Rocket Pharmaceuticals (NASDAQ:RCKT - Get Free Report)'s stock had its "buy" rating restated by equities research analysts at Needham & Company LLC in a report issued on Tuesday,Benzinga reports. They presently have a $52.00 price target on the biotechnology company's stock. Needham & Company LLC's price target points to a potential upside of 295.44% from the stock's previous close.

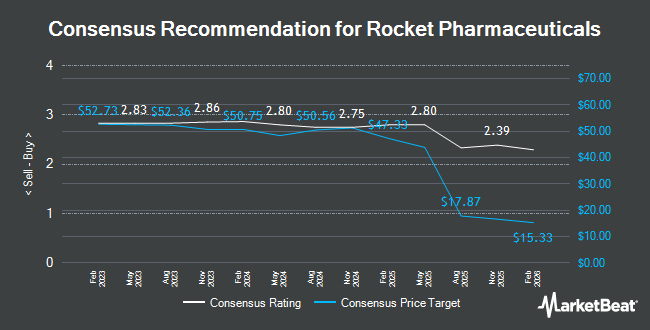

RCKT has been the topic of a number of other reports. JPMorgan Chase & Co. boosted their target price on shares of Rocket Pharmaceuticals from $50.00 to $54.00 and gave the company an "overweight" rating in a research note on Tuesday, August 6th. Chardan Capital reissued a "buy" rating and set a $62.00 price objective on shares of Rocket Pharmaceuticals in a report on Monday. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $65.00 price target on shares of Rocket Pharmaceuticals in a research report on Tuesday, August 6th. Scotiabank initiated coverage on Rocket Pharmaceuticals in a report on Wednesday, October 16th. They issued a "sector outperform" rating and a $50.00 price objective for the company. Finally, Canaccord Genuity Group reaffirmed a "buy" rating and set a $38.00 price objective on shares of Rocket Pharmaceuticals in a report on Monday, September 30th. One analyst has rated the stock with a sell rating, one has given a hold rating and ten have issued a buy rating to the stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $50.89.

View Our Latest Research Report on RCKT

Rocket Pharmaceuticals Stock Performance

Shares of RCKT traded down $0.51 on Tuesday, reaching $13.15. 1,569,396 shares of the company's stock traded hands, compared to its average volume of 789,253. The stock has a market cap of $1.20 billion, a PE ratio of -4.92 and a beta of 1.09. Rocket Pharmaceuticals has a 52-week low of $13.07 and a 52-week high of $32.53. The company has a current ratio of 6.05, a quick ratio of 6.05 and a debt-to-equity ratio of 0.06. The stock's 50 day simple moving average is $17.63 and its two-hundred day simple moving average is $20.10.

Institutional Investors Weigh In On Rocket Pharmaceuticals

A number of institutional investors and hedge funds have recently modified their holdings of the company. Mirae Asset Global Investments Co. Ltd. increased its holdings in shares of Rocket Pharmaceuticals by 21.5% in the third quarter. Mirae Asset Global Investments Co. Ltd. now owns 3,292 shares of the biotechnology company's stock worth $61,000 after purchasing an additional 582 shares during the period. Nisa Investment Advisors LLC lifted its stake in shares of Rocket Pharmaceuticals by 31.9% in the second quarter. Nisa Investment Advisors LLC now owns 3,160 shares of the biotechnology company's stock worth $68,000 after buying an additional 764 shares in the last quarter. Values First Advisors Inc. purchased a new stake in shares of Rocket Pharmaceuticals during the 3rd quarter valued at about $108,000. SG Americas Securities LLC bought a new stake in Rocket Pharmaceuticals during the third quarter valued at approximately $113,000. Finally, XTX Topco Ltd purchased a new stake in shares of Rocket Pharmaceuticals in the 3rd quarter worth $286,000. 98.39% of the stock is owned by hedge funds and other institutional investors.

Rocket Pharmaceuticals Company Profile

(

Get Free Report)

Rocket Pharmaceuticals, Inc, together with its subsidiaries, operates as a late-stage biotechnology company that focuses on developing gene therapies for rare and devastating diseases. It has three clinical-stage ex vivo lentiviral vector programs for fanconi anemia, a genetic defect in the bone marrow that reduces production of blood cells or promotes the production of faulty blood cells; leukocyte adhesion deficiency-I, a genetic disorder that causes the immune system to malfunction; and pyruvate kinase deficiency, a rare red blood cell autosomal recessive disorder that results in chronic non-spherocytic hemolytic anemia.

See Also

Before you consider Rocket Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rocket Pharmaceuticals wasn't on the list.

While Rocket Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.