Robeco Institutional Asset Management B.V. lifted its holdings in shares of Pilgrim's Pride Co. (NASDAQ:PPC - Free Report) by 28.9% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 87,070 shares of the company's stock after acquiring an additional 19,518 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Pilgrim's Pride were worth $4,010,000 as of its most recent filing with the Securities & Exchange Commission.

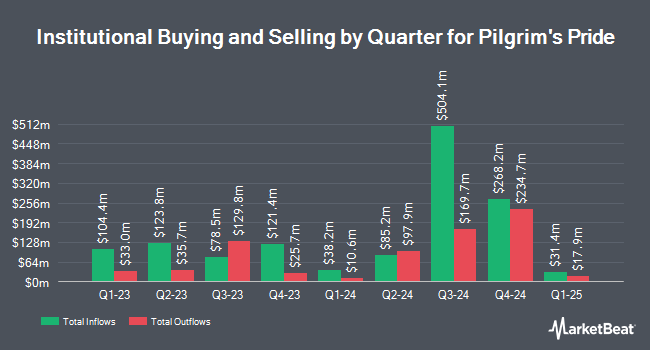

Other large investors have also added to or reduced their stakes in the company. SG Americas Securities LLC bought a new position in Pilgrim's Pride in the second quarter worth approximately $1,583,000. Quadrature Capital Ltd bought a new stake in Pilgrim's Pride during the first quarter valued at about $904,000. ORG Wealth Partners LLC bought a new position in shares of Pilgrim's Pride in the third quarter worth about $29,000. Edgestream Partners L.P. bought a new position in shares of Pilgrim's Pride in the first quarter worth about $787,000. Finally, Inspire Investing LLC bought a new position in shares of Pilgrim's Pride during the 1st quarter valued at approximately $934,000. Institutional investors own 16.64% of the company's stock.

Pilgrim's Pride Stock Up 2.8 %

PPC stock traded up $1.47 during mid-day trading on Friday, reaching $53.82. The company had a trading volume of 661,636 shares, compared to its average volume of 1,083,450. The company has a market capitalization of $12.76 billion, a price-to-earnings ratio of 13.00, a price-to-earnings-growth ratio of 0.22 and a beta of 0.81. The company has a debt-to-equity ratio of 0.75, a quick ratio of 1.27 and a current ratio of 1.95. The firm has a fifty day simple moving average of $45.68 and a 200 day simple moving average of $41.25. Pilgrim's Pride Co. has a fifty-two week low of $25.23 and a fifty-two week high of $55.50.

Pilgrim's Pride (NASDAQ:PPC - Get Free Report) last issued its earnings results on Wednesday, October 30th. The company reported $1.63 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.27 by $0.36. Pilgrim's Pride had a return on equity of 29.92% and a net margin of 5.46%. The business had revenue of $4.58 billion during the quarter, compared to the consensus estimate of $4.69 billion. During the same period in the prior year, the business posted $0.58 EPS. The company's revenue for the quarter was up 5.2% on a year-over-year basis. Analysts forecast that Pilgrim's Pride Co. will post 4.91 earnings per share for the current fiscal year.

Analyst Ratings Changes

A number of research analysts recently commented on the company. Stephens began coverage on Pilgrim's Pride in a report on Thursday, October 3rd. They issued an "equal weight" rating and a $43.00 price target on the stock. Bank of America downgraded shares of Pilgrim's Pride from a "buy" rating to a "neutral" rating and set a $47.00 price target on the stock. in a report on Thursday, August 15th. BMO Capital Markets raised their price objective on Pilgrim's Pride from $42.00 to $43.00 and gave the company a "market perform" rating in a research report on Friday, November 1st. Barclays boosted their target price on Pilgrim's Pride from $45.00 to $49.00 and gave the stock an "equal weight" rating in a research report on Friday, November 1st. Finally, Argus raised their price target on Pilgrim's Pride from $50.00 to $55.00 and gave the company a "buy" rating in a report on Wednesday, August 28th. Five investment analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $45.50.

View Our Latest Stock Analysis on Pilgrim's Pride

Pilgrim's Pride Profile

(

Free Report)

Pilgrim's Pride Corporation produces, processes, markets, and distributes fresh, frozen, and value-added chicken and pork products to retailers, distributors, and foodservice operators. The company offers fresh products, including refrigerated whole or cut-up chicken, selected chicken parts that are either marinated or non-marinated, primary pork cuts, added value pork, and pork ribs; and prepared products, which include fully cooked, ready-to-cook and individually frozen chicken parts, strips, nuggets and patties, processed sausages, bacon, smoked meat, gammon joints, pre-packed meats, sandwich and deli counter meats and meat balls.

Featured Articles

Before you consider Pilgrim's Pride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pilgrim's Pride wasn't on the list.

While Pilgrim's Pride currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.