Paymentus (NYSE:PAY - Get Free Report) had its target price decreased by investment analysts at Robert W. Baird from $36.00 to $30.00 in a note issued to investors on Friday, Marketbeat reports. The firm presently has an "outperform" rating on the business services provider's stock. Robert W. Baird's target price suggests a potential upside of 12.07% from the stock's previous close.

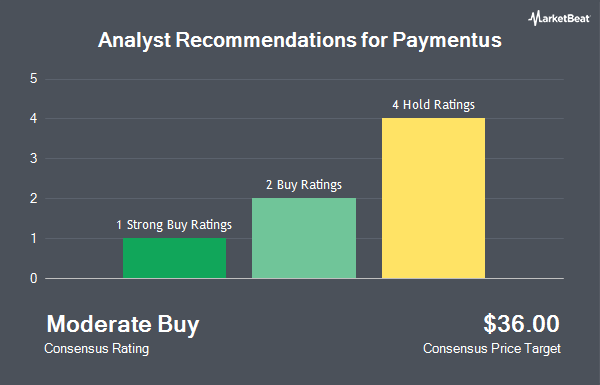

Several other analysts have also recently issued reports on the stock. JPMorgan Chase & Co. dropped their price objective on shares of Paymentus from $31.00 to $29.00 and set a "neutral" rating for the company in a research note on Tuesday, March 11th. StockNews.com raised Paymentus from a "sell" rating to a "hold" rating in a report on Wednesday, March 19th. Wedbush restated an "outperform" rating and issued a $38.00 target price on shares of Paymentus in a report on Wednesday, March 12th. Finally, Wells Fargo & Company raised their target price on Paymentus from $27.00 to $33.00 and gave the stock an "equal weight" rating in a research note on Thursday, January 16th. One investment analyst has rated the stock with a sell rating, five have given a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $30.00.

Get Our Latest Analysis on Paymentus

Paymentus Trading Up 9.8 %

PAY traded up $2.40 on Friday, hitting $26.77. 176,524 shares of the company's stock were exchanged, compared to its average volume of 327,048. Paymentus has a fifty-two week low of $16.94 and a fifty-two week high of $38.94. The stock has a market cap of $3.35 billion, a price-to-earnings ratio of 86.35 and a beta of 1.65. The firm has a 50-day moving average price of $28.47 and a 200-day moving average price of $29.22.

Insider Buying and Selling

In other news, CFO Sanjay Kalra sold 15,794 shares of the stock in a transaction on Tuesday, February 18th. The stock was sold at an average price of $31.99, for a total transaction of $505,250.06. Following the completion of the transaction, the chief financial officer now directly owns 466,035 shares in the company, valued at approximately $14,908,459.65. This represents a 3.28 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, General Counsel Andrew A. Gerber sold 3,070 shares of the business's stock in a transaction dated Tuesday, February 18th. The shares were sold at an average price of $31.98, for a total transaction of $98,178.60. Following the completion of the sale, the general counsel now owns 94,855 shares in the company, valued at approximately $3,033,462.90. This trade represents a 3.14 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 87.76% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Paymentus

A number of hedge funds have recently made changes to their positions in PAY. Park Square Financial Group LLC acquired a new position in Paymentus during the fourth quarter worth $32,000. TimesSquare Capital Management LLC purchased a new stake in shares of Paymentus in the 4th quarter valued at $35,000. R Squared Ltd acquired a new position in Paymentus during the 4th quarter worth about $43,000. Point72 Asia Singapore Pte. Ltd. purchased a new position in Paymentus during the 3rd quarter valued at about $43,000. Finally, Deutsche Bank AG acquired a new position in Paymentus in the 4th quarter valued at about $73,000. Hedge funds and other institutional investors own 78.38% of the company's stock.

Paymentus Company Profile

(

Get Free Report)

Paymentus Holdings, Inc provides cloud-based bill payment technology and solutions in the United States and internationally. The company offers electronic bill presentment and payment services, enterprise customer communication, and self-service revenue management to billers through a software-as-a-service technology platform.

Read More

Before you consider Paymentus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paymentus wasn't on the list.

While Paymentus currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.