Rockefeller Capital Management L.P. grew its position in shares of PJT Partners Inc. (NYSE:PJT - Free Report) by 3.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 300,964 shares of the financial services provider's stock after purchasing an additional 8,953 shares during the period. Rockefeller Capital Management L.P. owned approximately 1.27% of PJT Partners worth $40,119,000 at the end of the most recent reporting period.

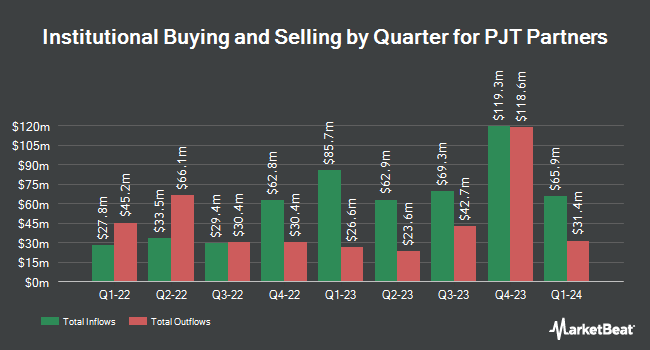

A number of other institutional investors have also recently made changes to their positions in PJT. Point72 Asset Management L.P. purchased a new position in shares of PJT Partners during the second quarter valued at about $13,803,000. Congress Asset Management Co. grew its position in shares of PJT Partners by 29.6% during the third quarter. Congress Asset Management Co. now owns 317,974 shares of the financial services provider's stock valued at $42,399,000 after purchasing an additional 72,582 shares in the last quarter. Marshall Wace LLP purchased a new position in shares of PJT Partners during the second quarter valued at about $5,801,000. Champlain Investment Partners LLC grew its position in shares of PJT Partners by 7.4% during the third quarter. Champlain Investment Partners LLC now owns 594,359 shares of the financial services provider's stock valued at $79,252,000 after purchasing an additional 41,119 shares in the last quarter. Finally, FMR LLC grew its position in shares of PJT Partners by 10.9% during the third quarter. FMR LLC now owns 417,271 shares of the financial services provider's stock valued at $55,639,000 after purchasing an additional 41,007 shares in the last quarter. Hedge funds and other institutional investors own 89.23% of the company's stock.

PJT Partners Stock Up 1.3 %

PJT traded up $2.17 on Friday, hitting $167.36. The company had a trading volume of 107,048 shares, compared to its average volume of 233,818. The company has a market cap of $3.97 billion, a PE ratio of 42.48 and a beta of 0.61. PJT Partners Inc. has a 12-month low of $85.98 and a 12-month high of $168.92. The business's fifty day simple moving average is $147.49 and its 200 day simple moving average is $126.30.

PJT Partners (NYSE:PJT - Get Free Report) last announced its quarterly earnings data on Tuesday, October 29th. The financial services provider reported $0.93 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.91 by $0.02. The business had revenue of $326.30 million during the quarter, compared to the consensus estimate of $313.46 million. PJT Partners had a net margin of 8.03% and a return on equity of 18.79%. The firm's quarterly revenue was up 17.2% compared to the same quarter last year. During the same quarter last year, the firm earned $0.78 earnings per share. On average, analysts anticipate that PJT Partners Inc. will post 4.4 earnings per share for the current fiscal year.

PJT Partners Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Wednesday, December 4th will be paid a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 0.60%. The ex-dividend date is Wednesday, December 4th. PJT Partners's payout ratio is currently 25.38%.

Insiders Place Their Bets

In other news, insider Ji-Yeun Lee sold 10,000 shares of PJT Partners stock in a transaction that occurred on Tuesday, September 3rd. The shares were sold at an average price of $118.85, for a total transaction of $1,188,500.00. Following the completion of the sale, the insider now owns 61,433 shares of the company's stock, valued at approximately $7,301,312.05. The trade was a 14.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director James Costos sold 1,500 shares of PJT Partners stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $161.41, for a total transaction of $242,115.00. Following the sale, the director now directly owns 9,360 shares of the company's stock, valued at $1,510,797.60. This represents a 13.81 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 14,766 shares of company stock valued at $1,951,480 over the last 90 days. Insiders own 11.71% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently weighed in on the company. JMP Securities raised their price objective on PJT Partners from $142.00 to $150.00 and gave the company a "market outperform" rating in a research report on Wednesday, October 9th. UBS Group lifted their price target on PJT Partners from $110.00 to $120.00 and gave the stock a "sell" rating in a research report on Tuesday, October 8th. Two analysts have rated the stock with a sell rating, three have assigned a hold rating and one has given a buy rating to the company. According to data from MarketBeat, PJT Partners presently has an average rating of "Hold" and a consensus target price of $123.80.

Get Our Latest Report on PJT Partners

About PJT Partners

(

Free Report)

PJT Partners Inc, an investment bank, provides various strategic and capital markets advisory, restructuring and special situations, and shareholder advisory services to corporations, financial sponsors, institutional investors, and governments worldwide. It offers advisory services to clients on various transactions, including mergers and acquisitions (M&A), spin-offs, activism defense, contested M&A, joint ventures, minority investments, and divestitures.

Featured Stories

Before you consider PJT Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PJT Partners wasn't on the list.

While PJT Partners currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.