Rockefeller Capital Management L.P. boosted its stake in shares of Public Service Enterprise Group Incorporated (NYSE:PEG - Free Report) by 5.4% during the third quarter, according to its most recent disclosure with the SEC. The institutional investor owned 195,564 shares of the utilities provider's stock after purchasing an additional 9,989 shares during the period. Rockefeller Capital Management L.P.'s holdings in Public Service Enterprise Group were worth $17,436,000 at the end of the most recent reporting period.

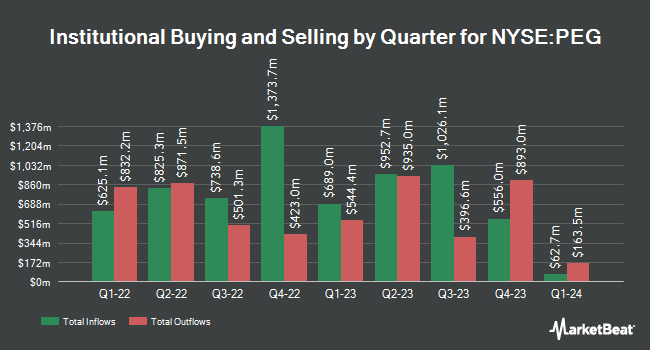

Other large investors have also recently added to or reduced their stakes in the company. Heritage Wealth Management Inc. purchased a new position in shares of Public Service Enterprise Group during the 2nd quarter valued at $422,000. DRW Securities LLC purchased a new position in Public Service Enterprise Group in the third quarter valued at about $8,244,000. QRG Capital Management Inc. increased its position in Public Service Enterprise Group by 28.0% in the 2nd quarter. QRG Capital Management Inc. now owns 70,927 shares of the utilities provider's stock worth $5,227,000 after purchasing an additional 15,505 shares during the last quarter. Cerity Partners LLC raised its stake in shares of Public Service Enterprise Group by 36.1% during the 3rd quarter. Cerity Partners LLC now owns 96,118 shares of the utilities provider's stock worth $8,575,000 after purchasing an additional 25,503 shares in the last quarter. Finally, CWM LLC raised its stake in shares of Public Service Enterprise Group by 72.3% during the 2nd quarter. CWM LLC now owns 20,786 shares of the utilities provider's stock worth $1,532,000 after purchasing an additional 8,723 shares in the last quarter. Institutional investors and hedge funds own 73.34% of the company's stock.

Insider Activity

In related news, EVP Tamara Louise Linde sold 9,564 shares of the company's stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $90.61, for a total value of $866,594.04. Following the sale, the executive vice president now owns 48,397 shares of the company's stock, valued at $4,385,252.17. The trade was a 16.50 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, SVP Richard T. Thigpen sold 5,900 shares of the stock in a transaction dated Monday, November 11th. The stock was sold at an average price of $87.95, for a total transaction of $518,905.00. Following the completion of the transaction, the senior vice president now directly owns 25,829 shares of the company's stock, valued at $2,271,660.55. This trade represents a 18.59 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 28,739 shares of company stock worth $2,467,753. Company insiders own 0.57% of the company's stock.

Analysts Set New Price Targets

A number of research firms recently commented on PEG. LADENBURG THALM/SH SH upgraded Public Service Enterprise Group from a "hold" rating to a "strong-buy" rating in a report on Monday, August 5th. Evercore ISI increased their price target on shares of Public Service Enterprise Group from $92.00 to $95.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 8th. Morgan Stanley lifted their price objective on shares of Public Service Enterprise Group from $83.00 to $95.00 and gave the company an "overweight" rating in a research note on Monday, September 23rd. UBS Group upped their price target on Public Service Enterprise Group from $94.00 to $98.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 30th. Finally, Jefferies Financial Group assumed coverage on Public Service Enterprise Group in a research note on Friday, September 13th. They issued a "hold" rating and a $85.00 price objective on the stock. Four research analysts have rated the stock with a hold rating, eight have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $88.08.

Check Out Our Latest Report on Public Service Enterprise Group

Public Service Enterprise Group Stock Performance

PEG stock traded down $2.00 on Monday, reaching $92.30. 2,078,943 shares of the company were exchanged, compared to its average volume of 2,763,792. The firm has a market capitalization of $45.99 billion, a PE ratio of 22.68, a PEG ratio of 3.46 and a beta of 0.61. Public Service Enterprise Group Incorporated has a 12 month low of $56.85 and a 12 month high of $95.22. The stock's fifty day moving average price is $89.31 and its 200 day moving average price is $81.44. The company has a debt-to-equity ratio of 1.18, a current ratio of 0.68 and a quick ratio of 0.48.

Public Service Enterprise Group (NYSE:PEG - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The utilities provider reported $0.90 EPS for the quarter, beating analysts' consensus estimates of $0.87 by $0.03. Public Service Enterprise Group had a net margin of 19.48% and a return on equity of 10.70%. The business had revenue of $2.64 billion during the quarter, compared to analyst estimates of $2.44 billion. During the same quarter in the prior year, the business earned $0.85 earnings per share. The firm's revenue for the quarter was up 7.6% on a year-over-year basis. On average, research analysts anticipate that Public Service Enterprise Group Incorporated will post 3.67 EPS for the current fiscal year.

Public Service Enterprise Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Tuesday, December 10th will be issued a dividend of $0.60 per share. This represents a $2.40 annualized dividend and a dividend yield of 2.60%. The ex-dividend date is Tuesday, December 10th. Public Service Enterprise Group's payout ratio is presently 58.97%.

About Public Service Enterprise Group

(

Free Report)

Public Service Enterprise Group Incorporated, through its subsidiaries, operates in electric and gas utility business in the United States. It operates through PSE&G and PSEG Power segments. The PSE&G segment transmits electricity; distributes electricity and natural gas to residential, commercial, and industrial customers; and appliance services and repairs to customers through its service territory, as well as invests in solar generation projects, and energy efficiency and related programs.

Further Reading

Before you consider Public Service Enterprise Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Public Service Enterprise Group wasn't on the list.

While Public Service Enterprise Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.