Rockefeller Capital Management L.P. increased its position in shares of Gentherm Incorporated (NASDAQ:THRM - Free Report) by 9.2% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 443,715 shares of the auto parts company's stock after acquiring an additional 37,215 shares during the period. Rockefeller Capital Management L.P. owned about 1.43% of Gentherm worth $20,659,000 at the end of the most recent reporting period.

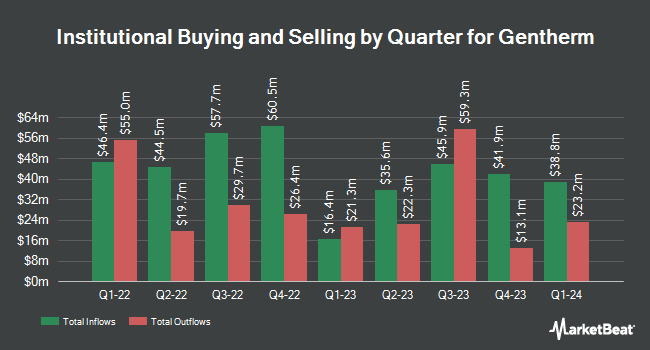

A number of other hedge funds and other institutional investors have also bought and sold shares of THRM. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in shares of Gentherm by 3.7% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 69,731 shares of the auto parts company's stock valued at $3,246,000 after buying an additional 2,491 shares during the last quarter. BNP Paribas Financial Markets raised its stake in Gentherm by 21.0% during the 3rd quarter. BNP Paribas Financial Markets now owns 22,123 shares of the auto parts company's stock worth $1,030,000 after buying an additional 3,837 shares during the period. FMR LLC raised its stake in Gentherm by 26.8% during the 3rd quarter. FMR LLC now owns 507,598 shares of the auto parts company's stock worth $23,629,000 after buying an additional 107,322 shares during the period. Cerity Partners LLC raised its stake in shares of Gentherm by 880.7% in the third quarter. Cerity Partners LLC now owns 188,683 shares of the auto parts company's stock worth $8,783,000 after purchasing an additional 169,443 shares during the last quarter. Finally, Eagle Asset Management Inc. raised its stake in shares of Gentherm by 2.6% in the third quarter. Eagle Asset Management Inc. now owns 235,563 shares of the auto parts company's stock worth $10,259,000 after purchasing an additional 5,925 shares during the last quarter. Institutional investors own 97.13% of the company's stock.

Insiders Place Their Bets

In other Gentherm news, CEO Phillip Eyler sold 4,402 shares of Gentherm stock in a transaction on Wednesday, September 18th. The shares were sold at an average price of $50.20, for a total value of $220,980.40. Following the transaction, the chief executive officer now directly owns 147,317 shares of the company's stock, valued at approximately $7,395,313.40. The trade was a 2.90 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 1.91% of the company's stock.

Gentherm Stock Performance

Shares of THRM stock traded up $0.58 during mid-day trading on Monday, reaching $42.68. 160,663 shares of the company's stock traded hands, compared to its average volume of 186,740. The firm has a market capitalization of $1.32 billion, a PE ratio of 19.94 and a beta of 1.44. The company has a debt-to-equity ratio of 0.34, a quick ratio of 1.38 and a current ratio of 2.02. The firm has a 50 day moving average price of $43.00 and a two-hundred day moving average price of $47.73. Gentherm Incorporated has a 12 month low of $39.86 and a 12 month high of $62.93.

Gentherm (NASDAQ:THRM - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The auto parts company reported $0.75 EPS for the quarter, beating analysts' consensus estimates of $0.66 by $0.09. Gentherm had a net margin of 4.61% and a return on equity of 14.36%. The firm had revenue of $371.50 million during the quarter, compared to the consensus estimate of $372.89 million. During the same quarter last year, the firm earned $0.64 EPS. The firm's revenue for the quarter was up 1.4% compared to the same quarter last year. On average, research analysts forecast that Gentherm Incorporated will post 2.71 EPS for the current year.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on THRM shares. Craig Hallum reduced their target price on Gentherm from $85.00 to $65.00 and set a "buy" rating for the company in a report on Thursday, October 31st. StockNews.com raised Gentherm from a "hold" rating to a "buy" rating in a report on Friday, August 9th. JPMorgan Chase & Co. raised Gentherm from an "underweight" rating to a "neutral" rating and set a $56.00 price target for the company in a report on Monday, October 21st. Finally, Robert W. Baird lowered their price objective on Gentherm from $54.00 to $50.00 and set a "neutral" rating on the stock in a research report on Thursday, October 31st. Three investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $57.00.

View Our Latest Stock Analysis on THRM

About Gentherm

(

Free Report)

Gentherm Incorporated designs, develops, manufactures, and sells thermal management and pneumatic comfort technologies in the United States and internationally. The company operates in two segments, Automotive and Medical. The Automotive segment offers climate comfort systems, which include seat heaters, blowers, and thermoelectric devices for variable temperature climate control seats and steering wheel heaters that are designed to provide thermal comfort to automobile passengers; integrated electronic components, such as electronic control units; and other climate comfort systems, including neck and shoulder conditioners and climate control system products for door panels, armrests, cupholders, and storage bins.

Read More

Before you consider Gentherm, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gentherm wasn't on the list.

While Gentherm currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.