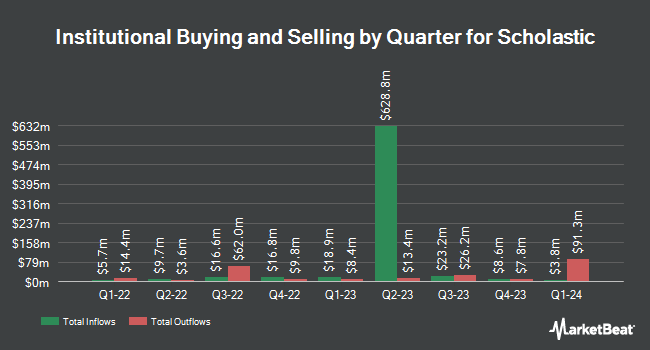

Robeco Institutional Asset Management B.V. grew its stake in Scholastic Co. (NASDAQ:SCHL - Free Report) by 744.3% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 65,625 shares of the company's stock after purchasing an additional 57,852 shares during the period. Robeco Institutional Asset Management B.V. owned approximately 0.23% of Scholastic worth $2,101,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also recently added to or reduced their stakes in the stock. Pacer Advisors Inc. raised its stake in shares of Scholastic by 18.1% in the 2nd quarter. Pacer Advisors Inc. now owns 1,120,491 shares of the company's stock valued at $39,744,000 after acquiring an additional 171,775 shares during the period. Azarias Capital Management L.P. increased its stake in shares of Scholastic by 32.7% during the second quarter. Azarias Capital Management L.P. now owns 264,565 shares of the company's stock worth $9,384,000 after buying an additional 65,120 shares during the period. American Century Companies Inc. raised its holdings in shares of Scholastic by 13.2% in the 2nd quarter. American Century Companies Inc. now owns 488,259 shares of the company's stock valued at $17,319,000 after purchasing an additional 56,835 shares in the last quarter. Millennium Management LLC boosted its position in shares of Scholastic by 45.0% during the 2nd quarter. Millennium Management LLC now owns 182,630 shares of the company's stock worth $6,478,000 after acquiring an additional 56,647 shares in the last quarter. Finally, Renaissance Technologies LLC purchased a new position in Scholastic in the second quarter valued at approximately $1,936,000. Hedge funds and other institutional investors own 82.57% of the company's stock.

Scholastic Stock Performance

SCHL traded down $0.26 during trading on Friday, hitting $26.17. 203,431 shares of the stock were exchanged, compared to its average volume of 190,881. The firm has a market capitalization of $736.42 million, a P/E ratio of 46.73 and a beta of 1.06. Scholastic Co. has a 1-year low of $23.69 and a 1-year high of $41.79. The stock has a fifty day moving average price of $28.18 and a two-hundred day moving average price of $31.98. The company has a quick ratio of 0.64, a current ratio of 1.14 and a debt-to-equity ratio of 0.24.

Scholastic (NASDAQ:SCHL - Get Free Report) last issued its quarterly earnings results on Thursday, September 26th. The company reported ($2.13) earnings per share for the quarter, topping analysts' consensus estimates of ($2.48) by $0.35. Scholastic had a net margin of 1.49% and a return on equity of 4.32%. The firm had revenue of $237.20 million during the quarter, compared to analysts' expectations of $233.49 million. During the same quarter in the prior year, the business earned ($2.20) EPS. As a group, sell-side analysts predict that Scholastic Co. will post 1.41 earnings per share for the current year.

Scholastic Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Thursday, October 31st will be given a dividend of $0.20 per share. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $0.80 dividend on an annualized basis and a yield of 3.06%. Scholastic's payout ratio is currently 142.86%.

Wall Street Analyst Weigh In

Separately, StockNews.com downgraded shares of Scholastic from a "buy" rating to a "hold" rating in a research report on Saturday, October 5th.

Get Our Latest Stock Report on Scholastic

About Scholastic

(

Free Report)

Scholastic Corporation publishes and distributes children's books worldwide. It operates in three segments: Children's Book Publishing and Distribution, Education Solutions, and International. The Children's Book Publishing and Distribution segment engages in publication and distribution of children's print, digital, and audio books, as well as media and interactive products through its school reading events and trade channel; and operation of school-based book clubs and book fairs in the United States.

See Also

Before you consider Scholastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Scholastic wasn't on the list.

While Scholastic currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.