Rockefeller Capital Management L.P. reduced its position in shares of Golub Capital BDC, Inc. (NASDAQ:GBDC - Free Report) by 23.8% during the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 3,073,223 shares of the investment management company's stock after selling 958,664 shares during the quarter. Rockefeller Capital Management L.P. owned about 1.79% of Golub Capital BDC worth $46,436,000 at the end of the most recent quarter.

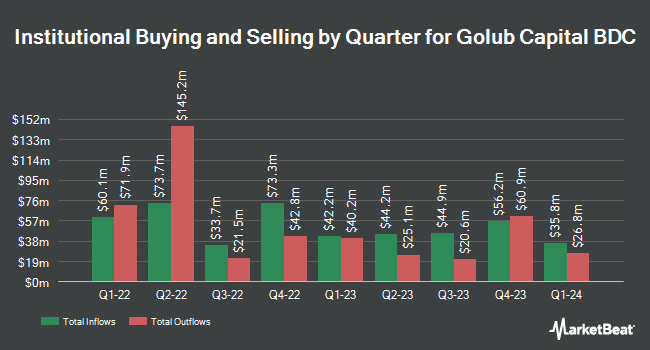

Several other institutional investors and hedge funds have also added to or reduced their stakes in GBDC. Tidal Investments LLC increased its stake in Golub Capital BDC by 7.3% in the 1st quarter. Tidal Investments LLC now owns 65,932 shares of the investment management company's stock worth $1,096,000 after acquiring an additional 4,471 shares during the last quarter. Virtu Financial LLC bought a new stake in shares of Golub Capital BDC during the 1st quarter valued at $257,000. Cetera Advisors LLC purchased a new position in shares of Golub Capital BDC during the 1st quarter valued at $995,000. Boston Partners bought a new position in Golub Capital BDC in the 1st quarter worth $12,126,000. Finally, Confluence Investment Management LLC increased its stake in Golub Capital BDC by 1.5% in the 2nd quarter. Confluence Investment Management LLC now owns 336,119 shares of the investment management company's stock worth $5,280,000 after buying an additional 4,835 shares in the last quarter. Institutional investors own 42.38% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on GBDC. Oppenheimer reiterated an "outperform" rating and issued a $17.00 price target on shares of Golub Capital BDC in a report on Wednesday, August 7th. StockNews.com upgraded shares of Golub Capital BDC from a "sell" rating to a "hold" rating in a research note on Friday. Keefe, Bruyette & Woods dropped their target price on Golub Capital BDC from $17.50 to $16.50 and set an "outperform" rating on the stock in a research report on Wednesday, August 7th. Finally, Wells Fargo & Company lowered their price target on Golub Capital BDC from $15.50 to $15.00 and set an "equal weight" rating on the stock in a research report on Thursday, November 21st. Three analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat, Golub Capital BDC presently has a consensus rating of "Moderate Buy" and an average target price of $16.40.

Read Our Latest Research Report on GBDC

Insider Buying and Selling

In other news, Chairman Lawrence E. Golub bought 20,000 shares of the company's stock in a transaction on Thursday, September 5th. The stock was bought at an average cost of $14.91 per share, with a total value of $298,200.00. Following the transaction, the chairman now directly owns 1,998,880 shares in the company, valued at $29,803,300.80. The trade was a 1.01 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Corporate insiders own 2.70% of the company's stock.

Golub Capital BDC Trading Up 1.7 %

Shares of GBDC traded up $0.27 during midday trading on Friday, reaching $15.67. The company had a trading volume of 930,722 shares, compared to its average volume of 1,173,341. Golub Capital BDC, Inc. has a 1-year low of $14.05 and a 1-year high of $17.72. The stock has a market cap of $4.14 billion, a PE ratio of 11.11 and a beta of 0.54. The firm has a 50 day simple moving average of $15.26 and a 200-day simple moving average of $15.38. The company has a quick ratio of 4.73, a current ratio of 4.73 and a debt-to-equity ratio of 1.15.

Golub Capital BDC Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Monday, December 9th will be given a dividend of $0.39 per share. This represents a $1.56 dividend on an annualized basis and a dividend yield of 9.96%. The ex-dividend date is Monday, December 9th. Golub Capital BDC's payout ratio is 110.64%.

Golub Capital BDC Profile

(

Free Report)

Golub Capital BDC, Inc (GBDC) is a business development company and operates as an externally managed closed-end non-diversified management investment company. It invests in debt and minority equity investments in middle-market companies that are, in most cases, sponsored by private equity investors.

Read More

Before you consider Golub Capital BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Golub Capital BDC wasn't on the list.

While Golub Capital BDC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.