Rockefeller Capital Management L.P. reduced its position in TransUnion (NYSE:TRU - Free Report) by 4.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 1,259,300 shares of the business services provider's stock after selling 59,262 shares during the period. Rockefeller Capital Management L.P. owned about 0.65% of TransUnion worth $131,849,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

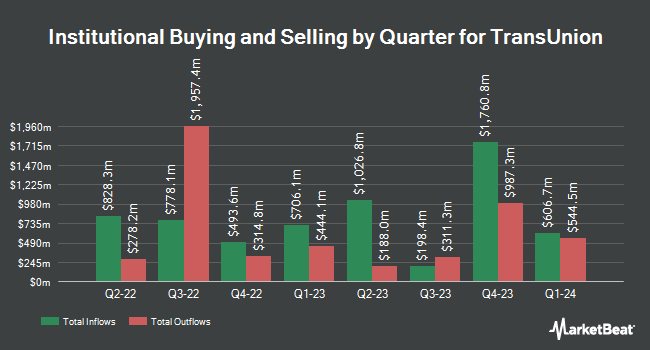

A number of other hedge funds have also recently added to or reduced their stakes in the company. Vinva Investment Management Ltd increased its position in shares of TransUnion by 97.7% in the third quarter. Vinva Investment Management Ltd now owns 15,659 shares of the business services provider's stock valued at $1,627,000 after buying an additional 7,738 shares in the last quarter. PEAK6 Investments LLC raised its holdings in shares of TransUnion by 469.6% during the third quarter. PEAK6 Investments LLC now owns 142,317 shares of the business services provider's stock valued at $14,901,000 after acquiring an additional 117,333 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in shares of TransUnion by 12.3% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,180,036 shares of the business services provider's stock valued at $123,550,000 after acquiring an additional 129,547 shares in the last quarter. Townsquare Capital LLC increased its position in shares of TransUnion by 1.0% during the third quarter. Townsquare Capital LLC now owns 10,211 shares of the business services provider's stock worth $1,069,000 after purchasing an additional 100 shares in the last quarter. Finally, Thematics Asset Management lifted its holdings in TransUnion by 19.3% in the 3rd quarter. Thematics Asset Management now owns 213,000 shares of the business services provider's stock valued at $22,301,000 after purchasing an additional 34,500 shares in the last quarter.

Wall Street Analysts Forecast Growth

TRU has been the subject of a number of recent research reports. The Goldman Sachs Group increased their price objective on shares of TransUnion from $97.00 to $109.00 and gave the company a "neutral" rating in a report on Wednesday, October 2nd. UBS Group started coverage on shares of TransUnion in a report on Tuesday, October 1st. They issued a "neutral" rating and a $110.00 price objective for the company. Royal Bank of Canada reaffirmed an "outperform" rating and set a $121.00 target price on shares of TransUnion in a research note on Thursday, October 24th. Morgan Stanley increased their price target on shares of TransUnion from $103.00 to $119.00 and gave the company an "overweight" rating in a research note on Thursday, October 24th. Finally, Needham & Company LLC reaffirmed a "hold" rating on shares of TransUnion in a research report on Thursday, October 24th. Seven research analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $106.38.

View Our Latest Stock Analysis on TransUnion

Insiders Place Their Bets

In other TransUnion news, insider Steven M. Chaouki sold 1,500 shares of the firm's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $105.66, for a total transaction of $158,490.00. Following the transaction, the insider now owns 62,988 shares of the company's stock, valued at approximately $6,655,312.08. This trade represents a 2.33 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director George M. Awad sold 12,000 shares of the business's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $100.00, for a total value of $1,200,000.00. Following the completion of the sale, the director now directly owns 27,026 shares of the company's stock, valued at $2,702,600. The trade was a 30.75 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 19,500 shares of company stock valued at $1,954,740 in the last ninety days. Insiders own 0.22% of the company's stock.

TransUnion Stock Up 0.5 %

TRU stock traded up $0.50 during mid-day trading on Friday, reaching $101.50. The company had a trading volume of 652,470 shares, compared to its average volume of 1,602,257. TransUnion has a fifty-two week low of $57.80 and a fifty-two week high of $113.17. The company has a market capitalization of $19.78 billion, a price-to-earnings ratio of 87.83, a price-to-earnings-growth ratio of 1.40 and a beta of 1.62. The company has a debt-to-equity ratio of 1.19, a quick ratio of 1.68 and a current ratio of 1.68. The firm has a fifty day simple moving average of $103.61 and a 200 day simple moving average of $90.25.

TransUnion (NYSE:TRU - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The business services provider reported $1.04 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.01 by $0.03. TransUnion had a net margin of 5.47% and a return on equity of 15.38%. The company had revenue of $1.09 billion during the quarter, compared to the consensus estimate of $1.06 billion. During the same quarter in the previous year, the firm earned $0.80 earnings per share. The firm's quarterly revenue was up 12.0% on a year-over-year basis. Analysts forecast that TransUnion will post 3.44 earnings per share for the current fiscal year.

TransUnion Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, December 9th. Shareholders of record on Friday, November 22nd will be paid a $0.105 dividend. This represents a $0.42 dividend on an annualized basis and a yield of 0.41%. The ex-dividend date is Friday, November 22nd. TransUnion's dividend payout ratio is presently 36.52%.

TransUnion Profile

(

Free Report)

TransUnion operates as a global consumer credit reporting agency that provides risk and information solutions. The company operates through U.S. Markets, International, and Consumer Interactive segments. The U.S. Markets segment provides consumer reports, actionable insights, and analytic services to businesses, which uses its services to acquire new customers; assess consumer ability to pay for services; identify cross-selling opportunities; measure and manage debt portfolio risk; collect debt; verify consumer identities; and mitigate fraud risk.

Read More

Before you consider TransUnion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransUnion wasn't on the list.

While TransUnion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.