Melqart Asset Management UK Ltd cut its stake in Roivant Sciences Ltd. (NASDAQ:ROIV - Free Report) by 41.4% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 742,070 shares of the company's stock after selling 523,539 shares during the period. Melqart Asset Management UK Ltd owned about 0.10% of Roivant Sciences worth $8,563,000 at the end of the most recent quarter.

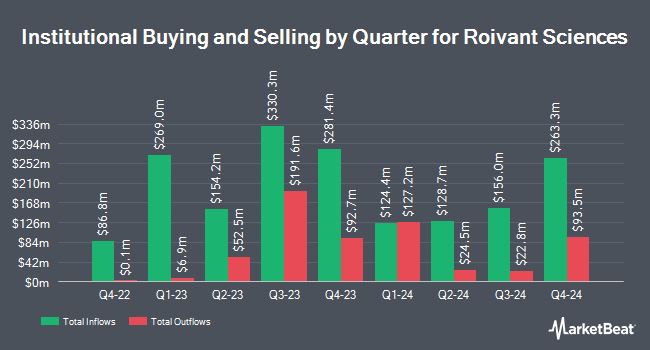

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Mutual of America Capital Management LLC increased its position in Roivant Sciences by 0.4% during the 2nd quarter. Mutual of America Capital Management LLC now owns 327,079 shares of the company's stock worth $3,457,000 after purchasing an additional 1,142 shares during the period. Acadian Asset Management LLC grew its holdings in shares of Roivant Sciences by 23.2% in the 2nd quarter. Acadian Asset Management LLC now owns 8,510 shares of the company's stock worth $89,000 after acquiring an additional 1,603 shares during the period. Covestor Ltd grew its holdings in shares of Roivant Sciences by 9.1% in the 3rd quarter. Covestor Ltd now owns 19,190 shares of the company's stock worth $222,000 after acquiring an additional 1,605 shares during the period. US Bancorp DE grew its holdings in shares of Roivant Sciences by 146.5% in the 3rd quarter. US Bancorp DE now owns 3,278 shares of the company's stock worth $38,000 after acquiring an additional 1,948 shares during the period. Finally, Gladius Capital Management LP acquired a new stake in Roivant Sciences during the 3rd quarter valued at $35,000. 64.76% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on ROIV shares. HC Wainwright reiterated a "buy" rating and set a $18.00 target price on shares of Roivant Sciences in a report on Wednesday, November 13th. Bank of America increased their price target on Roivant Sciences from $12.00 to $12.50 and gave the stock a "neutral" rating in a research note on Wednesday, September 11th. Finally, Cantor Fitzgerald reissued an "overweight" rating on shares of Roivant Sciences in a research note on Thursday, September 19th. One research analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $17.93.

Get Our Latest Stock Analysis on Roivant Sciences

Insider Buying and Selling at Roivant Sciences

In related news, COO Eric Venker sold 100,000 shares of Roivant Sciences stock in a transaction dated Wednesday, November 20th. The stock was sold at an average price of $11.32, for a total value of $1,132,000.00. Following the completion of the transaction, the chief operating officer now directly owns 606,525 shares in the company, valued at approximately $6,865,863. This trade represents a 14.15 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Financial Lp Qvt sold 876,000 shares of Roivant Sciences stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $11.82, for a total value of $10,354,320.00. Following the completion of the transaction, the director now owns 22,179,358 shares of the company's stock, valued at $262,160,011.56. This trade represents a 3.80 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 3,677,309 shares of company stock valued at $43,283,184 over the last three months. 7.90% of the stock is owned by company insiders.

Roivant Sciences Trading Down 0.1 %

NASDAQ:ROIV traded down $0.01 during mid-day trading on Wednesday, hitting $12.11. The company had a trading volume of 6,446,554 shares, compared to its average volume of 5,814,928. The business has a fifty day simple moving average of $11.78 and a 200-day simple moving average of $11.39. Roivant Sciences Ltd. has a 1 year low of $9.48 and a 1 year high of $13.06. The firm has a market capitalization of $8.82 billion, a price-to-earnings ratio of 2.15 and a beta of 1.25.

About Roivant Sciences

(

Free Report)

Roivant Sciences Ltd., a commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for inflammation and immunology areas. The company provides Vants, a model to develop and commercialize its medicines and technologies focusing on biopharmaceutical businesses, discovery-stage companies, and health technology startups.

Recommended Stories

Before you consider Roivant Sciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Roivant Sciences wasn't on the list.

While Roivant Sciences currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.