Robeco Institutional Asset Management B.V. grew its position in shares of Xylem Inc. (NYSE:XYL - Free Report) by 27.1% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 314,964 shares of the industrial products company's stock after buying an additional 67,061 shares during the quarter. Robeco Institutional Asset Management B.V. owned approximately 0.13% of Xylem worth $42,530,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

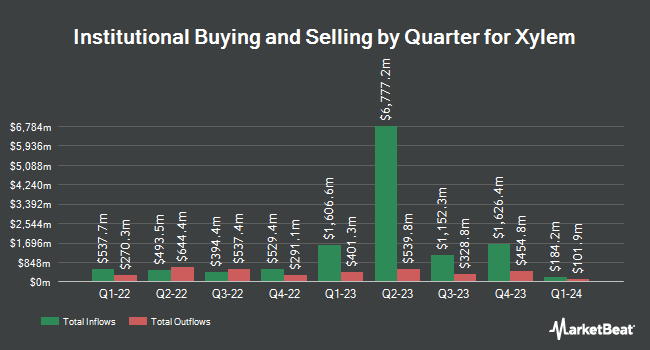

Several other large investors also recently added to or reduced their stakes in XYL. Swedbank AB bought a new position in shares of Xylem in the first quarter worth about $311,684,000. Sei Investments Co. boosted its position in shares of Xylem by 56.4% in the first quarter. Sei Investments Co. now owns 1,013,314 shares of the industrial products company's stock valued at $130,961,000 after acquiring an additional 365,420 shares during the period. LPL Financial LLC grew its stake in shares of Xylem by 246.6% in the second quarter. LPL Financial LLC now owns 324,504 shares of the industrial products company's stock worth $44,012,000 after acquiring an additional 230,878 shares during the last quarter. TCW Group Inc. grew its position in Xylem by 189.2% in the 2nd quarter. TCW Group Inc. now owns 315,400 shares of the industrial products company's stock worth $42,778,000 after purchasing an additional 206,350 shares during the last quarter. Finally, Marshall Wace LLP increased its holdings in shares of Xylem by 433.0% during the 2nd quarter. Marshall Wace LLP now owns 229,082 shares of the industrial products company's stock worth $31,070,000 after purchasing an additional 186,105 shares during the period. 87.96% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of research firms recently weighed in on XYL. Royal Bank of Canada decreased their target price on Xylem from $163.00 to $162.00 and set an "outperform" rating on the stock in a research report on Friday, November 1st. TD Cowen decreased their price target on shares of Xylem from $138.00 to $125.00 and set a "hold" rating on the stock in a research note on Wednesday. UBS Group initiated coverage on shares of Xylem in a research note on Tuesday, August 13th. They issued a "buy" rating and a $165.00 price objective for the company. Robert W. Baird dropped their price target on shares of Xylem from $175.00 to $154.00 and set an "outperform" rating for the company in a research report on Friday, November 1st. Finally, Stifel Nicolaus increased their target price on Xylem from $170.00 to $172.00 and gave the stock a "buy" rating in a report on Wednesday, July 31st. Four equities research analysts have rated the stock with a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $147.17.

View Our Latest Research Report on Xylem

Xylem Price Performance

XYL traded up $1.47 during midday trading on Wednesday, hitting $123.73. The company had a trading volume of 2,017,004 shares, compared to its average volume of 1,193,117. Xylem Inc. has a twelve month low of $95.35 and a twelve month high of $146.08. The company has a debt-to-equity ratio of 0.19, a quick ratio of 1.42 and a current ratio of 1.96. The firm's 50-day simple moving average is $132.21 and its 200-day simple moving average is $135.16. The company has a market capitalization of $30.06 billion, a PE ratio of 36.14, a P/E/G ratio of 2.23 and a beta of 1.05.

Xylem (NYSE:XYL - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The industrial products company reported $1.11 EPS for the quarter, meeting analysts' consensus estimates of $1.11. The firm had revenue of $2.10 billion for the quarter, compared to analyst estimates of $2.17 billion. Xylem had a return on equity of 9.61% and a net margin of 9.85%. The business's quarterly revenue was up .2% compared to the same quarter last year. During the same period last year, the company earned $0.99 EPS. Equities research analysts predict that Xylem Inc. will post 4.23 EPS for the current fiscal year.

Xylem Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, September 26th. Investors of record on Thursday, August 29th were paid a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a dividend yield of 1.16%. The ex-dividend date was Thursday, August 29th. Xylem's dividend payout ratio (DPR) is 42.11%.

About Xylem

(

Free Report)

Xylem Inc, together with its subsidiaries, engages in the design, manufacture, and servicing of engineered products and solutions worldwide. It operates through four segments: Water Infrastructure, Applied Water, Measurement & Control Solutions, and Integrated Solutions and Services. The Water Infrastructure segment offers products, including water, storm water, and wastewater pumps; controls and systems; filtration, disinfection, and biological treatment equipment; and mobile dewatering equipment and rental services under the ADI, Flygt, Godwin, Sanitaire, Magneto, Neptune Benson, Ionpure, Leopold, Wedeco, and Xylem Vue brands.

See Also

Before you consider Xylem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Xylem wasn't on the list.

While Xylem currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.