Robeco Institutional Asset Management B.V. boosted its stake in Full Truck Alliance Co. Ltd. (NYSE:YMM - Free Report) by 10.6% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 3,701,028 shares of the company's stock after purchasing an additional 353,891 shares during the period. Robeco Institutional Asset Management B.V. owned about 0.35% of Full Truck Alliance worth $33,346,000 at the end of the most recent reporting period.

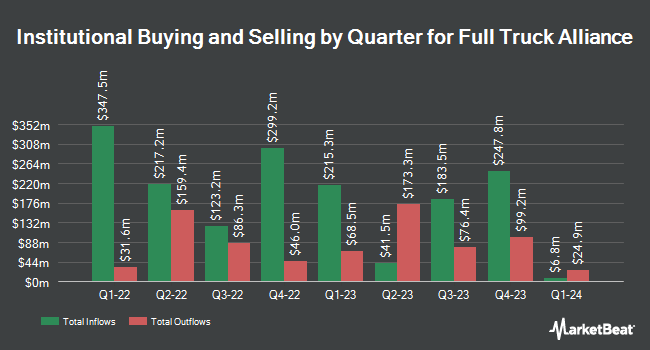

Other large investors have also bought and sold shares of the company. Mubadala Investment Co PJSC grew its holdings in shares of Full Truck Alliance by 45.7% in the first quarter. Mubadala Investment Co PJSC now owns 16,776,591 shares of the company's stock worth $121,966,000 after purchasing an additional 5,263,157 shares during the last quarter. Sylebra Capital LLC purchased a new position in shares of Full Truck Alliance in the first quarter valued at about $36,877,000. Polunin Capital Partners Ltd purchased a new position in shares of Full Truck Alliance in the third quarter valued at about $29,632,000. Jupiter Asset Management Ltd. bought a new position in shares of Full Truck Alliance during the first quarter valued at about $13,854,000. Finally, Healthcare of Ontario Pension Plan Trust Fund boosted its holdings in shares of Full Truck Alliance by 1,220.8% during the second quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 1,985,200 shares of the company's stock worth $15,961,000 after purchasing an additional 1,834,900 shares during the period. 39.02% of the stock is owned by hedge funds and other institutional investors.

Full Truck Alliance Trading Down 2.2 %

NYSE YMM traded down $0.20 during trading on Wednesday, hitting $8.79. The company had a trading volume of 5,533,706 shares, compared to its average volume of 8,558,489. The company's fifty day moving average is $8.42 and its 200-day moving average is $8.34. Full Truck Alliance Co. Ltd. has a one year low of $5.70 and a one year high of $10.29. The company has a market cap of $9.26 billion, a price-to-earnings ratio of 24.86 and a beta of 0.23.

Full Truck Alliance (NYSE:YMM - Get Free Report) last released its quarterly earnings results on Wednesday, August 21st. The company reported $0.12 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.11 by $0.01. The company had revenue of $380.38 million during the quarter, compared to the consensus estimate of $369.24 million. Full Truck Alliance had a net margin of 26.80% and a return on equity of 7.88%. As a group, equities analysts anticipate that Full Truck Alliance Co. Ltd. will post 0.41 EPS for the current year.

Wall Street Analyst Weigh In

Separately, Barclays reduced their price target on Full Truck Alliance from $9.00 to $7.00 and set an "equal weight" rating on the stock in a report on Friday, August 23rd.

Get Our Latest Stock Report on Full Truck Alliance

About Full Truck Alliance

(

Free Report)

Full Truck Alliance Co Ltd., together with its subsidiaries, operates a digital freight platform that connects shippers with truckers to facilitate shipments across distance ranges, cargo weights, and types in the People's Republic of China. The company offers freight matching services, such as freight listing and brokerage services; and online transaction services, as well as various value-added services, such as credit solutions, insurance brokerage, software solutions, electronic toll collection, and energy services.

Recommended Stories

Before you consider Full Truck Alliance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Full Truck Alliance wasn't on the list.

While Full Truck Alliance currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.