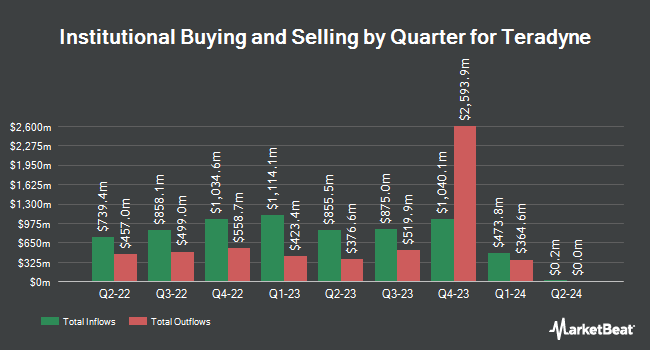

Robeco Institutional Asset Management B.V. increased its position in shares of Teradyne, Inc. (NASDAQ:TER - Free Report) by 64.8% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 149,285 shares of the company's stock after acquiring an additional 58,688 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.09% of Teradyne worth $19,994,000 at the end of the most recent quarter.

Several other large investors have also modified their holdings of TER. Van ECK Associates Corp raised its holdings in Teradyne by 6.3% during the third quarter. Van ECK Associates Corp now owns 3,082,064 shares of the company's stock valued at $383,501,000 after buying an additional 183,721 shares in the last quarter. Janney Montgomery Scott LLC grew its holdings in Teradyne by 2.1% in the 3rd quarter. Janney Montgomery Scott LLC now owns 207,900 shares of the company's stock valued at $27,844,000 after buying an additional 4,367 shares during the last quarter. VELA Investment Management LLC increased its position in Teradyne by 0.9% in the 3rd quarter. VELA Investment Management LLC now owns 12,782 shares of the company's stock worth $1,712,000 after buying an additional 113 shares during the period. Chicago Partners Investment Group LLC bought a new stake in shares of Teradyne in the third quarter valued at approximately $223,000. Finally, Farther Finance Advisors LLC grew its stake in shares of Teradyne by 149.0% in the third quarter. Farther Finance Advisors LLC now owns 2,435 shares of the company's stock worth $326,000 after acquiring an additional 1,457 shares during the last quarter. 99.77% of the stock is owned by institutional investors.

Analyst Upgrades and Downgrades

TER has been the subject of several recent research reports. Citigroup cut their price target on Teradyne from $185.00 to $162.00 and set a "buy" rating for the company in a report on Friday, July 26th. Susquehanna raised their target price on Teradyne from $130.00 to $145.00 and gave the stock a "positive" rating in a research report on Friday, July 26th. Evercore ISI increased their target price on shares of Teradyne from $130.00 to $145.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 9th. Craig Hallum cut their target price on shares of Teradyne from $124.00 to $111.00 and set a "hold" rating for the company in a research note on Friday, October 25th. Finally, Stifel Nicolaus dropped their price target on Teradyne from $140.00 to $125.00 and set a "hold" rating for the company in a report on Friday, October 25th. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and eight have given a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $142.62.

Get Our Latest Analysis on Teradyne

Teradyne Price Performance

Teradyne stock traded up $2.74 during trading hours on Thursday, hitting $111.74. The company had a trading volume of 1,145,160 shares, compared to its average volume of 2,039,313. Teradyne, Inc. has a one year low of $84.66 and a one year high of $163.21. The firm has a market cap of $18.20 billion, a PE ratio of 35.39, a PEG ratio of 2.27 and a beta of 1.52. The firm has a 50-day moving average of $125.35 and a 200 day moving average of $132.13.

Teradyne (NASDAQ:TER - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The company reported $0.90 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.78 by $0.12. Teradyne had a return on equity of 18.56% and a net margin of 18.75%. The business had revenue of $737.30 million during the quarter, compared to analysts' expectations of $716.40 million. During the same period in the previous year, the company posted $0.80 earnings per share. The firm's revenue for the quarter was up 4.8% compared to the same quarter last year. As a group, research analysts expect that Teradyne, Inc. will post 3.15 earnings per share for the current year.

Teradyne Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, September 27th. Shareholders of record on Thursday, September 5th were issued a dividend of $0.12 per share. The ex-dividend date was Thursday, September 5th. This represents a $0.48 annualized dividend and a yield of 0.43%. Teradyne's payout ratio is 15.24%.

Insider Buying and Selling at Teradyne

In other news, insider Richard John Burns sold 789 shares of Teradyne stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total value of $104,779.20. Following the completion of the transaction, the insider now owns 21,864 shares in the company, valued at $2,903,539.20. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. In other Teradyne news, insider Richard John Burns sold 789 shares of the stock in a transaction that occurred on Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total transaction of $104,779.20. Following the transaction, the insider now directly owns 21,864 shares in the company, valued at $2,903,539.20. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, CEO Gregory Stephen Smith sold 3,080 shares of the company's stock in a transaction dated Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total transaction of $409,024.00. Following the sale, the chief executive officer now owns 80,736 shares of the company's stock, valued at approximately $10,721,740.80. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders sold 14,352 shares of company stock worth $1,899,353. Insiders own 0.36% of the company's stock.

About Teradyne

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

Featured Articles

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report