Rockefeller Capital Management L.P. increased its holdings in shares of Insight Enterprises, Inc. (NASDAQ:NSIT - Free Report) by 6.9% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 62,927 shares of the software maker's stock after purchasing an additional 4,055 shares during the period. Rockefeller Capital Management L.P. owned 0.20% of Insight Enterprises worth $13,554,000 as of its most recent SEC filing.

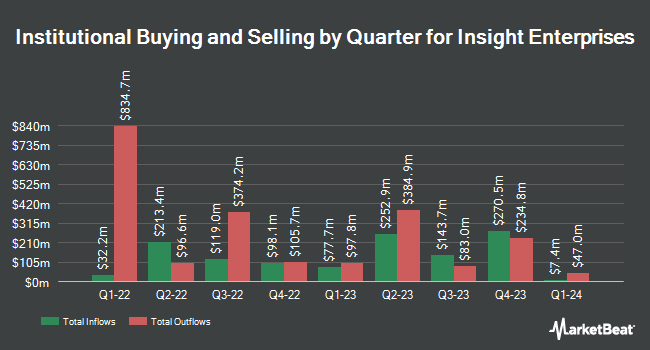

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the stock. DekaBank Deutsche Girozentrale boosted its holdings in Insight Enterprises by 10.7% in the 1st quarter. DekaBank Deutsche Girozentrale now owns 3,529 shares of the software maker's stock valued at $652,000 after purchasing an additional 342 shares in the last quarter. GAMMA Investing LLC increased its stake in shares of Insight Enterprises by 56.9% during the 2nd quarter. GAMMA Investing LLC now owns 452 shares of the software maker's stock worth $90,000 after purchasing an additional 164 shares in the last quarter. Harbor Capital Advisors Inc. raised its position in shares of Insight Enterprises by 288.2% during the 2nd quarter. Harbor Capital Advisors Inc. now owns 14,289 shares of the software maker's stock worth $2,834,000 after purchasing an additional 10,608 shares during the last quarter. CWM LLC boosted its stake in shares of Insight Enterprises by 154.8% during the second quarter. CWM LLC now owns 1,995 shares of the software maker's stock valued at $396,000 after acquiring an additional 1,212 shares during the last quarter. Finally, Opal Wealth Advisors LLC purchased a new stake in Insight Enterprises during the 2nd quarter worth about $38,000.

Wall Street Analyst Weigh In

NSIT has been the subject of a number of recent research reports. Redburn Atlantic started coverage on shares of Insight Enterprises in a report on Friday, November 15th. They set a "buy" rating and a $220.00 price target for the company. Barrington Research lowered their target price on shares of Insight Enterprises from $225.00 to $205.00 and set an "outperform" rating for the company in a research note on Monday, November 4th. Three analysts have rated the stock with a hold rating and two have issued a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $212.50.

Read Our Latest Stock Report on NSIT

Insight Enterprises Trading Down 0.2 %

Shares of NASDAQ:NSIT traded down $0.37 during trading on Tuesday, reaching $160.01. 343,660 shares of the stock were exchanged, compared to its average volume of 248,192. Insight Enterprises, Inc. has a 12-month low of $146.56 and a 12-month high of $228.07. The firm's 50-day moving average price is $190.01 and its 200 day moving average price is $199.06. The company has a debt-to-equity ratio of 0.43, a quick ratio of 1.20 and a current ratio of 1.24. The firm has a market cap of $5.08 billion, a price-to-earnings ratio of 20.13, a price-to-earnings-growth ratio of 1.40 and a beta of 1.42.

Insight Enterprises (NASDAQ:NSIT - Get Free Report) last posted its earnings results on Thursday, October 31st. The software maker reported $2.19 earnings per share for the quarter, missing the consensus estimate of $2.37 by ($0.18). Insight Enterprises had a net margin of 3.42% and a return on equity of 19.71%. The business had revenue of $2.09 billion for the quarter, compared to analyst estimates of $2.34 billion. During the same quarter in the previous year, the firm posted $2.37 EPS. The business's revenue was down 7.9% compared to the same quarter last year. On average, sell-side analysts anticipate that Insight Enterprises, Inc. will post 9.55 earnings per share for the current fiscal year.

About Insight Enterprises

(

Free Report)

Insight Enterprises, Inc, together with its subsidiaries, provides information technology, hardware, software, and services in the United States and internationally. The company offers modern platforms/infrastructure that manages and supports cloud and data platforms, modern networks, and edge technologies; cybersecurity solutions automates and connects modern platform securely; data and artificial intelligence modernizes data platforms and architectures, and build data analytics and AI solutions; modern workplace and apps; and intelligent edge solutions that gathers and utilizes data for real-time decision making.

Featured Stories

Before you consider Insight Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Insight Enterprises wasn't on the list.

While Insight Enterprises currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.