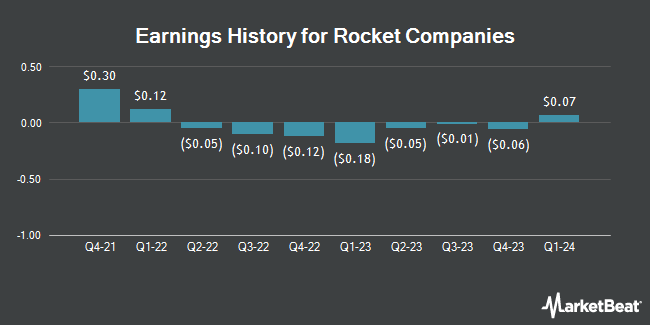

Rocket Companies (NYSE:RKT - Get Free Report) is scheduled to be posting its quarterly earnings results after the market closes on Tuesday, November 12th. Analysts expect Rocket Companies to post earnings of $0.08 per share for the quarter. Individual that are interested in participating in the company's earnings conference call can do so using this link.

Rocket Companies Trading Up 1.8 %

Shares of RKT stock traded up $0.29 during mid-day trading on Tuesday, reaching $16.29. The company's stock had a trading volume of 2,219,640 shares, compared to its average volume of 2,804,103. The company has a quick ratio of 13.18, a current ratio of 13.18 and a debt-to-equity ratio of 1.27. The firm has a market capitalization of $32.41 billion, a PE ratio of 232.89 and a beta of 2.46. The company's 50 day simple moving average is $18.36 and its 200-day simple moving average is $16.13. Rocket Companies has a 12-month low of $7.85 and a 12-month high of $21.38.

Analyst Upgrades and Downgrades

A number of research analysts have commented on RKT shares. Barclays boosted their price objective on Rocket Companies from $10.00 to $14.00 and gave the stock an "underweight" rating in a research note on Tuesday, October 8th. Morgan Stanley started coverage on Rocket Companies in a report on Tuesday. They issued an "equal weight" rating and a $18.00 price target for the company. Bank of America lifted their price objective on shares of Rocket Companies from $12.00 to $14.00 and gave the company an "underperform" rating in a research note on Thursday, August 29th. UBS Group upped their target price on shares of Rocket Companies from $11.50 to $14.00 and gave the company a "sell" rating in a research note on Monday, September 16th. Finally, Wedbush lifted their price target on shares of Rocket Companies from $15.00 to $18.00 and gave the stock a "neutral" rating in a research note on Wednesday, September 11th. Five equities research analysts have rated the stock with a sell rating and seven have issued a hold rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $15.15.

View Our Latest Research Report on RKT

Rocket Companies Company Profile

(

Get Free Report)

Rocket Companies, Inc, a fintech holding company, provides mortgage lending, title and settlement services, and other financial technology services in the United States and Canada. It operates through two segments, Direct to Consumer and Partner Network. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; and Rocket Loans, an online-based personal loans business.

Featured Stories

Before you consider Rocket Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Companies wasn't on the list.

While Rocket Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.