Robeco Institutional Asset Management B.V. lowered its position in shares of Kellanova (NYSE:K - Free Report) by 97.9% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 15,293 shares of the company's stock after selling 701,443 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Kellanova were worth $1,234,000 at the end of the most recent quarter.

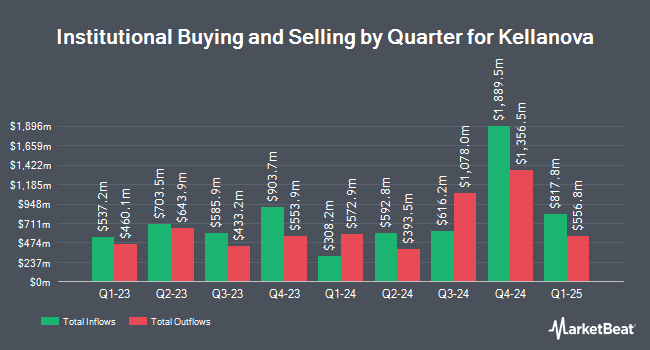

Other hedge funds have also recently modified their holdings of the company. Janney Montgomery Scott LLC boosted its holdings in Kellanova by 3.7% in the first quarter. Janney Montgomery Scott LLC now owns 42,382 shares of the company's stock worth $2,428,000 after acquiring an additional 1,504 shares in the last quarter. SG Americas Securities LLC boosted its stake in Kellanova by 29.9% in the 1st quarter. SG Americas Securities LLC now owns 43,581 shares of the company's stock worth $2,497,000 after purchasing an additional 10,022 shares in the last quarter. Sei Investments Co. grew its position in Kellanova by 2.6% during the 1st quarter. Sei Investments Co. now owns 79,195 shares of the company's stock valued at $4,537,000 after purchasing an additional 1,984 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. raised its holdings in Kellanova by 16.9% in the first quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 593,241 shares of the company's stock worth $33,987,000 after buying an additional 85,748 shares during the last quarter. Finally, TD Asset Management Inc raised its holdings in Kellanova by 8.3% in the first quarter. TD Asset Management Inc now owns 1,350,790 shares of the company's stock worth $77,387,000 after buying an additional 103,517 shares during the last quarter. Institutional investors own 83.87% of the company's stock.

Kellanova Price Performance

Kellanova stock traded up $0.10 during mid-day trading on Monday, reaching $81.10. 1,410,190 shares of the company's stock traded hands, compared to its average volume of 3,056,599. Kellanova has a 12-month low of $51.02 and a 12-month high of $81.26. The company has a market cap of $27.96 billion, a price-to-earnings ratio of 27.88, a PEG ratio of 2.60 and a beta of 0.39. The stock has a 50 day moving average of $80.65 and a two-hundred day moving average of $69.19. The company has a quick ratio of 0.53, a current ratio of 0.77 and a debt-to-equity ratio of 1.34.

Kellanova (NYSE:K - Get Free Report) last released its quarterly earnings results on Thursday, October 31st. The company reported $0.91 EPS for the quarter, topping analysts' consensus estimates of $0.85 by $0.06. Kellanova had a net margin of 7.85% and a return on equity of 37.05%. The firm had revenue of $3.23 billion during the quarter, compared to analysts' expectations of $3.16 billion. During the same period in the previous year, the company earned $1.03 EPS. The firm's revenue for the quarter was down .7% compared to the same quarter last year. Equities analysts forecast that Kellanova will post 3.74 earnings per share for the current year.

Kellanova Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Monday, December 2nd will be given a $0.57 dividend. The ex-dividend date is Monday, December 2nd. This represents a $2.28 annualized dividend and a yield of 2.81%. Kellanova's dividend payout ratio (DPR) is 78.35%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on K. The Goldman Sachs Group assumed coverage on Kellanova in a report on Monday, August 12th. They set a "neutral" rating and a $75.00 price target on the stock. Bank of America raised shares of Kellanova from a "neutral" rating to a "buy" rating and raised their price target for the company from $62.00 to $70.00 in a report on Friday, August 2nd. DA Davidson cut shares of Kellanova from a "buy" rating to a "neutral" rating and boosted their price objective for the company from $80.00 to $83.50 in a report on Monday, August 26th. Wells Fargo & Company raised their target price on shares of Kellanova from $76.00 to $83.50 and gave the stock an "equal weight" rating in a report on Thursday, August 15th. Finally, Deutsche Bank Aktiengesellschaft boosted their target price on shares of Kellanova from $76.00 to $83.50 and gave the company a "hold" rating in a research note on Thursday, August 15th. Fifteen equities research analysts have rated the stock with a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $76.35.

View Our Latest Stock Analysis on Kellanova

Insider Transactions at Kellanova

In other Kellanova news, major shareholder Kellogg W. K. Foundation Trust sold 77,800 shares of the company's stock in a transaction on Wednesday, August 14th. The stock was sold at an average price of $80.05, for a total value of $6,227,890.00. Following the completion of the sale, the insider now directly owns 50,753,038 shares in the company, valued at approximately $4,062,780,691.90. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In other Kellanova news, major shareholder Kellogg W. K. Foundation Trust sold 114,583 shares of the stock in a transaction on Monday, October 28th. The stock was sold at an average price of $80.76, for a total transaction of $9,253,723.08. Following the sale, the insider now owns 49,680,774 shares of the company's stock, valued at approximately $4,012,219,308.24. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, major shareholder Kellogg W. K. Foundation Trust sold 77,800 shares of the business's stock in a transaction on Wednesday, August 14th. The stock was sold at an average price of $80.05, for a total value of $6,227,890.00. Following the completion of the transaction, the insider now directly owns 50,753,038 shares of the company's stock, valued at approximately $4,062,780,691.90. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 1,150,064 shares of company stock valued at $92,680,265. 1.80% of the stock is currently owned by company insiders.

Kellanova Profile

(

Free Report)

Kellanova, together with its subsidiaries, manufactures and markets snacks and convenience foods in North America, Europe, Latin America, the Asia Pacific, the Middle East, Australia, and Africa. Its principal products include crackers, crisps, savory snacks, toaster pastries, cereal bars, granola bars and bites, ready-to-eat cereals, frozen waffles, veggie foods, and noodles.

Read More

Before you consider Kellanova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kellanova wasn't on the list.

While Kellanova currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report