Healthpeak Properties (NYSE:DOC - Get Free Report) had its target price lowered by analysts at Robert W. Baird from $25.00 to $24.00 in a research report issued on Tuesday,Benzinga reports. The brokerage presently has an "outperform" rating on the real estate investment trust's stock. Robert W. Baird's target price points to a potential upside of 22.50% from the company's previous close.

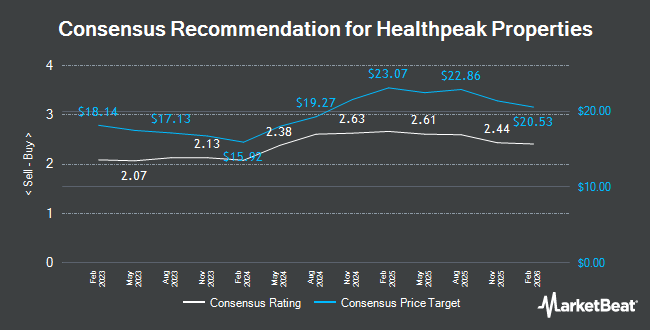

A number of other equities research analysts have also recently issued reports on DOC. Wells Fargo & Company decreased their target price on Healthpeak Properties from $23.00 to $22.00 and set an "equal weight" rating for the company in a research report on Tuesday, December 10th. StockNews.com cut Healthpeak Properties from a "hold" rating to a "sell" rating in a research report on Wednesday, October 30th. Deutsche Bank Aktiengesellschaft upgraded Healthpeak Properties from a "hold" rating to a "buy" rating and upped their price target for the stock from $20.00 to $28.00 in a report on Monday, October 21st. Mizuho cut their price target on Healthpeak Properties from $25.00 to $24.00 and set an "outperform" rating for the company in a report on Thursday, December 5th. Finally, Royal Bank of Canada upped their price target on Healthpeak Properties from $25.00 to $26.00 and gave the stock an "outperform" rating in a report on Monday, November 4th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, ten have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $24.00.

Get Our Latest Stock Analysis on Healthpeak Properties

Healthpeak Properties Stock Performance

Healthpeak Properties stock traded down $0.07 during trading hours on Tuesday, reaching $19.59. 2,014,848 shares of the company were exchanged, compared to its average volume of 4,752,985. The firm has a market cap of $13.71 billion, a price-to-earnings ratio of 55.90, a PEG ratio of 2.18 and a beta of 1.15. The company has a current ratio of 1.35, a quick ratio of 1.31 and a debt-to-equity ratio of 0.96. The stock has a 50-day moving average of $20.43 and a 200 day moving average of $21.48. Healthpeak Properties has a 12 month low of $16.01 and a 12 month high of $23.26.

Institutional Trading of Healthpeak Properties

Several large investors have recently made changes to their positions in DOC. AMF Tjanstepension AB bought a new stake in shares of Healthpeak Properties during the third quarter worth $15,548,000. CWM LLC bought a new stake in shares of Healthpeak Properties during the third quarter worth $1,298,000. UMB Bank n.a. bought a new stake in shares of Healthpeak Properties during the third quarter worth $40,000. Livforsakringsbolaget Skandia Omsesidigt bought a new stake in shares of Healthpeak Properties during the third quarter worth $67,000. Finally, Valeo Financial Advisors LLC bought a new stake in shares of Healthpeak Properties during the third quarter worth $471,000. Institutional investors own 93.57% of the company's stock.

Healthpeak Properties Company Profile

(

Get Free Report)

Healthpeak Properties, Inc is a fully integrated real estate investment trust (REIT) and S&P 500 company. Healthpeak owns, operates, and develops high-quality real estate for healthcare discovery and delivery.

Featured Stories

Before you consider Healthpeak Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Healthpeak Properties wasn't on the list.

While Healthpeak Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.