered their price target on ManpowerGroup from $84.00 to $75.00 and set a "neutral" rating for the company in a research report on Friday, July 19th. Six analysts have rated the stock with a hold rating and one has given a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $76.60.

View Our Latest Analysis on MAN

ManpowerGroup Trading Up 3.8 %

Shares of MAN stock traded up $2.39 during mid-day trading on Wednesday, reaching $65.80. The company's stock had a trading volume of 710,292 shares, compared to its average volume of 433,264. The company has a quick ratio of 1.14, a current ratio of 1.15 and a debt-to-equity ratio of 0.46. The firm has a market capitalization of $3.12 billion, a PE ratio of 80.24 and a beta of 1.46. The company's 50 day simple moving average is $69.74 and its 200-day simple moving average is $71.82. ManpowerGroup Inc. has a 12-month low of $61.53 and a 12-month high of $80.25.

Insider Activity at ManpowerGroup

In related news, CFO John T. Mcginnis acquired 8,000 shares of ManpowerGroup stock in a transaction on Wednesday, October 23rd. The shares were bought at an average price of $62.28 per share, for a total transaction of $498,240.00. Following the completion of the purchase, the chief financial officer now directly owns 70,639 shares in the company, valued at $4,399,396.92. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 3.00% of the stock is owned by insiders.

ManpowerGroup Company Profile

(

Free Report)

ManpowerGroup Inc provides workforce solutions and services worldwide. The company offers recruitment services, including permanent, temporary, and contract recruitment of professionals, as well as administrative and industrial positions under the Manpower and Experis brands. It also offers various assessment services; training and development services; career and talent management; and outsourcing services related to human resources functions primarily in the areas of large-scale recruiting and workforce-intensive initiatives.

Read More

Before you consider ManpowerGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ManpowerGroup wasn't on the list.

While ManpowerGroup currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.