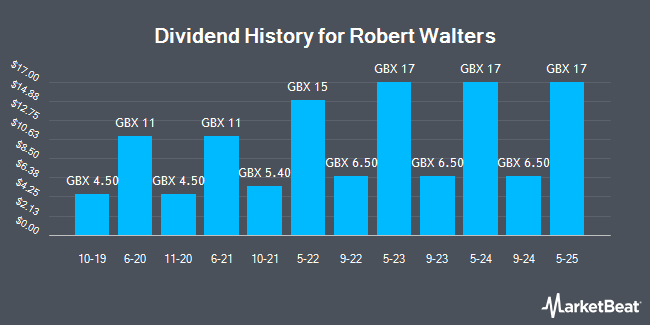

Robert Walters plc (LON:RWA - Get Free Report) announced a dividend on Thursday, March 6th, DividendData.Co.Uk reports. Investors of record on Thursday, April 24th will be paid a dividend of GBX 17 ($0.23) per share on Tuesday, May 27th. This represents a dividend yield of 7.2%. The ex-dividend date of this dividend is Thursday, April 24th. This is a 161.5% increase from Robert Walters's previous dividend of $6.50. The official announcement can be accessed at this link.

Robert Walters Price Performance

Shares of LON RWA traded up GBX 2 ($0.03) during midday trading on Friday, reaching GBX 227 ($3.02). 95,657 shares of the company were exchanged, compared to its average volume of 105,927. Robert Walters has a one year low of GBX 211.17 ($2.81) and a one year high of GBX 449 ($5.98). The stock's 50-day moving average price is GBX 238.48 and its 200-day moving average price is GBX 298.86. The company has a quick ratio of 1.52, a current ratio of 1.47 and a debt-to-equity ratio of 64.28. The stock has a market cap of £161.97 million, a P/E ratio of 26.19, a PEG ratio of 0.08 and a beta of 1.22.

Robert Walters (LON:RWA - Get Free Report) last released its quarterly earnings results on Thursday, March 6th. The company reported GBX (9.10) (($0.12)) earnings per share (EPS) for the quarter. Robert Walters had a net margin of 0.58% and a return on equity of 3.65%. On average, sell-side analysts anticipate that Robert Walters will post 61.5448447 earnings per share for the current fiscal year.

Insider Activity at Robert Walters

In other news, insider Jane Hesmondhalgh bought 7,000 shares of the firm's stock in a transaction on Tuesday, March 11th. The stock was acquired at an average cost of GBX 248 ($3.30) per share, with a total value of £17,360 ($23,115.85). Also, insider Leslie Van de Walle acquired 8,500 shares of the firm's stock in a transaction that occurred on Thursday, March 6th. The stock was purchased at an average cost of GBX 242 ($3.22) per share, with a total value of £20,570 ($27,390.15). 19.70% of the stock is currently owned by insiders.

Robert Walters Company Profile

(

Get Free Report)

Established in 1985, Robert Walters is a global talent solutions business operating in 31 countries across the globe. We support organisations to build high-performing teams, and help professionals to grow meaningful careers. Our client base ranges from the world's leading blue-chip corporates through to SMEs and start-ups.

Further Reading

Before you consider Robert Walters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Robert Walters wasn't on the list.

While Robert Walters currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.