Rockefeller Capital Management L.P. trimmed its holdings in Lowe's Companies, Inc. (NYSE:LOW - Free Report) by 7.3% in the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 297,118 shares of the home improvement retailer's stock after selling 23,428 shares during the quarter. Rockefeller Capital Management L.P. owned 0.05% of Lowe's Companies worth $73,334,000 at the end of the most recent quarter.

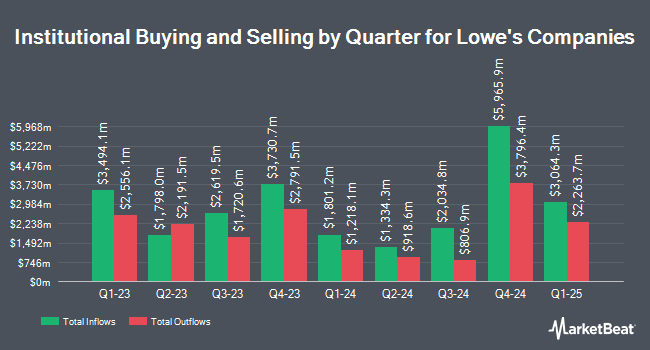

A number of other institutional investors also recently made changes to their positions in LOW. IFS Advisors LLC bought a new position in shares of Lowe's Companies during the fourth quarter valued at about $25,000. Winch Advisory Services LLC grew its holdings in shares of Lowe's Companies by 56.4% in the fourth quarter. Winch Advisory Services LLC now owns 122 shares of the home improvement retailer's stock worth $30,000 after purchasing an additional 44 shares during the last quarter. Marshall Investment Management LLC bought a new stake in Lowe's Companies during the 4th quarter valued at $31,000. Caisse Des Depots ET Consignations bought a new stake in Lowe's Companies in the 4th quarter worth $33,000. Finally, Millstone Evans Group LLC bought a new position in shares of Lowe's Companies during the fourth quarter valued at about $44,000. Hedge funds and other institutional investors own 74.06% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on LOW shares. Piper Sandler reduced their price target on Lowe's Companies from $296.00 to $269.00 and set an "overweight" rating on the stock in a report on Monday, March 24th. Truist Financial cut their target price on shares of Lowe's Companies from $295.00 to $258.00 and set a "buy" rating on the stock in a research note on Tuesday, April 8th. Mizuho reduced their target price on Lowe's Companies from $305.00 to $300.00 and set an "outperform" rating on the stock in a report on Thursday, February 27th. StockNews.com upgraded Lowe's Companies from a "hold" rating to a "buy" rating in a research note on Tuesday. Finally, Telsey Advisory Group reiterated an "outperform" rating and issued a $305.00 price objective on shares of Lowe's Companies in a report on Tuesday. One analyst has rated the stock with a sell rating, nine have issued a hold rating and fifteen have issued a buy rating to the company's stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $278.74.

Check Out Our Latest Report on LOW

Lowe's Companies Stock Performance

Shares of LOW stock traded down $3.68 on Tuesday, reaching $220.46. The stock had a trading volume of 2,804,710 shares, compared to its average volume of 2,468,318. Lowe's Companies, Inc. has a 1 year low of $206.39 and a 1 year high of $287.01. The stock has a market cap of $123.40 billion, a P/E ratio of 18.39, a price-to-earnings-growth ratio of 1.96 and a beta of 1.07. The company has a 50 day simple moving average of $235.57 and a 200 day simple moving average of $253.99.

Lowe's Companies (NYSE:LOW - Get Free Report) last announced its earnings results on Wednesday, February 26th. The home improvement retailer reported $1.93 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.83 by $0.10. Lowe's Companies had a negative return on equity of 47.55% and a net margin of 8.19%. The business had revenue of $18.55 billion for the quarter, compared to analysts' expectations of $18.29 billion. On average, equities research analysts anticipate that Lowe's Companies, Inc. will post 11.9 earnings per share for the current fiscal year.

Lowe's Companies Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, May 7th. Stockholders of record on Wednesday, April 23rd will be given a dividend of $1.15 per share. This represents a $4.60 dividend on an annualized basis and a dividend yield of 2.09%. The ex-dividend date is Wednesday, April 23rd. Lowe's Companies's payout ratio is 37.67%.

Lowe's Companies Company Profile

(

Free Report)

Lowe's Companies, Inc, together with its subsidiaries, operates as a home improvement retailer in the United States. The company offers a line of products for construction, maintenance, repair, remodeling, and decorating. It also provides home improvement products, such as appliances, seasonal and outdoor living, lawn and garden, lumber, kitchens and bath, tools, paint, millwork, hardware, flooring, rough plumbing, building materials, décor, and electrical.

Further Reading

Before you consider Lowe's Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lowe's Companies wasn't on the list.

While Lowe's Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.