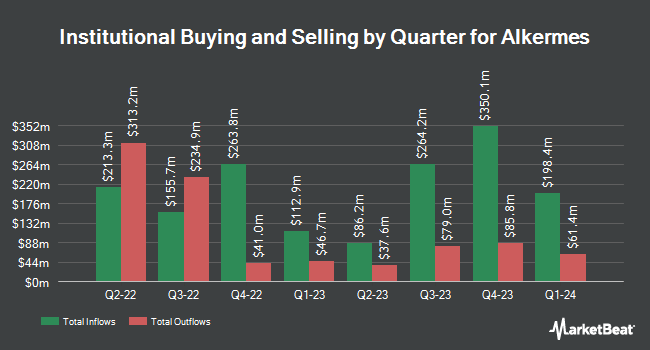

Robeco Institutional Asset Management B.V. boosted its stake in shares of Alkermes plc (NASDAQ:ALKS - Free Report) by 92.4% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 95,509 shares of the company's stock after buying an additional 45,857 shares during the quarter. Robeco Institutional Asset Management B.V. owned 0.06% of Alkermes worth $2,673,000 as of its most recent SEC filing.

Several other hedge funds also recently bought and sold shares of ALKS. V Square Quantitative Management LLC purchased a new stake in shares of Alkermes in the 3rd quarter valued at $29,000. Signaturefd LLC boosted its stake in shares of Alkermes by 51.2% in the second quarter. Signaturefd LLC now owns 1,417 shares of the company's stock valued at $34,000 after purchasing an additional 480 shares during the period. Hexagon Capital Partners LLC grew its holdings in shares of Alkermes by 3,841.0% in the second quarter. Hexagon Capital Partners LLC now owns 1,537 shares of the company's stock valued at $37,000 after purchasing an additional 1,498 shares in the last quarter. GAMMA Investing LLC increased its stake in Alkermes by 44.4% during the 2nd quarter. GAMMA Investing LLC now owns 2,287 shares of the company's stock worth $55,000 after buying an additional 703 shares during the period. Finally, Ashton Thomas Private Wealth LLC acquired a new stake in Alkermes during the 2nd quarter worth approximately $116,000. Hedge funds and other institutional investors own 95.21% of the company's stock.

Insider Activity

In other Alkermes news, EVP Craig C. Hopkinson sold 10,471 shares of Alkermes stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $29.53, for a total transaction of $309,208.63. Following the transaction, the executive vice president now owns 99,238 shares of the company's stock, valued at $2,930,498.14. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Company insiders own 4.89% of the company's stock.

Analyst Ratings Changes

Several equities analysts have commented on the stock. Piper Sandler restated an "overweight" rating and issued a $37.00 price target (down previously from $38.00) on shares of Alkermes in a research note on Friday, October 25th. Cantor Fitzgerald lowered their target price on Alkermes from $48.00 to $43.00 and set an "overweight" rating for the company in a research note on Friday, October 25th. HC Wainwright reaffirmed a "neutral" rating and issued a $37.00 price target on shares of Alkermes in a research report on Friday, October 25th. JPMorgan Chase & Co. lowered their price objective on Alkermes from $32.00 to $26.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Finally, Stifel Nicolaus upgraded shares of Alkermes from a "hold" rating to a "buy" rating and upped their target price for the stock from $25.00 to $36.00 in a research note on Tuesday, November 5th. One investment analyst has rated the stock with a sell rating, three have given a hold rating and eight have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $35.00.

Check Out Our Latest Analysis on Alkermes

Alkermes Stock Performance

NASDAQ ALKS traded down $0.11 during trading hours on Friday, hitting $28.86. The company had a trading volume of 1,837,154 shares, compared to its average volume of 1,889,883. The business has a 50 day moving average of $27.66 and a 200-day moving average of $26.08. The company has a market cap of $4.67 billion, a PE ratio of 14.80, a price-to-earnings-growth ratio of 0.98 and a beta of 0.47. Alkermes plc has a 1-year low of $22.06 and a 1-year high of $32.88. The company has a debt-to-equity ratio of 0.22, a quick ratio of 3.03 and a current ratio of 3.45.

Alkermes Company Profile

(

Free Report)

Alkermes plc, a biopharmaceutical company, researches, develops, and commercializes pharmaceutical products to address unmet medical needs of patients in therapeutic areas in the United States, Ireland, and internationally. It has a portfolio of proprietary commercial products for the treatment of alcohol dependence, opioid dependence, schizophrenia and bipolar I disorder and a pipeline of clinical and preclinical product candidates in development for neurological disorders.

Featured Stories

Before you consider Alkermes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alkermes wasn't on the list.

While Alkermes currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.