Cramer Rosenthal Mcglynn LLC increased its position in Rogers Co. (NYSE:ROG - Free Report) by 92.8% in the fourth quarter, according to its most recent disclosure with the SEC. The institutional investor owned 145,278 shares of the electronics maker's stock after purchasing an additional 69,941 shares during the period. Cramer Rosenthal Mcglynn LLC owned 0.78% of Rogers worth $14,762,000 at the end of the most recent reporting period.

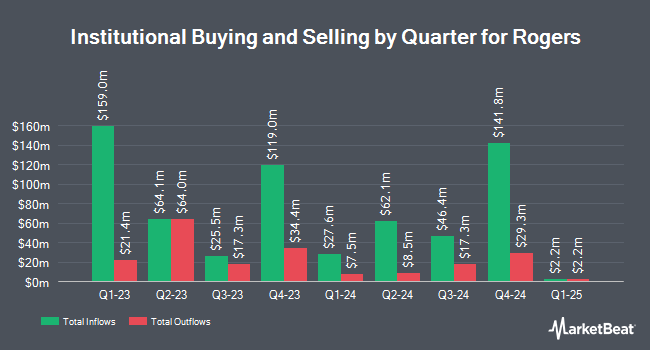

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Canada Pension Plan Investment Board bought a new stake in shares of Rogers in the 4th quarter valued at approximately $274,000. Gamco Investors INC. ET AL raised its holdings in shares of Rogers by 9.9% during the fourth quarter. Gamco Investors INC. ET AL now owns 116,125 shares of the electronics maker's stock worth $11,799,000 after purchasing an additional 10,442 shares during the period. Gabelli Funds LLC lifted its position in shares of Rogers by 3.9% in the 4th quarter. Gabelli Funds LLC now owns 42,450 shares of the electronics maker's stock worth $4,313,000 after buying an additional 1,595 shares during the last quarter. XTX Topco Ltd boosted its stake in Rogers by 90.2% in the fourth quarter. XTX Topco Ltd now owns 9,826 shares of the electronics maker's stock valued at $998,000 after acquiring an additional 4,661 shares during the period. Finally, Mariner LLC increased its position in Rogers by 27.3% in the fourth quarter. Mariner LLC now owns 19,989 shares of the electronics maker's stock worth $2,031,000 after buying an additional 4,283 shares during the period. 96.02% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, CL King started coverage on shares of Rogers in a report on Monday, March 31st. They issued a "buy" rating and a $85.00 price objective on the stock.

Read Our Latest Analysis on Rogers

Rogers Trading Up 0.8 %

ROG traded up $0.44 during trading hours on Wednesday, hitting $55.67. The company's stock had a trading volume of 145,878 shares, compared to its average volume of 169,392. The company has a 50-day simple moving average of $71.23 and a 200 day simple moving average of $90.60. The firm has a market capitalization of $1.03 billion, a PE ratio of 39.48 and a beta of 0.51. Rogers Co. has a fifty-two week low of $51.43 and a fifty-two week high of $134.07.

Rogers (NYSE:ROG - Get Free Report) last issued its quarterly earnings data on Wednesday, February 19th. The electronics maker reported $0.46 earnings per share for the quarter, beating analysts' consensus estimates of $0.43 by $0.03. The business had revenue of $192.20 million for the quarter, compared to analysts' expectations of $191.75 million. Rogers had a net margin of 3.14% and a return on equity of 3.98%. During the same period in the previous year, the business earned $0.60 earnings per share. Research analysts expect that Rogers Co. will post 3.57 earnings per share for the current fiscal year.

Rogers Company Profile

(

Free Report)

Rogers Corporation engages in the design, development, manufacture, and sale of engineered materials and components worldwide. It operates through Advanced Electronics Solutions (AES), Elastomeric Material Solutions (EMS), and Other segments. The AES segment offers circuit materials, ceramic substrate materials, busbars, and cooling solutions for applications in electric and hybrid electric vehicles (EV/HEV), wireless infrastructure, automotive, renewable energy, aerospace and defense, mass transit, industrial, connected devices, and wired infrastructure.

See Also

Before you consider Rogers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers wasn't on the list.

While Rogers currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.