Robeco Institutional Asset Management B.V. boosted its holdings in shares of BioMarin Pharmaceutical Inc. (NASDAQ:BMRN - Free Report) by 157.4% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 210,666 shares of the biotechnology company's stock after buying an additional 128,807 shares during the period. Robeco Institutional Asset Management B.V. owned about 0.11% of BioMarin Pharmaceutical worth $14,808,000 as of its most recent SEC filing.

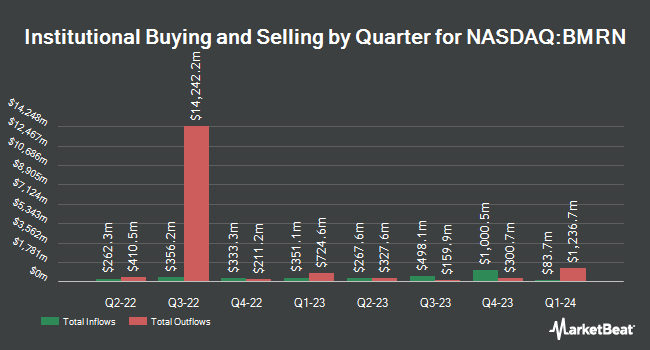

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Innealta Capital LLC bought a new stake in BioMarin Pharmaceutical during the second quarter worth about $25,000. nVerses Capital LLC acquired a new position in shares of BioMarin Pharmaceutical in the 3rd quarter worth approximately $28,000. BOKF NA bought a new stake in BioMarin Pharmaceutical during the 2nd quarter worth approximately $31,000. Quent Capital LLC grew its position in BioMarin Pharmaceutical by 58.9% during the 2nd quarter. Quent Capital LLC now owns 391 shares of the biotechnology company's stock worth $32,000 after acquiring an additional 145 shares during the last quarter. Finally, Itau Unibanco Holding S.A. acquired a new stake in BioMarin Pharmaceutical during the 2nd quarter valued at $47,000. Institutional investors own 98.71% of the company's stock.

BioMarin Pharmaceutical Stock Up 1.6 %

Shares of NASDAQ BMRN traded up $1.05 during mid-day trading on Thursday, hitting $67.20. The company had a trading volume of 779,205 shares, compared to its average volume of 1,843,027. The company has a current ratio of 4.27, a quick ratio of 2.62 and a debt-to-equity ratio of 0.11. The firm has a 50-day simple moving average of $73.68 and a two-hundred day simple moving average of $80.10. The company has a market capitalization of $12.81 billion, a PE ratio of 39.61, a price-to-earnings-growth ratio of 0.66 and a beta of 0.31. BioMarin Pharmaceutical Inc. has a one year low of $65.35 and a one year high of $99.56.

BioMarin Pharmaceutical (NASDAQ:BMRN - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The biotechnology company reported $0.55 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.78 by ($0.23). BioMarin Pharmaceutical had a net margin of 11.71% and a return on equity of 8.53%. The firm had revenue of $746.00 million during the quarter, compared to the consensus estimate of $703.37 million. During the same period last year, the business earned $0.26 earnings per share. The business's revenue was up 28.4% compared to the same quarter last year. On average, equities analysts expect that BioMarin Pharmaceutical Inc. will post 2.47 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on BMRN shares. Raymond James reissued an "outperform" rating and set a $79.00 price objective on shares of BioMarin Pharmaceutical in a report on Thursday, October 10th. StockNews.com upgraded shares of BioMarin Pharmaceutical from a "hold" rating to a "buy" rating in a research report on Thursday, August 8th. Piper Sandler upped their target price on shares of BioMarin Pharmaceutical from $107.00 to $122.00 and gave the company an "overweight" rating in a research report on Thursday, September 5th. Barclays lowered their price target on BioMarin Pharmaceutical from $110.00 to $86.00 and set an "overweight" rating for the company in a research note on Friday, October 4th. Finally, UBS Group increased their target price on shares of BioMarin Pharmaceutical from $104.00 to $106.00 and gave the stock a "buy" rating in a report on Wednesday, October 30th. Seven research analysts have rated the stock with a hold rating, fifteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average price target of $94.16.

Check Out Our Latest Stock Analysis on BMRN

BioMarin Pharmaceutical Profile

(

Free Report)

BioMarin Pharmaceutical Inc develops and commercializes therapies for people with serious and life-threatening rare diseases and medical conditions. Its commercial products include Vimizim, an enzyme replacement therapy for the treatment of mucopolysaccharidosis (MPS) IV type A, a lysosomal storage disorder; Naglazyme, a recombinant form of N-acetylgalactosamine 4-sulfatase for patients with MPS VI; and Kuvan, a proprietary synthetic oral form of 6R-BH4 that is used to treat patients with phenylketonuria (PKU), an inherited metabolic disease.

See Also

Before you consider BioMarin Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioMarin Pharmaceutical wasn't on the list.

While BioMarin Pharmaceutical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.