Rockefeller Capital Management L.P. boosted its holdings in shares of Trinity Capital Inc. (NASDAQ:TRIN - Free Report) by 9.3% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 843,849 shares of the company's stock after purchasing an additional 71,633 shares during the quarter. Rockefeller Capital Management L.P. owned about 1.43% of Trinity Capital worth $12,211,000 at the end of the most recent quarter.

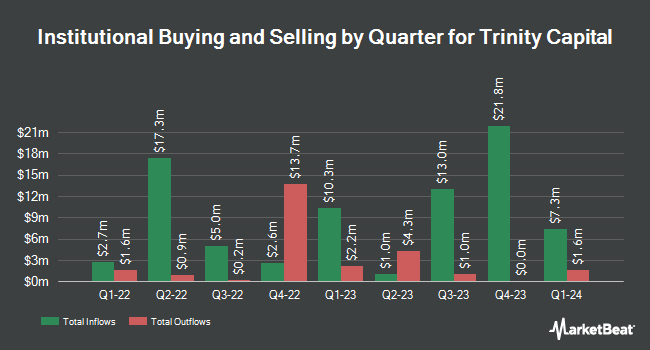

Other large investors also recently added to or reduced their stakes in the company. Wells Fargo & Company MN grew its position in shares of Trinity Capital by 652.3% during the 4th quarter. Wells Fargo & Company MN now owns 243,414 shares of the company's stock worth $3,522,000 after buying an additional 211,060 shares in the last quarter. Round Rock Advisors LLC acquired a new stake in Trinity Capital during the fourth quarter worth about $2,772,000. Trexquant Investment LP raised its position in shares of Trinity Capital by 421.3% in the fourth quarter. Trexquant Investment LP now owns 225,710 shares of the company's stock worth $3,266,000 after acquiring an additional 182,414 shares during the period. GraniteShares Advisors LLC purchased a new stake in Trinity Capital in the 4th quarter worth $2,469,000. Finally, Van ECK Associates Corp lifted its position in shares of Trinity Capital by 6.8% in the fourth quarter. Van ECK Associates Corp now owns 1,389,788 shares of the company's stock valued at $20,110,000 after acquiring an additional 88,698 shares in the last quarter. 24.62% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

TRIN has been the subject of several analyst reports. Keefe, Bruyette & Woods upped their target price on Trinity Capital from $15.00 to $16.00 and gave the company a "market perform" rating in a report on Thursday, February 27th. Wells Fargo & Company boosted their price target on shares of Trinity Capital from $13.00 to $14.00 and gave the company an "underweight" rating in a research note on Friday, February 28th. Finally, UBS Group dropped their target price on shares of Trinity Capital from $18.00 to $16.50 and set a "buy" rating for the company in a report on Thursday.

Check Out Our Latest Research Report on TRIN

Trinity Capital Stock Up 1.3 %

Shares of TRIN traded up $0.19 during midday trading on Friday, hitting $14.32. The company had a trading volume of 384,021 shares, compared to its average volume of 522,351. The company's 50-day simple moving average is $15.44 and its 200-day simple moving average is $14.75. The company has a debt-to-equity ratio of 0.07, a quick ratio of 0.05 and a current ratio of 0.05. Trinity Capital Inc. has a 1 year low of $12.50 and a 1 year high of $16.82. The firm has a market capitalization of $899.74 million, a P/E ratio of 8.37 and a beta of 0.56.

Trinity Capital (NASDAQ:TRIN - Get Free Report) last released its quarterly earnings data on Wednesday, February 26th. The company reported $0.56 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.53 by $0.03. The business had revenue of $70.83 million during the quarter, compared to analysts' expectations of $64.13 million. Trinity Capital had a net margin of 40.73% and a return on equity of 15.90%. As a group, sell-side analysts expect that Trinity Capital Inc. will post 2.06 EPS for the current year.

Trinity Capital Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st were issued a $0.51 dividend. This represents a $2.04 annualized dividend and a dividend yield of 14.25%. The ex-dividend date was Monday, March 31st. Trinity Capital's payout ratio is 99.03%.

About Trinity Capital

(

Free Report)

Trinity Capital Inc is a business development company. It is a venture capital firm specializing in venture debt to growth stage companies looking for loans and/or equipment financing. Trinity Capital Inc was founded in 2019 is based in Phoenix, Arizona with additional offices in the United States.

Further Reading

Before you consider Trinity Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trinity Capital wasn't on the list.

While Trinity Capital currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.