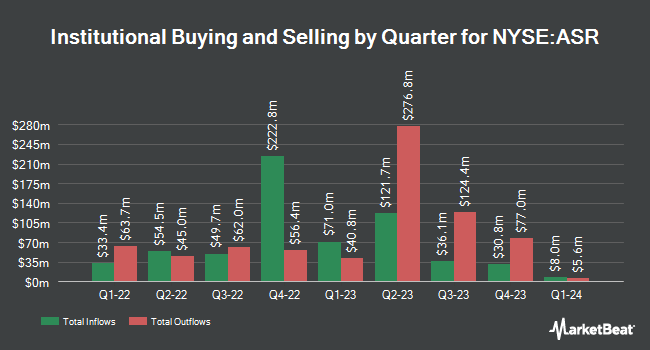

Robeco Institutional Asset Management B.V. reduced its holdings in Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR - Free Report) by 5.8% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 129,517 shares of the transportation company's stock after selling 7,914 shares during the quarter. Robeco Institutional Asset Management B.V. owned 0.43% of Grupo Aeroportuario del Sureste, S. A. B. de C. V. worth $36,622,000 at the end of the most recent reporting period.

A number of other hedge funds also recently modified their holdings of ASR. Dimensional Fund Advisors LP boosted its stake in Grupo Aeroportuario del Sureste, S. A. B. de C. V. by 1.2% in the 2nd quarter. Dimensional Fund Advisors LP now owns 64,453 shares of the transportation company's stock worth $19,300,000 after purchasing an additional 746 shares during the period. 1832 Asset Management L.P. acquired a new position in shares of Grupo Aeroportuario del Sureste, S. A. B. de C. V. during the second quarter worth about $14,927,000. BNP Paribas Financial Markets grew its holdings in shares of Grupo Aeroportuario del Sureste, S. A. B. de C. V. by 22.5% during the first quarter. BNP Paribas Financial Markets now owns 46,061 shares of the transportation company's stock worth $14,679,000 after buying an additional 8,462 shares in the last quarter. Marshall Wace LLP raised its position in Grupo Aeroportuario del Sureste, S. A. B. de C. V. by 99.7% in the 2nd quarter. Marshall Wace LLP now owns 32,377 shares of the transportation company's stock valued at $9,698,000 after buying an additional 16,163 shares during the last quarter. Finally, Sei Investments Co. lifted its stake in Grupo Aeroportuario del Sureste, S. A. B. de C. V. by 337.4% in the 2nd quarter. Sei Investments Co. now owns 26,694 shares of the transportation company's stock valued at $7,995,000 after acquiring an additional 20,591 shares in the last quarter. Institutional investors and hedge funds own 10.57% of the company's stock.

Grupo Aeroportuario del Sureste, S. A. B. de C. V. Stock Down 0.6 %

Shares of NYSE ASR traded down $1.66 during mid-day trading on Wednesday, hitting $263.97. The company had a trading volume of 54,482 shares, compared to its average volume of 42,933. Grupo Aeroportuario del Sureste, S. A. B. de C. V. has a one year low of $213.50 and a one year high of $357.90. The company has a market capitalization of $7.92 billion, a PE ratio of 10.00, a price-to-earnings-growth ratio of 4.03 and a beta of 1.13. The company has a current ratio of 4.65, a quick ratio of 4.65 and a debt-to-equity ratio of 0.20. The firm has a 50-day simple moving average of $275.69 and a two-hundred day simple moving average of $299.58.

Wall Street Analyst Weigh In

Separately, StockNews.com raised shares of Grupo Aeroportuario del Sureste, S. A. B. de C. V. from a "hold" rating to a "buy" rating in a research note on Thursday, September 5th. One analyst has rated the stock with a sell rating, one has issued a hold rating and three have issued a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and an average price target of $274.00.

Check Out Our Latest Stock Analysis on ASR

About Grupo Aeroportuario del Sureste, S. A. B. de C. V.

(

Free Report)

Grupo Aeroportuario del Sureste, S. A. B. de C. V. holds concessions to operate, maintain, and develop airports in the southeast region of Mexico. The company operates airports that are located in the cities of Cancún, Cozumel, Mérida, Huatulco, Oaxaca, Veracruz, Villahermosa, Tapachula, and Minatitlán.

Further Reading

Before you consider Grupo Aeroportuario del Sureste, S. A. B. de C. V., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grupo Aeroportuario del Sureste, S. A. B. de C. V. wasn't on the list.

While Grupo Aeroportuario del Sureste, S. A. B. de C. V. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.