AZEK (NYSE:AZEK - Get Free Report) had its price target raised by analysts at Robert W. Baird from $52.00 to $54.00 in a note issued to investors on Wednesday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Robert W. Baird's price objective points to a potential upside of 11.99% from the company's current price.

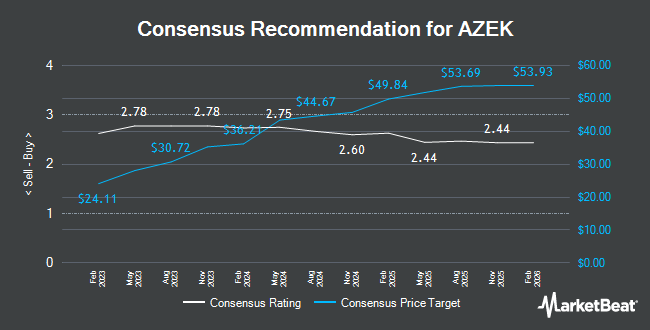

A number of other research firms also recently issued reports on AZEK. Truist Financial cut their price target on AZEK from $57.00 to $52.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Stifel Nicolaus lowered their price target on AZEK from $52.00 to $50.00 and set a "buy" rating on the stock in a report on Thursday, August 8th. JPMorgan Chase & Co. decreased their price objective on AZEK from $52.00 to $48.00 and set an "overweight" rating on the stock in a report on Tuesday, August 13th. Loop Capital downgraded shares of AZEK from a "buy" rating to a "hold" rating and set a $47.00 price objective on the stock. in a research report on Friday, October 4th. Finally, BMO Capital Markets upped their target price on shares of AZEK from $46.00 to $49.00 and gave the stock a "market perform" rating in a research report on Tuesday, October 22nd. Six analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. Based on data from MarketBeat, AZEK presently has a consensus rating of "Moderate Buy" and an average target price of $48.88.

Check Out Our Latest Stock Report on AZEK

AZEK Price Performance

AZEK traded up $1.76 during trading on Wednesday, hitting $48.22. 3,326,189 shares of the stock traded hands, compared to its average volume of 1,696,952. The business has a 50 day moving average price of $45.00 and a 200 day moving average price of $44.20. The company has a market cap of $6.98 billion, a price-to-earnings ratio of 42.73, a PEG ratio of 1.18 and a beta of 1.88. The company has a debt-to-equity ratio of 0.41, a current ratio of 3.07 and a quick ratio of 2.11. AZEK has a twelve month low of $30.76 and a twelve month high of $50.78.

Hedge Funds Weigh In On AZEK

Institutional investors have recently made changes to their positions in the company. ORG Wealth Partners LLC purchased a new position in AZEK in the third quarter valued at about $31,000. Farther Finance Advisors LLC grew its stake in AZEK by 183.1% in the third quarter. Farther Finance Advisors LLC now owns 753 shares of the company's stock valued at $35,000 after purchasing an additional 487 shares during the last quarter. Paladin Wealth LLC purchased a new position in AZEK in the third quarter valued at about $39,000. Blue Trust Inc. grew its stake in AZEK by 106.4% in the third quarter. Blue Trust Inc. now owns 931 shares of the company's stock valued at $44,000 after purchasing an additional 480 shares during the last quarter. Finally, Versant Capital Management Inc grew its stake in AZEK by 5,452.2% in the second quarter. Versant Capital Management Inc now owns 1,277 shares of the company's stock valued at $54,000 after purchasing an additional 1,254 shares during the last quarter. Hedge funds and other institutional investors own 97.44% of the company's stock.

About AZEK

(

Get Free Report)

The AZEK Company Inc engages in the design, manufacturing, and selling of building products for residential, commercial, and industrial markets in the United States and Canada. It operates through two segments: Residential and Commercial. The Residential segment designs and manufactures engineered outdoor living products, such as decking, railing, trim and molding, siding and cladding, pergolas and cabanas, and accessories under the TimberTech, AZEK Exteriors, VERSATEX, ULTRALOX, StruXure, and INTEX brands.

Recommended Stories

Before you consider AZEK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AZEK wasn't on the list.

While AZEK currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.