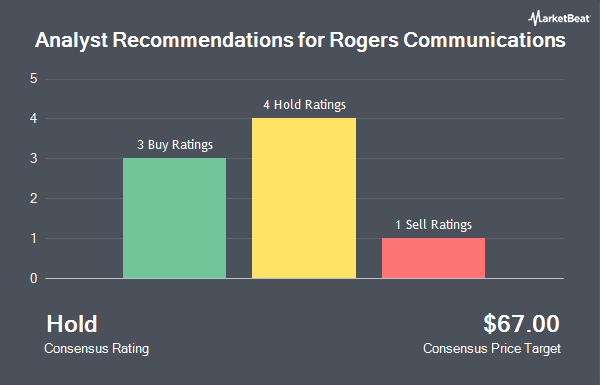

Rogers Communications Inc. (NYSE:RCI - Get Free Report) TSE: RCI.B has received a consensus rating of "Hold" from the seven brokerages that are covering the firm, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell recommendation, four have issued a hold recommendation and two have issued a buy recommendation on the company. The average 1-year target price among analysts that have updated their coverage on the stock in the last year is $61.75.

A number of research firms have recently issued reports on RCI. Bank of America cut shares of Rogers Communications from a "buy" rating to a "neutral" rating in a research note on Tuesday, January 14th. Morgan Stanley started coverage on shares of Rogers Communications in a report on Monday, December 16th. They issued an "underweight" rating for the company. Finally, Barclays reissued an "equal weight" rating on shares of Rogers Communications in a report on Tuesday, January 21st.

Read Our Latest Research Report on RCI

Rogers Communications Price Performance

Shares of NYSE:RCI traded up $0.02 during trading on Friday, reaching $28.38. The stock had a trading volume of 1,398,777 shares, compared to its average volume of 860,022. Rogers Communications has a 52 week low of $26.57 and a 52 week high of $44.38. The business's 50-day moving average price is $28.57 and its 200 day moving average price is $34.23. The company has a debt-to-equity ratio of 3.67, a current ratio of 0.66 and a quick ratio of 0.61. The stock has a market capitalization of $15.17 billion, a PE ratio of 12.23, a P/E/G ratio of 1.43 and a beta of 0.67.

Rogers Communications (NYSE:RCI - Get Free Report) TSE: RCI.B last posted its earnings results on Thursday, January 30th. The Wireless communications provider reported $1.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.97 by $0.07. Rogers Communications had a net margin of 8.40% and a return on equity of 25.19%. As a group, equities analysts predict that Rogers Communications will post 3.57 earnings per share for the current year.

Rogers Communications Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, April 2nd. Shareholders of record on Monday, March 10th will be issued a dividend of $0.347 per share. This represents a $1.39 dividend on an annualized basis and a yield of 4.89%. The ex-dividend date of this dividend is Monday, March 10th. Rogers Communications's dividend payout ratio is presently 59.48%.

Institutional Trading of Rogers Communications

Institutional investors have recently bought and sold shares of the business. Lindbrook Capital LLC grew its holdings in shares of Rogers Communications by 95.1% in the 4th quarter. Lindbrook Capital LLC now owns 1,526 shares of the Wireless communications provider's stock valued at $47,000 after buying an additional 744 shares during the period. Jones Financial Companies Lllp lifted its position in Rogers Communications by 141.4% during the 4th quarter. Jones Financial Companies Lllp now owns 1,796 shares of the Wireless communications provider's stock worth $55,000 after buying an additional 1,052 shares in the last quarter. Headlands Technologies LLC lifted its position in Rogers Communications by 274.2% during the 4th quarter. Headlands Technologies LLC now owns 5,306 shares of the Wireless communications provider's stock worth $163,000 after buying an additional 3,888 shares in the last quarter. V Square Quantitative Management LLC lifted its position in Rogers Communications by 19.1% during the 4th quarter. V Square Quantitative Management LLC now owns 5,795 shares of the Wireless communications provider's stock worth $178,000 after buying an additional 930 shares in the last quarter. Finally, Y Intercept Hong Kong Ltd bought a new stake in shares of Rogers Communications in the 3rd quarter valued at about $206,000. Institutional investors and hedge funds own 45.49% of the company's stock.

Rogers Communications Company Profile

(

Get Free ReportRogers Communications Inc operates as a communications and media company in Canada. It operates through three segments: Wireless, Cable, and Media. The company offers mobile Internet access, wireless voice and enhanced voice, device financing, device protection, global voice and data roaming, wireless home phone, bridging landline, machine-to-machine and Internet of Things solutions, and advanced wireless solutions for businesses, as well as device shipping and express pickup services; and postpaid and prepaid services under the Rogers, Fido, and chatr brands.

Recommended Stories

Before you consider Rogers Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rogers Communications wasn't on the list.

While Rogers Communications currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.