Rockefeller Capital Management L.P. bought a new position in Carvana Co. (NYSE:CVNA - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor bought 10,180 shares of the company's stock, valued at approximately $1,772,000.

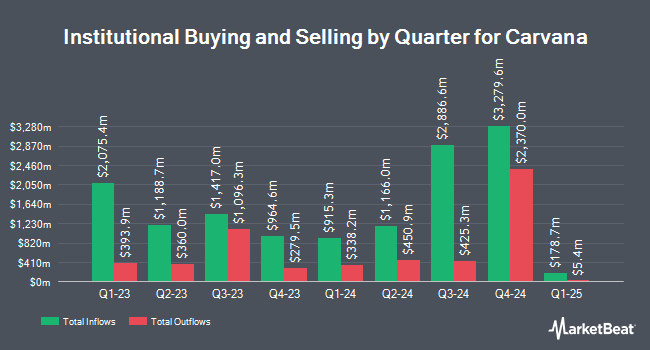

Other hedge funds have also made changes to their positions in the company. Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in Carvana by 13.3% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 19,140 shares of the company's stock valued at $3,332,000 after purchasing an additional 2,243 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund grew its holdings in shares of Carvana by 4.5% during the third quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 306,148 shares of the company's stock worth $53,303,000 after purchasing an additional 13,048 shares during the last quarter. Townsquare Capital LLC acquired a new stake in shares of Carvana in the third quarter valued at $282,000. Quantbot Technologies LP raised its holdings in shares of Carvana by 509.1% in the third quarter. Quantbot Technologies LP now owns 47,610 shares of the company's stock valued at $8,289,000 after buying an additional 39,794 shares during the last quarter. Finally, FMR LLC lifted its position in Carvana by 90.8% during the 3rd quarter. FMR LLC now owns 12,361,790 shares of the company's stock worth $2,152,311,000 after buying an additional 5,882,656 shares in the last quarter. Institutional investors and hedge funds own 56.71% of the company's stock.

Insider Buying and Selling

In related news, insider Daniel J. Gill sold 44,000 shares of the stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $259.47, for a total transaction of $11,416,680.00. Following the completion of the transaction, the insider now owns 191,225 shares in the company, valued at approximately $49,617,150.75. This represents a 18.71 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Benjamin E. Huston sold 3,043 shares of the business's stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $240.00, for a total transaction of $730,320.00. Following the sale, the chief operating officer now directly owns 218,686 shares in the company, valued at $52,484,640. This trade represents a 1.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 2,097,063 shares of company stock worth $393,287,959 over the last ninety days. Company insiders own 17.12% of the company's stock.

Wall Street Analyst Weigh In

Several research firms have weighed in on CVNA. Robert W. Baird raised their price objective on shares of Carvana from $160.00 to $240.00 and gave the company a "neutral" rating in a research report on Thursday, October 31st. JMP Securities upped their price objective on Carvana from $200.00 to $320.00 and gave the stock a "market outperform" rating in a report on Thursday, October 31st. Wells Fargo & Company lifted their target price on Carvana from $175.00 to $250.00 and gave the company an "overweight" rating in a research note on Wednesday, October 23rd. Needham & Company LLC upped their price target on Carvana from $200.00 to $300.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Finally, Wedbush raised their price target on Carvana from $150.00 to $175.00 and gave the company a "neutral" rating in a report on Monday, October 7th. Eleven analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat.com, Carvana has an average rating of "Hold" and an average price target of $220.94.

View Our Latest Analysis on CVNA

Carvana Trading Down 1.8 %

Shares of Carvana stock traded down $4.52 during trading hours on Friday, hitting $251.21. The company's stock had a trading volume of 2,730,660 shares, compared to its average volume of 2,256,915. Carvana Co. has a 12 month low of $36.53 and a 12 month high of $268.34. The company has a debt-to-equity ratio of 18.99, a current ratio of 3.25 and a quick ratio of 2.12. The company has a market capitalization of $52.16 billion, a PE ratio of 25,146.15 and a beta of 3.32. The stock has a 50 day moving average of $221.77 and a 200 day moving average of $164.17.

Carvana (NYSE:CVNA - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported $0.64 EPS for the quarter, topping the consensus estimate of $0.23 by $0.41. The company had revenue of $3.66 billion for the quarter, compared to analyst estimates of $3.47 billion. The business's quarterly revenue was up 31.8% on a year-over-year basis. During the same quarter last year, the business posted $0.23 earnings per share. Analysts predict that Carvana Co. will post 0.76 earnings per share for the current year.

About Carvana

(

Free Report)

Carvana Co, together with its subsidiaries, operates an e-commerce platform for buying and selling used cars in the United States. Its platform allows customers to research and identify a vehicle; inspect it using company's 360-degree vehicle imaging technology; obtain financing and warranty coverage; purchase the vehicle; and schedule delivery or pick-up from their desktop or mobile devices.

Featured Articles

Before you consider Carvana, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carvana wasn't on the list.

While Carvana currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.