GMS (NYSE:GMS - Get Free Report) had its target price dropped by Robert W. Baird from $115.00 to $110.00 in a research report issued to clients and investors on Friday,Benzinga reports. The brokerage currently has an "outperform" rating on the stock. Robert W. Baird's price objective indicates a potential upside of 13.34% from the stock's previous close.

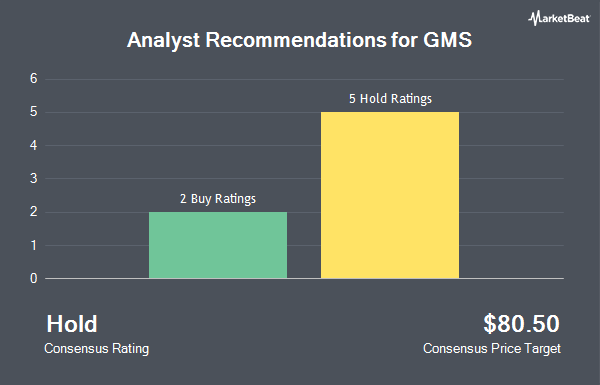

GMS has been the subject of a number of other reports. Loop Capital upped their price objective on shares of GMS from $85.00 to $93.00 and gave the company a "hold" rating in a research report on Monday, November 25th. Truist Financial lowered their price objective on GMS from $95.00 to $90.00 and set a "hold" rating for the company in a research note on Friday, August 30th. StockNews.com lowered GMS from a "buy" rating to a "hold" rating in a research report on Monday, September 2nd. DA Davidson cut GMS from a "buy" rating to a "neutral" rating and set a $97.00 target price for the company. in a research note on Tuesday, November 26th. Finally, Barclays dropped their price target on shares of GMS from $81.00 to $80.00 and set an "equal weight" rating for the company in a research note on Monday, September 9th. Six research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $93.25.

Read Our Latest Report on GMS

GMS Stock Down 0.7 %

Shares of NYSE GMS traded down $0.71 on Friday, hitting $97.05. The company had a trading volume of 422,927 shares, compared to its average volume of 392,173. The company has a quick ratio of 1.45, a current ratio of 2.31 and a debt-to-equity ratio of 0.90. GMS has a 12-month low of $68.13 and a 12-month high of $105.54. The firm has a market capitalization of $3.81 billion, a P/E ratio of 17.84 and a beta of 1.68. The business has a 50 day moving average of $95.68 and a two-hundred day moving average of $91.02.

GMS (NYSE:GMS - Get Free Report) last posted its quarterly earnings data on Thursday, December 5th. The company reported $2.02 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.26 by ($0.24). GMS had a net margin of 4.45% and a return on equity of 22.02%. The firm had revenue of $1.47 billion for the quarter, compared to analysts' expectations of $1.46 billion. During the same quarter in the prior year, the business earned $2.30 EPS. The company's revenue for the quarter was up 3.5% on a year-over-year basis. As a group, equities research analysts forecast that GMS will post 7.95 earnings per share for the current fiscal year.

Insider Transactions at GMS

In other news, COO George T. Hendren sold 5,000 shares of the stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $102.13, for a total transaction of $510,650.00. Following the sale, the chief operating officer now directly owns 23,772 shares in the company, valued at approximately $2,427,834.36. This represents a 17.38 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 1.90% of the company's stock.

Institutional Investors Weigh In On GMS

Large investors have recently added to or reduced their stakes in the stock. FMR LLC grew its position in shares of GMS by 25.3% during the third quarter. FMR LLC now owns 4,232,170 shares of the company's stock worth $383,308,000 after acquiring an additional 854,987 shares during the last quarter. American Century Companies Inc. grew its position in GMS by 28.5% in the 2nd quarter. American Century Companies Inc. now owns 1,830,833 shares of the company's stock worth $147,583,000 after purchasing an additional 406,406 shares during the last quarter. Pacer Advisors Inc. increased its stake in shares of GMS by 0.4% in the second quarter. Pacer Advisors Inc. now owns 1,474,821 shares of the company's stock valued at $118,885,000 after purchasing an additional 6,396 shares during the period. Federated Hermes Inc. raised its holdings in shares of GMS by 0.9% during the second quarter. Federated Hermes Inc. now owns 1,056,053 shares of the company's stock valued at $85,128,000 after buying an additional 9,516 shares during the last quarter. Finally, Westwood Holdings Group Inc. boosted its position in shares of GMS by 4.8% during the second quarter. Westwood Holdings Group Inc. now owns 739,908 shares of the company's stock worth $59,644,000 after buying an additional 34,205 shares during the period. 95.28% of the stock is owned by institutional investors and hedge funds.

GMS Company Profile

(

Get Free Report)

GMS Inc distributes wallboard, ceilings, steel framing and complementary construction products in the United States and Canada. The company offers ceilings products, including suspended mineral fibers, soft fibers, and metal ceiling systems primarily used in offices, hotels, hospitals, retail facilities, schools, and various other commercial and institutional buildings.

Read More

Before you consider GMS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GMS wasn't on the list.

While GMS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.