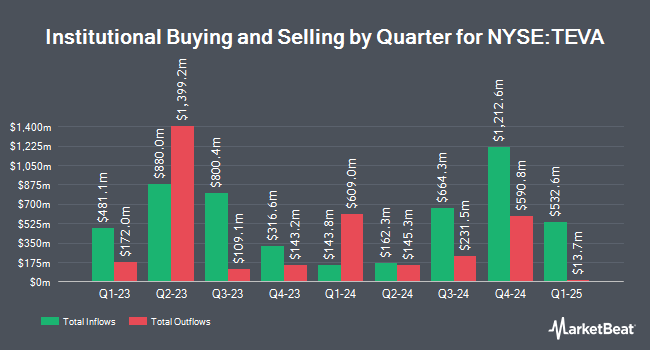

Robeco Institutional Asset Management B.V. boosted its position in Teva Pharmaceutical Industries Limited (NYSE:TEVA - Free Report) by 7.2% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 498,309 shares of the company's stock after acquiring an additional 33,277 shares during the quarter. Robeco Institutional Asset Management B.V.'s holdings in Teva Pharmaceutical Industries were worth $10,983,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also modified their holdings of TEVA. UMB Bank n.a. raised its holdings in shares of Teva Pharmaceutical Industries by 555.6% in the third quarter. UMB Bank n.a. now owns 2,439 shares of the company's stock valued at $44,000 after purchasing an additional 2,067 shares during the last quarter. Smithfield Trust Co raised its stake in shares of Teva Pharmaceutical Industries by 55.7% during the 3rd quarter. Smithfield Trust Co now owns 2,739 shares of the company's stock valued at $50,000 after purchasing an additional 980 shares during the period. Wilmington Savings Fund Society FSB bought a new position in shares of Teva Pharmaceutical Industries in the third quarter valued at approximately $50,000. Claro Advisors LLC bought a new position in shares of Teva Pharmaceutical Industries in the third quarter worth $52,000. Finally, Venturi Wealth Management LLC purchased a new position in shares of Teva Pharmaceutical Industries during the third quarter worth about $60,000. 54.05% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, EVP Christine Fox sold 19,388 shares of the firm's stock in a transaction on Wednesday, November 20th. The stock was sold at an average price of $16.87, for a total transaction of $327,075.56. Following the completion of the sale, the executive vice president now directly owns 44,104 shares of the company's stock, valued at $744,034.48. This trade represents a 30.54 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Roberto Mignone sold 286,000 shares of the firm's stock in a transaction on Friday, December 20th. The stock was sold at an average price of $22.01, for a total value of $6,294,860.00. Following the completion of the sale, the director now directly owns 695,000 shares of the company's stock, valued at approximately $15,296,950. This trade represents a 29.15 % decrease in their position. The disclosure for this sale can be found here. 0.55% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Several brokerages recently commented on TEVA. JPMorgan Chase & Co. increased their price objective on shares of Teva Pharmaceutical Industries from $16.00 to $18.00 and gave the company a "neutral" rating in a research report on Monday, October 21st. Barclays reduced their price target on shares of Teva Pharmaceutical Industries from $28.00 to $26.00 and set an "overweight" rating for the company in a research report on Thursday, January 30th. StockNews.com cut Teva Pharmaceutical Industries from a "strong-buy" rating to a "buy" rating in a research report on Wednesday, December 18th. Piper Sandler upped their target price on shares of Teva Pharmaceutical Industries from $23.00 to $30.00 and gave the stock an "overweight" rating in a report on Friday, January 17th. Finally, UBS Group reduced their price objective on shares of Teva Pharmaceutical Industries from $30.00 to $27.00 and set a "buy" rating on the stock in a research report on Thursday, January 30th. Two research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $22.00.

View Our Latest Stock Analysis on TEVA

Teva Pharmaceutical Industries Stock Performance

Shares of TEVA traded up $0.17 during mid-day trading on Wednesday, hitting $17.23. 12,436,205 shares of the company's stock were exchanged, compared to its average volume of 13,389,583. The business's 50 day moving average is $20.03 and its two-hundred day moving average is $18.50. Teva Pharmaceutical Industries Limited has a fifty-two week low of $11.83 and a fifty-two week high of $22.80. The company has a current ratio of 0.89, a quick ratio of 0.61 and a debt-to-equity ratio of 2.57. The firm has a market capitalization of $19.52 billion, a P/E ratio of -11.89, a P/E/G ratio of 1.43 and a beta of 0.71.

Teva Pharmaceutical Industries (NYSE:TEVA - Get Free Report) last posted its earnings results on Wednesday, January 29th. The company reported $0.70 earnings per share for the quarter, beating the consensus estimate of $0.69 by $0.01. Teva Pharmaceutical Industries had a negative net margin of 9.91% and a positive return on equity of 40.20%. On average, equities analysts expect that Teva Pharmaceutical Industries Limited will post 2.62 earnings per share for the current year.

About Teva Pharmaceutical Industries

(

Free Report)

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally. It offers generic medicines in various dosage forms, such as tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams; sterile products, hormones, high-potency drugs, and cytotoxic substances in parenteral and solid dosage forms; and generic products with medical devices and combination products.

See Also

Before you consider Teva Pharmaceutical Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teva Pharmaceutical Industries wasn't on the list.

While Teva Pharmaceutical Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.