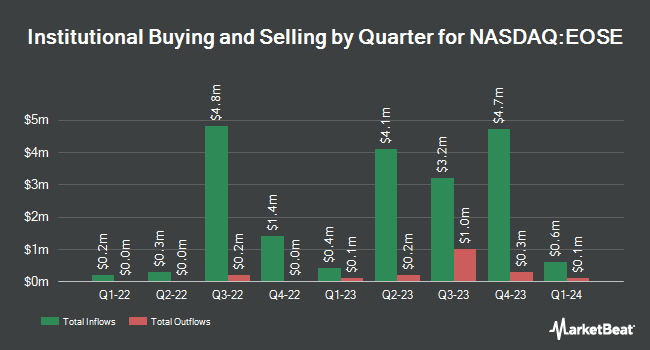

Rockefeller Capital Management L.P. reduced its holdings in Eos Energy Enterprises, Inc. (NASDAQ:EOSE - Free Report) by 52.3% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 148,008 shares of the company's stock after selling 162,222 shares during the quarter. Rockefeller Capital Management L.P. owned 0.07% of Eos Energy Enterprises worth $719,000 at the end of the most recent quarter.

Several other large investors have also recently added to or reduced their stakes in EOSE. Parkside Financial Bank & Trust bought a new position in shares of Eos Energy Enterprises in the fourth quarter valued at approximately $29,000. R Squared Ltd bought a new position in Eos Energy Enterprises during the 4th quarter valued at $31,000. Carmel Capital Partners LLC acquired a new position in shares of Eos Energy Enterprises during the 4th quarter valued at $49,000. Lake Street Private Wealth LLC acquired a new position in shares of Eos Energy Enterprises during the 4th quarter valued at $51,000. Finally, Harel Insurance Investments & Financial Services Ltd. bought a new stake in shares of Eos Energy Enterprises in the 4th quarter worth $58,000. 54.87% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

EOSE has been the topic of a number of research analyst reports. Roth Capital lowered Eos Energy Enterprises from a "strong-buy" rating to a "hold" rating in a report on Thursday, February 20th. Cowen reaffirmed a "hold" rating on shares of Eos Energy Enterprises in a research note on Friday, March 7th. Guggenheim reissued a "buy" rating and set a $7.00 target price on shares of Eos Energy Enterprises in a research note on Tuesday, March 18th. Finally, Roth Mkm lowered shares of Eos Energy Enterprises from a "buy" rating to a "neutral" rating and lifted their price target for the stock from $4.00 to $5.00 in a research report on Thursday, February 20th. Five analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $4.70.

Get Our Latest Stock Report on EOSE

Eos Energy Enterprises Stock Up 7.0 %

Shares of Eos Energy Enterprises stock traded up $0.34 during trading on Friday, hitting $5.22. The stock had a trading volume of 5,390,862 shares, compared to its average volume of 7,463,753. The stock has a 50 day simple moving average of $4.25 and a 200 day simple moving average of $4.13. Eos Energy Enterprises, Inc. has a 1 year low of $0.61 and a 1 year high of $6.64. The company has a market capitalization of $1.18 billion, a PE ratio of -2.17 and a beta of 2.17.

About Eos Energy Enterprises

(

Free Report)

Eos Energy Enterprises, Inc designs, manufactures, and markets zinc-based energy storage solutions for utility-scale, microgrid, and commercial and industrial (C&I) applications in the United States. The company offers Znyth technology battery energy storage system (BESS), which provides the operating flexibility to manage increased grid complexity and price volatility.

See Also

Before you consider Eos Energy Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eos Energy Enterprises wasn't on the list.

While Eos Energy Enterprises currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.