Robeco Institutional Asset Management B.V. reduced its stake in Kanzhun Limited (NASDAQ:BZ - Free Report) by 60.5% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 922,150 shares of the company's stock after selling 1,414,027 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.24% of Kanzhun worth $16,009,000 at the end of the most recent reporting period.

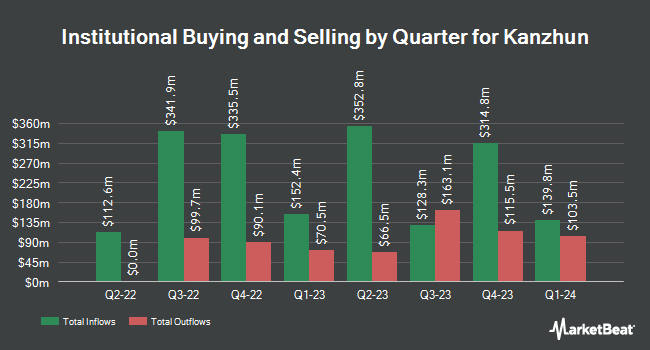

Several other institutional investors and hedge funds have also recently bought and sold shares of the stock. Van ECK Associates Corp acquired a new stake in shares of Kanzhun during the 3rd quarter worth about $61,000. abrdn plc raised its position in Kanzhun by 36.0% in the 3rd quarter. abrdn plc now owns 191,068 shares of the company's stock valued at $3,344,000 after purchasing an additional 50,598 shares during the last quarter. Assenagon Asset Management S.A. acquired a new stake in Kanzhun during the 3rd quarter worth $64,220,000. Allspring Global Investments Holdings LLC grew its position in Kanzhun by 3,918.5% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,648,976 shares of the company's stock worth $28,626,000 after purchasing an additional 1,607,941 shares during the last quarter. Finally, UMB Bank n.a. acquired a new position in Kanzhun in the third quarter valued at $42,000. 60.67% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several analysts recently commented on BZ shares. Daiwa America upgraded shares of Kanzhun to a "hold" rating in a research note on Thursday, July 25th. Barclays reduced their price target on shares of Kanzhun from $27.00 to $14.00 and set an "overweight" rating for the company in a research report on Friday, August 30th. Finally, Daiwa Capital Markets cut shares of Kanzhun from a "buy" rating to a "neutral" rating in a research note on Thursday, July 25th. Three investment analysts have rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $23.40.

View Our Latest Stock Analysis on BZ

Kanzhun Stock Performance

Shares of NASDAQ:BZ traded up $0.53 during mid-day trading on Thursday, hitting $15.33. 3,329,781 shares of the company traded hands, compared to its average volume of 4,120,500. The firm's 50 day simple moving average is $14.67 and its 200 day simple moving average is $16.94. The firm has a market cap of $5.84 billion, a P/E ratio of 35.65 and a beta of 0.55. Kanzhun Limited has a 52-week low of $10.57 and a 52-week high of $22.74.

Kanzhun (NASDAQ:BZ - Get Free Report) last posted its quarterly earnings data on Wednesday, August 28th. The company reported $0.13 earnings per share for the quarter, beating analysts' consensus estimates of $0.12 by $0.01. Kanzhun had a net margin of 20.90% and a return on equity of 10.19%. The company had revenue of $263.75 million during the quarter, compared to analysts' expectations of $264.38 million. Equities research analysts expect that Kanzhun Limited will post 0.47 EPS for the current fiscal year.

Kanzhun Profile

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

See Also

Before you consider Kanzhun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kanzhun wasn't on the list.

While Kanzhun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.