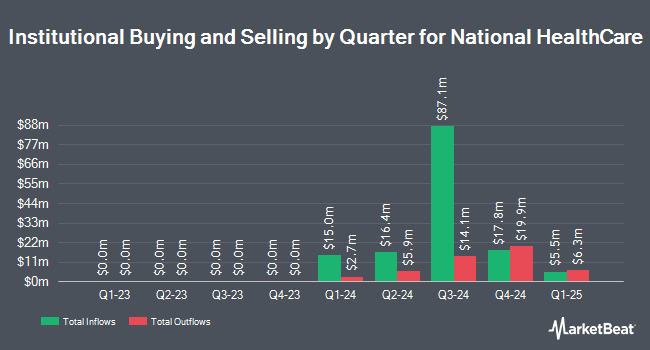

Robeco Institutional Asset Management B.V. grew its holdings in National HealthCare Co. (NYSE:NHC - Free Report) by 223.8% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 20,899 shares of the company's stock after acquiring an additional 14,445 shares during the quarter. Robeco Institutional Asset Management B.V. owned 0.14% of National HealthCare worth $2,628,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds and other institutional investors have also modified their holdings of the company. Illinois Municipal Retirement Fund acquired a new stake in National HealthCare during the first quarter worth about $745,000. Susquehanna Fundamental Investments LLC bought a new stake in shares of National HealthCare during the first quarter valued at approximately $206,000. ProShare Advisors LLC raised its stake in shares of National HealthCare by 7.3% in the first quarter. ProShare Advisors LLC now owns 2,539 shares of the company's stock valued at $240,000 after purchasing an additional 172 shares in the last quarter. State Board of Administration of Florida Retirement System lifted its position in National HealthCare by 7.9% in the first quarter. State Board of Administration of Florida Retirement System now owns 29,746 shares of the company's stock worth $2,811,000 after purchasing an additional 2,186 shares during the period. Finally, Vanguard Group Inc. lifted its position in National HealthCare by 4.9% in the first quarter. Vanguard Group Inc. now owns 1,593,829 shares of the company's stock worth $150,633,000 after purchasing an additional 74,911 shares during the period. Institutional investors and hedge funds own 56.44% of the company's stock.

Insider Buying and Selling at National HealthCare

In related news, SVP Brian F. Kidd sold 2,000 shares of National HealthCare stock in a transaction dated Wednesday, September 4th. The shares were sold at an average price of $130.01, for a total transaction of $260,020.00. Following the completion of the transaction, the senior vice president now directly owns 21,747 shares of the company's stock, valued at $2,827,327.47. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 13.75% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com cut shares of National HealthCare from a "strong-buy" rating to a "buy" rating in a research note on Friday.

Get Our Latest Stock Analysis on National HealthCare

National HealthCare Price Performance

NYSE:NHC traded up $4.51 during mid-day trading on Friday, hitting $134.43. The company's stock had a trading volume of 53,958 shares, compared to its average volume of 43,021. The company has a fifty day simple moving average of $123.72. The firm has a market cap of $2.07 billion, a P/E ratio of 32.39 and a beta of 0.41. National HealthCare Co. has a fifty-two week low of $70.03 and a fifty-two week high of $138.49.

National HealthCare (NYSE:NHC - Get Free Report) last posted its earnings results on Friday, August 9th. The company reported $1.00 EPS for the quarter. The business had revenue of $300.66 million during the quarter. National HealthCare had a return on equity of 6.39% and a net margin of 7.74%.

About National HealthCare

(

Free Report)

National HealthCare Corporation engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals. Its skilled nursing facilities offer licensed therapy services, nutrition services, social services, activities, and housekeeping and laundry services, as well as medical services prescribed by physicians; and rehabilitative services, such as physical, speech, respiratory, and occupational therapy for patients recovering from strokes, heart attacks, orthopedic conditions, neurological illnesses, or other illnesses, injuries, or disabilities.

See Also

Before you consider National HealthCare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National HealthCare wasn't on the list.

While National HealthCare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.