Rockefeller Capital Management L.P. trimmed its position in shares of Texas Instruments Incorporated (NASDAQ:TXN - Free Report) by 3.6% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 312,260 shares of the semiconductor company's stock after selling 11,704 shares during the period. Rockefeller Capital Management L.P.'s holdings in Texas Instruments were worth $64,499,000 as of its most recent SEC filing.

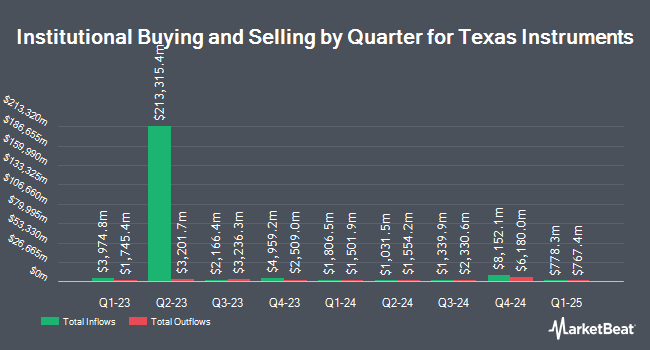

Other hedge funds also recently bought and sold shares of the company. Skandinaviska Enskilda Banken AB publ increased its stake in Texas Instruments by 4.3% in the 2nd quarter. Skandinaviska Enskilda Banken AB publ now owns 234,232 shares of the semiconductor company's stock worth $45,535,000 after purchasing an additional 9,608 shares during the period. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp increased its stake in shares of Texas Instruments by 60.2% in the second quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 174,310 shares of the semiconductor company's stock worth $33,909,000 after buying an additional 65,512 shares during the period. Healthcare of Ontario Pension Plan Trust Fund boosted its position in Texas Instruments by 454.5% during the 2nd quarter. Healthcare of Ontario Pension Plan Trust Fund now owns 1,256,289 shares of the semiconductor company's stock valued at $244,386,000 after buying an additional 1,029,741 shares during the period. GAMMA Investing LLC grew its holdings in Texas Instruments by 106.4% in the 2nd quarter. GAMMA Investing LLC now owns 12,987 shares of the semiconductor company's stock worth $2,526,000 after acquiring an additional 6,696 shares during the last quarter. Finally, Townsquare Capital LLC increased its position in shares of Texas Instruments by 5.9% in the third quarter. Townsquare Capital LLC now owns 93,689 shares of the semiconductor company's stock valued at $19,353,000 after acquiring an additional 5,201 shares during the period. Institutional investors own 84.99% of the company's stock.

Insider Activity

In other Texas Instruments news, Director Ronald Kirk sold 10,539 shares of the stock in a transaction dated Monday, November 25th. The stock was sold at an average price of $203.33, for a total value of $2,142,894.87. Following the transaction, the director now owns 14,323 shares of the company's stock, valued at approximately $2,912,295.59. This represents a 42.39 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Robert E. Sanchez sold 9,990 shares of the firm's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $208.80, for a total transaction of $2,085,912.00. Following the completion of the transaction, the director now directly owns 20,461 shares in the company, valued at approximately $4,272,256.80. The trade was a 32.81 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.68% of the company's stock.

Texas Instruments Stock Up 0.9 %

TXN stock traded up $1.84 during trading on Friday, hitting $201.03. 3,167,423 shares of the stock traded hands, compared to its average volume of 5,551,441. The stock has a market cap of $183.38 billion, a price-to-earnings ratio of 37.37, a price-to-earnings-growth ratio of 4.36 and a beta of 0.99. The company has a debt-to-equity ratio of 0.74, a current ratio of 4.31 and a quick ratio of 3.14. Texas Instruments Incorporated has a 1 year low of $151.27 and a 1 year high of $220.38. The firm's 50 day moving average is $204.29 and its two-hundred day moving average is $200.78.

Texas Instruments (NASDAQ:TXN - Get Free Report) last issued its earnings results on Tuesday, October 22nd. The semiconductor company reported $1.47 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.38 by $0.09. Texas Instruments had a net margin of 31.60% and a return on equity of 29.05%. The firm had revenue of $4.15 billion for the quarter, compared to the consensus estimate of $4.12 billion. During the same quarter in the prior year, the firm posted $1.80 earnings per share. The business's revenue was down 8.4% on a year-over-year basis. On average, sell-side analysts anticipate that Texas Instruments Incorporated will post 5.08 EPS for the current year.

Texas Instruments Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Tuesday, November 12th. Stockholders of record on Thursday, October 31st were issued a dividend of $1.36 per share. This is an increase from Texas Instruments's previous quarterly dividend of $1.30. This represents a $5.44 dividend on an annualized basis and a dividend yield of 2.71%. The ex-dividend date of this dividend was Thursday, October 31st. Texas Instruments's dividend payout ratio is presently 101.12%.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the stock. Cantor Fitzgerald reiterated a "neutral" rating and set a $200.00 target price on shares of Texas Instruments in a report on Wednesday, October 23rd. Truist Financial cut their price objective on Texas Instruments from $198.00 to $190.00 and set a "hold" rating on the stock in a research report on Wednesday, October 23rd. Evercore ISI upped their target price on Texas Instruments from $268.00 to $298.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. Summit Insights upgraded shares of Texas Instruments from a "hold" rating to a "buy" rating in a report on Wednesday, October 23rd. Finally, Wells Fargo & Company initiated coverage on shares of Texas Instruments in a report on Friday, November 22nd. They issued an "equal weight" rating and a $215.00 price objective for the company. Two research analysts have rated the stock with a sell rating, twelve have given a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $210.05.

Read Our Latest Stock Report on Texas Instruments

Texas Instruments Company Profile

(

Free Report)

Texas Instruments Incorporated designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments. The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products.

Featured Articles

Before you consider Texas Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Texas Instruments wasn't on the list.

While Texas Instruments currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report