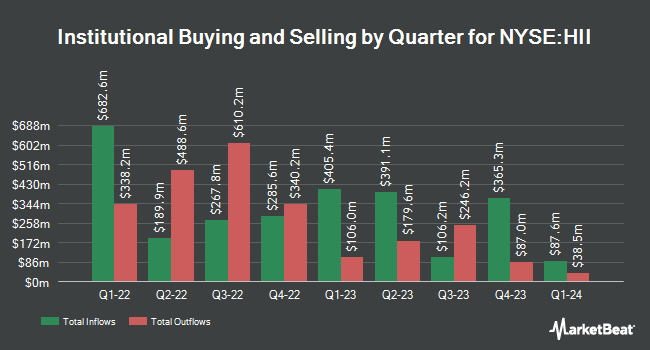

Robeco Institutional Asset Management B.V. lifted its stake in Huntington Ingalls Industries, Inc. (NYSE:HII - Free Report) by 6.0% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 54,580 shares of the aerospace company's stock after purchasing an additional 3,073 shares during the quarter. Robeco Institutional Asset Management B.V. owned 0.14% of Huntington Ingalls Industries worth $14,430,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other hedge funds also recently bought and sold shares of the company. First Trust Direct Indexing L.P. purchased a new position in Huntington Ingalls Industries in the first quarter worth about $210,000. Norden Group LLC bought a new position in Huntington Ingalls Industries in the 1st quarter valued at approximately $600,000. Private Advisor Group LLC boosted its stake in Huntington Ingalls Industries by 239.2% during the 1st quarter. Private Advisor Group LLC now owns 4,352 shares of the aerospace company's stock valued at $1,269,000 after purchasing an additional 3,069 shares during the last quarter. Fidelis Capital Partners LLC bought a new stake in shares of Huntington Ingalls Industries in the 1st quarter worth $31,000. Finally, Daiwa Securities Group Inc. lifted its holdings in shares of Huntington Ingalls Industries by 11.6% during the first quarter. Daiwa Securities Group Inc. now owns 3,911 shares of the aerospace company's stock valued at $1,140,000 after purchasing an additional 406 shares in the last quarter. Institutional investors own 90.46% of the company's stock.

Analyst Ratings Changes

Several equities research analysts recently commented on the company. Wolfe Research downgraded Huntington Ingalls Industries from an "outperform" rating to a "peer perform" rating in a report on Thursday, October 10th. StockNews.com cut shares of Huntington Ingalls Industries from a "buy" rating to a "hold" rating in a report on Friday, November 1st. TD Cowen cut shares of Huntington Ingalls Industries from a "buy" rating to a "hold" rating and set a $180.00 target price on the stock. in a report on Friday, November 1st. Vertical Research downgraded shares of Huntington Ingalls Industries from a "buy" rating to a "hold" rating and set a $275.00 target price for the company. in a research report on Thursday, October 10th. Finally, Alembic Global Advisors downgraded Huntington Ingalls Industries from an "overweight" rating to a "neutral" rating and set a $210.00 price target on the stock. in a research note on Friday, November 1st. One research analyst has rated the stock with a sell rating, eight have given a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Hold" and an average price target of $233.13.

Check Out Our Latest Research Report on Huntington Ingalls Industries

Huntington Ingalls Industries Price Performance

Huntington Ingalls Industries stock traded down $4.72 during midday trading on Thursday, reaching $198.49. 418,770 shares of the stock traded hands, compared to its average volume of 329,576. The company has a quick ratio of 0.73, a current ratio of 0.79 and a debt-to-equity ratio of 0.41. Huntington Ingalls Industries, Inc. has a 12 month low of $184.29 and a 12 month high of $299.50. The stock's fifty day moving average is $255.69 and its 200-day moving average is $257.29. The stock has a market cap of $7.77 billion, a P/E ratio of 11.47, a PEG ratio of 1.67 and a beta of 0.55.

Huntington Ingalls Industries (NYSE:HII - Get Free Report) last posted its earnings results on Thursday, October 31st. The aerospace company reported $2.56 earnings per share for the quarter, missing analysts' consensus estimates of $3.84 by ($1.28). The business had revenue of $2.75 billion during the quarter, compared to analysts' expectations of $2.87 billion. Huntington Ingalls Industries had a net margin of 5.99% and a return on equity of 16.89%. The company's revenue for the quarter was down 2.4% compared to the same quarter last year. During the same period last year, the business posted $3.70 earnings per share. As a group, equities research analysts anticipate that Huntington Ingalls Industries, Inc. will post 16.49 EPS for the current year.

Huntington Ingalls Industries Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Friday, November 29th will be given a dividend of $1.35 per share. The ex-dividend date is Friday, November 29th. This is an increase from Huntington Ingalls Industries's previous quarterly dividend of $1.30. This represents a $5.40 dividend on an annualized basis and a yield of 2.72%. Huntington Ingalls Industries's dividend payout ratio is 29.36%.

Huntington Ingalls Industries Profile

(

Free Report)

Huntington Ingalls Industries, Inc designs, builds, overhauls, and repairs military ships in the United States. It operates through three segments: Ingalls, Newport News, and Mission Technologies. The company is involved in the design and construction of non-nuclear ships comprising amphibious assault ships; expeditionary warfare ships; surface combatants; and national security cutters for the U.S.

See Also

Before you consider Huntington Ingalls Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Ingalls Industries wasn't on the list.

While Huntington Ingalls Industries currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.