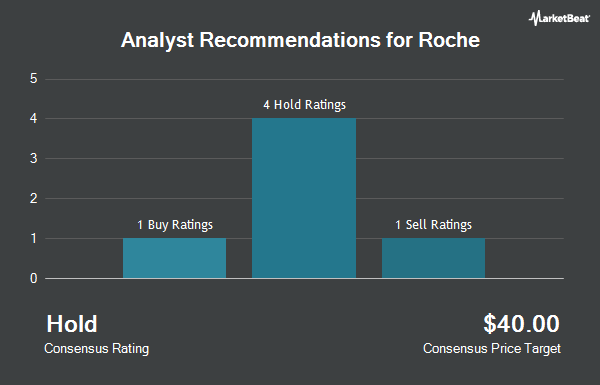

Roche Holding AG (OTCMKTS:RHHBY - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the six analysts that are covering the firm, Marketbeat.com reports. Two research analysts have rated the stock with a sell rating, one has given a hold rating, one has assigned a buy rating and two have issued a strong buy rating on the company.

Several brokerages have commented on RHHBY. Sanford C. Bernstein upgraded shares of Roche to a "strong-buy" rating in a research report on Thursday, January 30th. Morgan Stanley assumed coverage on shares of Roche in a report on Wednesday, February 12th. They issued an "equal weight" rating on the stock. Finally, UBS Group upgraded shares of Roche from a "hold" rating to a "strong-buy" rating in a report on Thursday, February 13th.

Check Out Our Latest Stock Report on Roche

Roche Stock Down 2.5 %

RHHBY traded down $1.06 during trading on Friday, reaching $42.00. The stock had a trading volume of 1,863,188 shares, compared to its average volume of 3,002,713. Roche has a 1-year low of $29.20 and a 1-year high of $43.96. The stock has a 50 day moving average of $39.31 and a two-hundred day moving average of $38.48. The company has a debt-to-equity ratio of 0.86, a quick ratio of 0.97 and a current ratio of 1.26.

Institutional Trading of Roche

Hedge funds have recently bought and sold shares of the company. Verity Asset Management Inc. purchased a new position in shares of Roche during the third quarter valued at $253,000. Canopy Partners LLC boosted its holdings in shares of Roche by 4.6% during the third quarter. Canopy Partners LLC now owns 7,772 shares of the company's stock worth $310,000 after purchasing an additional 344 shares during the period. Brooklyn Investment Group purchased a new position in Roche during the third quarter valued at approximately $40,000. IHT Wealth Management LLC acquired a new position in Roche in the 3rd quarter valued at approximately $236,000. Finally, Bard Financial Services Inc. lifted its position in Roche by 156.8% in the 3rd quarter. Bard Financial Services Inc. now owns 80,500 shares of the company's stock worth $3,216,000 after buying an additional 49,150 shares in the last quarter.

Roche Company Profile

(

Get Free ReportRoche Holding AG engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and Oceania. The company offers pharmaceutical products in the therapeutic areas of anemia, blood and solid tumors, dermatology, hemophilia, inflammatory and autoimmune, neurological disorders, ophthalmology, respiratory disorders, and transplantation.

Recommended Stories

Before you consider Roche, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roche wasn't on the list.

While Roche currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.